Technical Indicator

Posted On: February 12, 2024

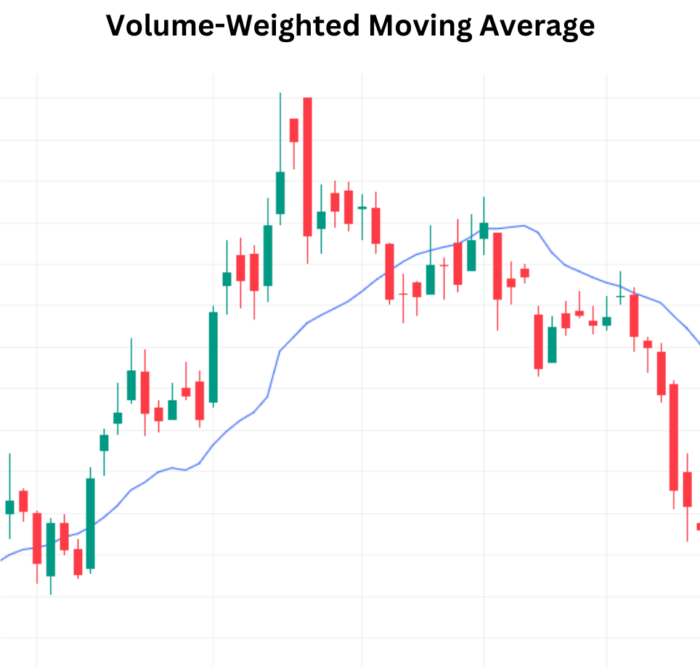

Become Trading Expert with Volume-Weighted Moving Average (VWMA)

Introduction:

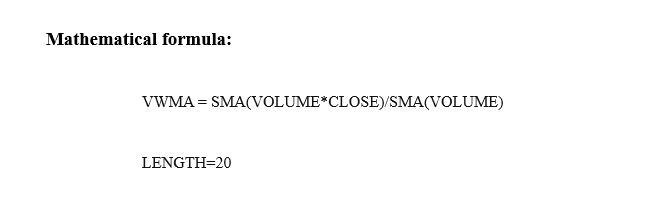

The Volume-Weighted Moving Average (VWMA) is a dynamic technical indicator that holds significant weight in the realm of technical analysis. Its unique approach involves incorporating trading volume, providing traders with valuable insights into market trends. By considering both price and volume data, VWMA enhances the analysis of trends and helps traders make informed decisions.

Key Components of Volume-Weighted Moving Average :

- Volume-Weighted Calculation:

- Volume-Weighted Moving Average gives precedence to volume, weighing prices based on the trading activity within a specified timeframe.

- It distinguishes itself by offering a nuanced perspective that aligns with the ebb and flow of market participation.

- Customizable Parameters:

- Traders have the flexibility to customize Volume-Weighted Moving Average parameters, including length, offset, and data source, tailoring the indicator to their specific preferences.

- This adaptability allows traders to align the indicator with their trading strategies.

Functional Dynamics:

- Similarity to Simple Moving Averages (SMA):

- During periods of low trading activity, the values of simple moving averages and VWMA tend to converge, reflecting similarity.

- However, VWMA’s distinguishing factor lies in its responsiveness to changes in trading volume.

- Trend Identification:

- VWMA serves as a powerful tool for identifying and trading trends in the market.

- Traders keen on trend analysis find VWMA particularly valuable for discerning potential shifts in market dynamics.

- Crossing Signals:

- A noteworthy aspect of VWMA is its utilization of price crossing, which can signify a change in direction.

- Traders observe crossovers as potential signals for adjusting their positions based on evolving market conditions.

Strategic Integration:

- Complementary Analysis:

- While VWMA is effective in isolation, seasoned technical analysts often integrate it with other tools and analysis techniques.

- This comprehensive approach enhances the accuracy of trend identification and trading signals.

Trading Signals:

- Bullish Signal – Rising VWMA:

- A buy signal is generated when the VWMA values show an upward trend.

- Rising VWMA suggests a potential bullish trajectory, prompting traders to consider long positions.

- Bearish Signal – Falling VWMA:

- Conversely, a sell signal emerges when VWMA values exhibit a downward trend.

- Falling VWMA indicates potential bearish sentiment, prompting traders to exercise caution or consider short positions.

Conclusion:

In conclusion, the Volume-Weighted Moving Average (VWMA) stands as a valuable ally for traders seeking a nuanced understanding of market trends. Its emphasis on trading volume distinguishes it from traditional moving averages, providing traders with a dynamic indicator for trend analysis. The customizable nature of VWMA enhances its adaptability to diverse trading styles, making it a versatile tool in the hands of traders navigating the complexities of financial markets. Whether utilized in isolation or in conjunction with other technical tools, VWMA contributes to informed decision-making, empowering traders to navigate the ever-changing landscape of market dynamics.

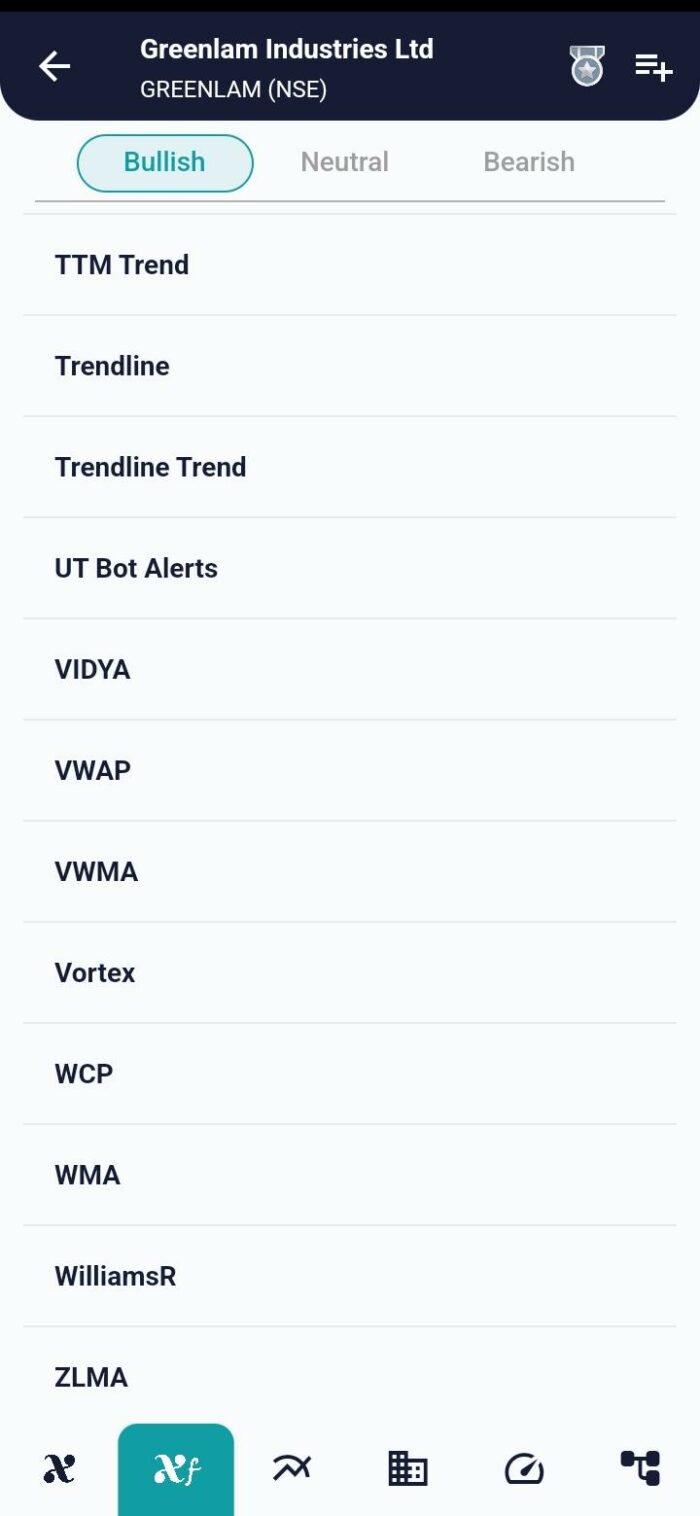

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight