Technical Indicator

Posted On: February 6, 2024

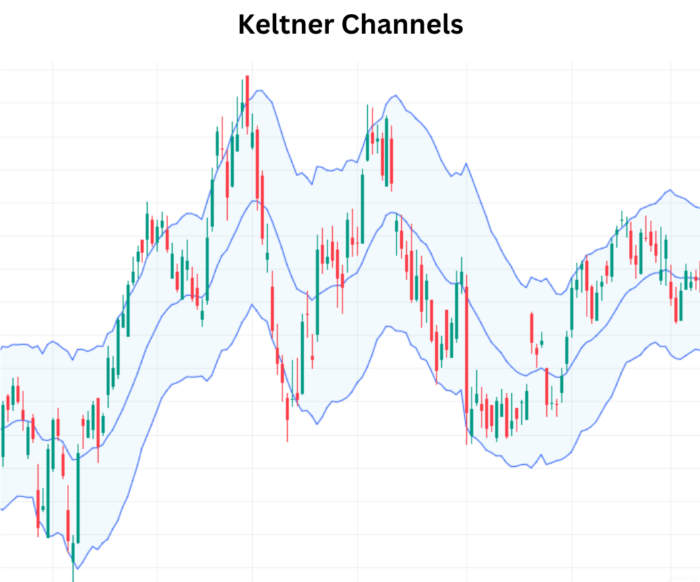

Boost Up Trading Skills Using Keltner Channels

Unveiling the Power of Keltner Channels

Keltner Channels, rooted in volatility, are indispensable technical indicator for traders seeking to decipher market trends. By leveraging the Average True Range (ATR), these bands offer valuable insights into potential trend directions, helping traders make informed decisions.

Components of Keltner Channels

- Middle Line (EMA):

- Based on the Exponential Moving Average (EMA) of the asset’s price.

- Upper Channel:

- Positioned above the middle line and calculated by adding a multiple of ATR to the EMA.

- Lower Channel:

- Positioned below the middle line and determined by subtracting a multiple of ATR from the EMA.

Mathematical formula:

Middle Line: 20-period Exponential Moving Average (EMA)

Upper Channel Line: 20 EMA + (2 * Average True Range)

Lower Channel Line: 20 EMA – (2 * Average True Range).

Interpreting Keltner Channels

1. Trend Confirmation:

- A breach above the upper channel suggests a potential uptrend, while a breach below the lower channel indicates a possible downtrend.

2. Price Crossovers:

- Bullish signals occur when the current price crosses above the upper channel after being below for the previous two days. Conversely, bearish signals manifest when the current price crosses below the lower channel after residing above for the previous two days.

3. Reversal Indicators:

- Watch for bullish reversals when the adjusted price crosses from above to below the upper Keltner value, signaling potential overbought conditions. Similarly, bearish reversals are indicated when the adjusted price crosses from below to above the lower Keltner value, pointing to potential oversold conditions.

4. Neutral Zones:

- When the adjusted price remains within the Keltner value, it suggests a neutral market, urging caution without clear directional signals.

Strategies for Effective Utilization

1. Confirmation with Other Indicators:

- Enhance the reliability of Keltner Channels by corroborating signals with other technical indicators.

2. Adjusting ATR Multiplier:

- Fine-tune Keltner Channels based on market conditions by adjusting the ATR multiplier.

3. Combining Trend Lines:

- Overlay trend lines to identify key support and resistance levels, aligning with Keltner Channel signals.

Cautionary Notes

- Avoid Over-Reliance: While Keltner Channels are powerful, refrain from relying solely on them. Combine insights from multiple indicators for robust decision-making.

- Market Conditions Matter: Consider prevailing market conditions, adjusting parameters accordingly to adapt to varying volatility.

In Conclusion

Mastering the art of interpreting Keltner Channels empowers traders with a nuanced understanding of trends, potential reversals, and neutral zones. By integrating this knowledge into your trading arsenal and employing complementary strategies, you can navigate the markets with greater confidence and precision. Explore, experiment, and elevate your trading journey with the invaluable insights provided by Keltner Channels. Happy trading!

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight