Stock of Interest

Posted On: October 10, 2022

10 Oct 2022 – Stock of Interest ERIS Lifesciences

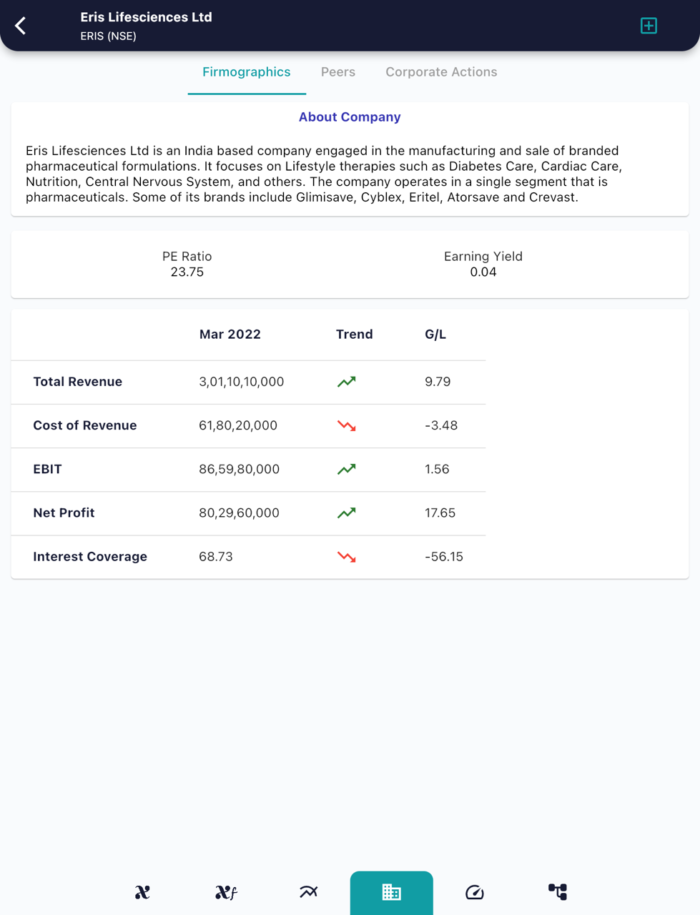

About ERIS:

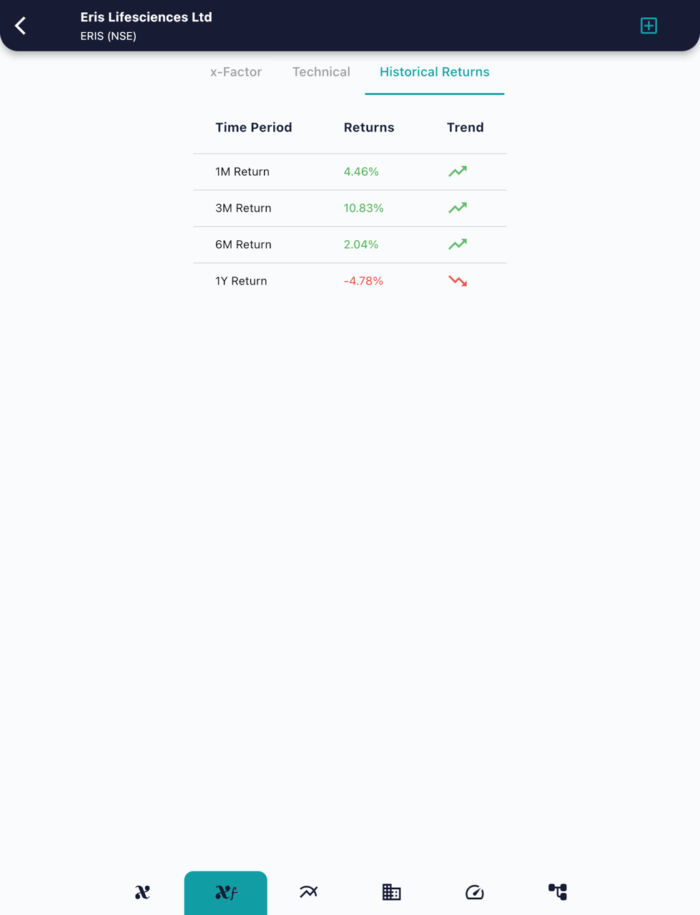

Historical Performance:

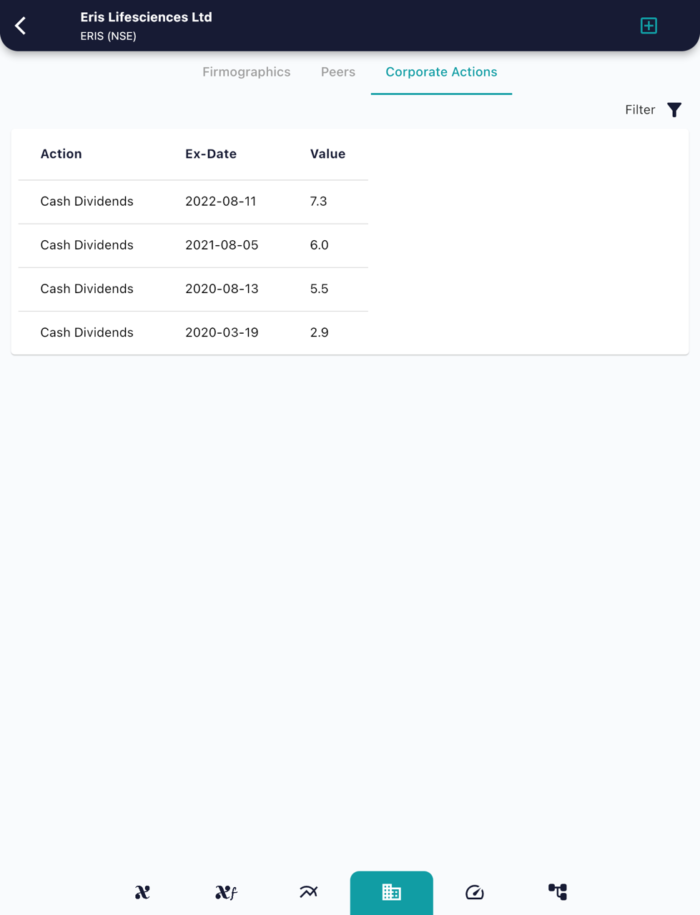

Historical Dividend returns:

shows consistent growth from Rs. 2.9 in 2019 to Rs. 7.3 in 2022. Pays dividends usually in Aug of the year.

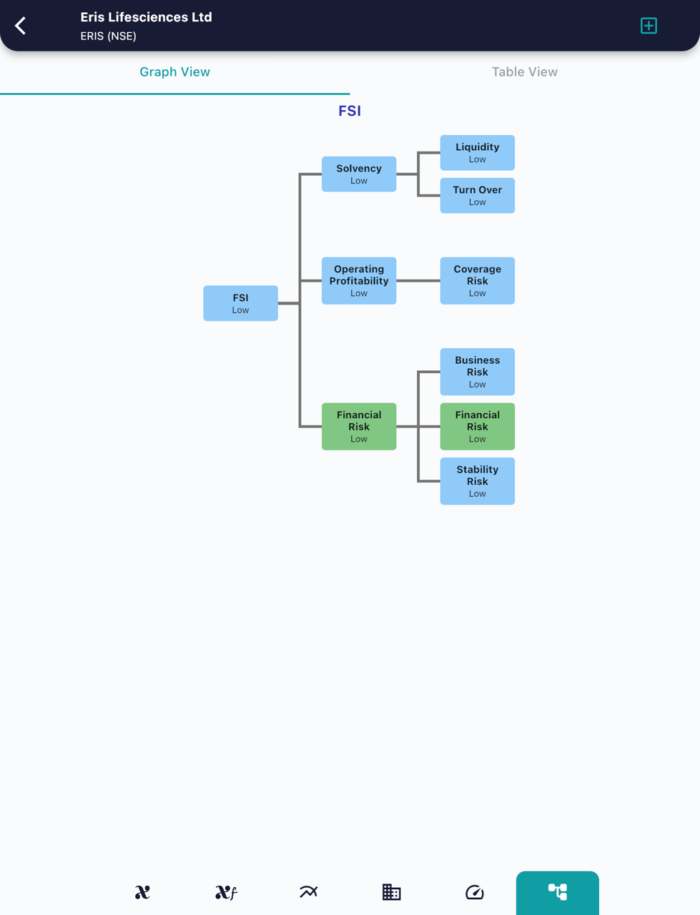

Is it fundamentally sound?

The stock has a low Financial risk . Compared to its peers its operating profitability is low.

It has a Book Value of 140 and PE of 24.95 and is trading at 724.

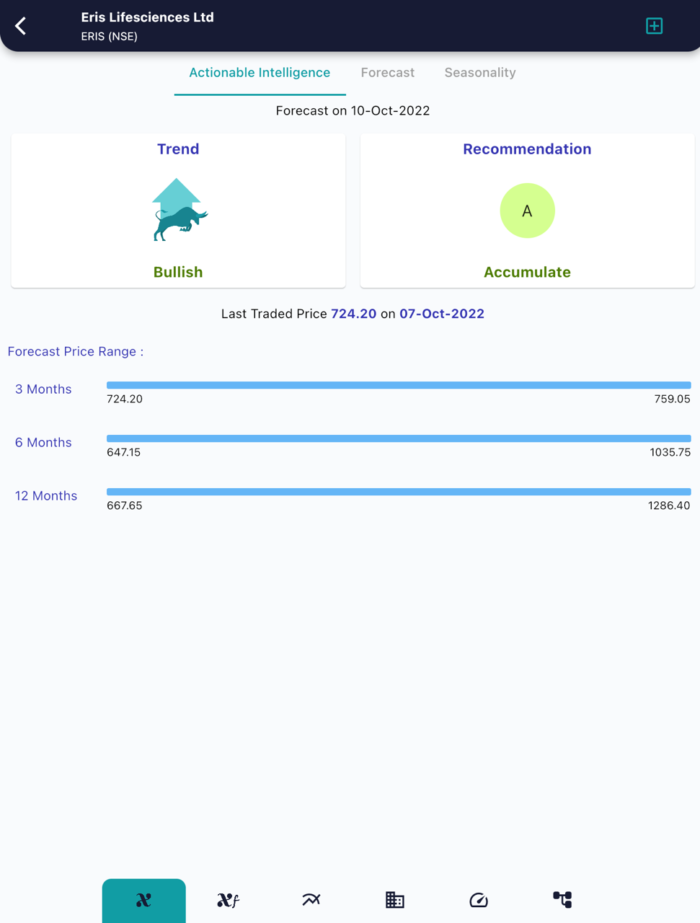

Where is it headed (forecast):

In the next few days stock is headed towards 750+.

In 6 months timeframe, xCalData Forecasts expect the stock at 1000+.

For more details:

Download xCalData app from google play for unbiased AI based stock level research reports.

https://play.google.com/store/apps/details?id=com.xcaldata.goldennest

Join our Telegram group for faster insights: https://t.me/xcaldataofficial

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight