Technical Indicator

Posted On: February 5, 2024

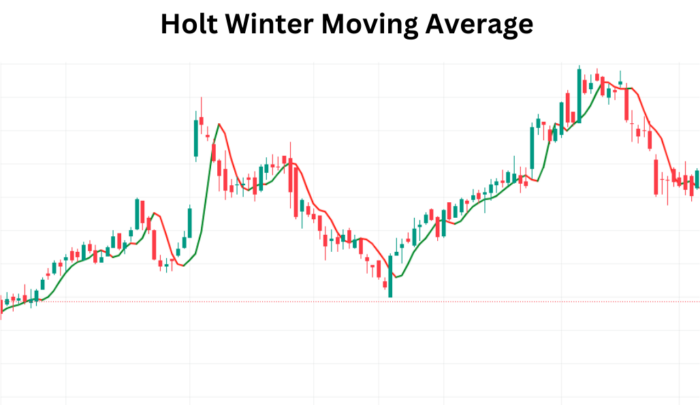

Accurate Trade Signals with Holt Winter Moving Average (HWMA) and Holt-Winters Channel (HWC)

Decoding Holt Winter Moving Average (HWMA)

1. Introduction to HWMA:

- The Holt Winter Moving Average (HWMA) emerges as a vital technical indicator empowering traders to decipher trade directions effectively.

- It utilizes a three-parameter moving average calculated through the Holt-Winters method, offering nuanced insights into market trends.

2. Signal Generation with HWMA:

- The crossing dynamics: If the price crosses above the HWMA line, it signals a potential downtrend, advocating a selling opportunity. Conversely, a price crossing below HWMA suggests the onset of an uptrend, indicating a potential buying opportunity.

3. Interpreting HWMA Signals:

- Buy Signal:

- Yesterday’s HWMA value above yesterday’s close price.

- Current HWMA value lesser than the current close price.

- Sell Signal:

- Yesterday’s HWMA value above yesterday’s close price.

- Current HWMA value less than the current close price.

- Hold:

- If none of the above conditions are met.

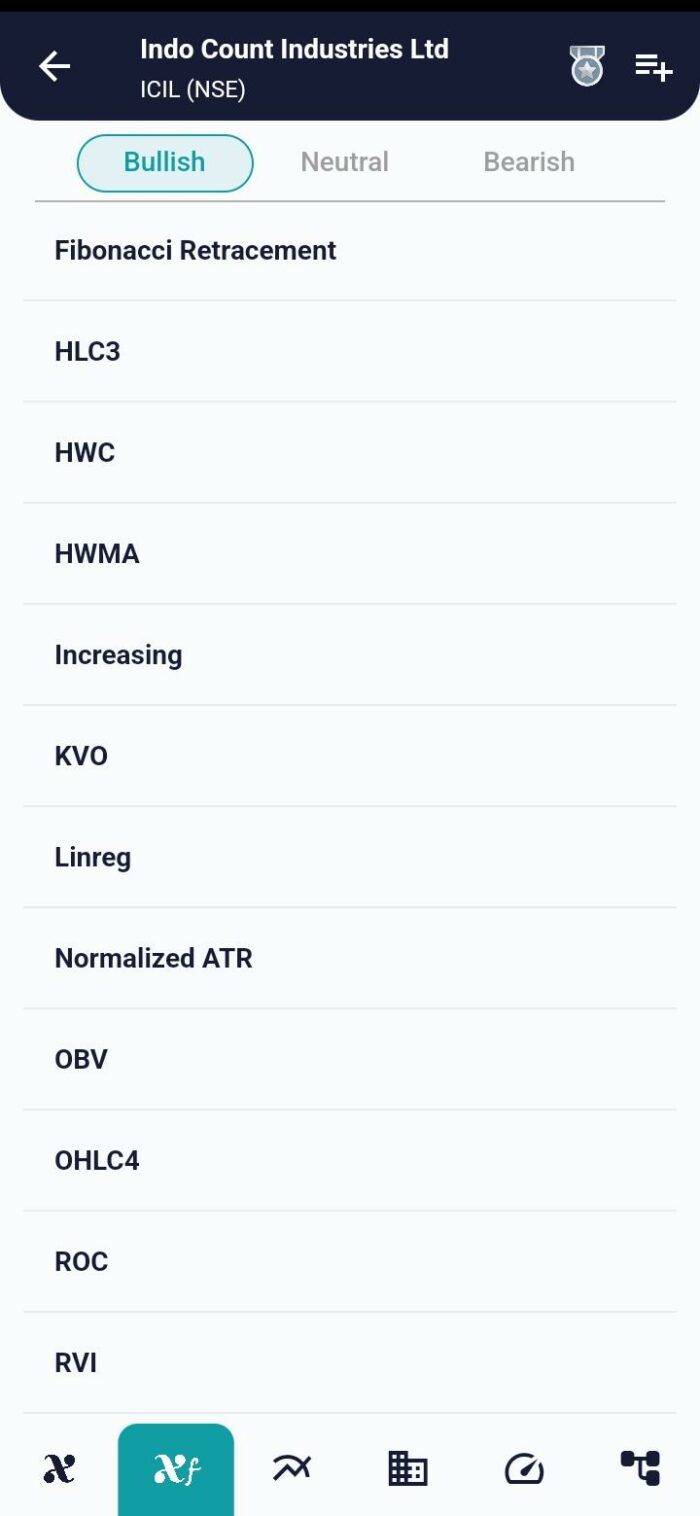

Unveiling Holt-Winters Channel (HWC)

1. Overview of HWC:

- The Holt-Winters Channel (HWC) complements HWMA, adding a layer of insight with upper and lower channels.

- The interplay of HWMA, HWC_UPPER, HWC_LOWER, and close price facilitates a comprehensive interpretation of market sentiment.

2. Interpreting HWC Signals:

- Bullish Signal:

- Yesterday’s HWMA value above yesterday’s close price.

- Current HWMA value lesser than the current close price.

- Bearish Signal:

- Yesterday’s HWMA value above yesterday’s close price.

- Current HWMA value less than the current close price.

- Strong Bearish Signal:

- Yesterday’s HWC_LOWER above yesterday’s close price.

- Current HWC_LOWER lesser than the current close price.

- Strong Bullish Signal:

- Yesterday’s HWC_UPPER above yesterday’s close price.

- Current HWC_UPPER lesser than the current close price.

- Neutral:

- If none of the above conditions are met.

Mathematical formula:

HWMA[i] = F[i] + V[i] + 0.5 * A[i]

Where:

F[i] = (1-nA) * (F[i-1] + V[i-1] + 0.5 * A[i-1]) + nA * Price[i]

V[i] = (1-nB) * (V[i-1] + A[i-1]) + nB * (F[i] – F[i-1])

A[i] = (1-nC) * A[i-1] + nC * (V[i] – V[i-1])

upper = HWMA + Multiplier * StDt

lower = HWMA – Multiplier * StDt

where.

StDt[i] = Sqrt(Var[i-1])

Var[i] = (1-d) * Var[i-1] + nD * (Price[i-1] – HWMA[i-1]) * (Price[i-1] – HWMA[i-1])

Practical Insights: Navigating Market Scenarios

1. Bullish Scenario:

- HWMA signals an uptrend.

- HWC corroborates with a Bullish or Strong Bullish indication.

- Traders might consider holding or entering long positions.

2. Bearish Scenario:

- HWMA indicates a downtrend.

- HWC aligns with a Bearish or Strong Bearish signal.

- Short positions or managing existing shorts could be contemplated.

3. Neutral Scenario:

- HWMA and HWC do not align with clear signals.

- Prudence suggests a cautious approach, monitoring the market for clearer indications.

Conclusion: Elevating Your Trading Game with HWMA and HWC

As you integrate Holt Winter Moving Average (HWMA) and Holt-Winters Channel (HWC) into your trading arsenal, the nuanced signals and channel dynamics provide a robust framework for decision-making. Whether you’re navigating bullish trends, bearish downturns, or traversing neutral territories, the combined insights of HWMA and HWC empower you to make informed choices. Remember, mastering these indicators requires practice and adaptability to diverse market conditions. As you embark on your trading journey, may the synergy of HWMA and HWC be your guiding light to trading success.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight