Candlestick Pattern

Posted On: February 12, 2024

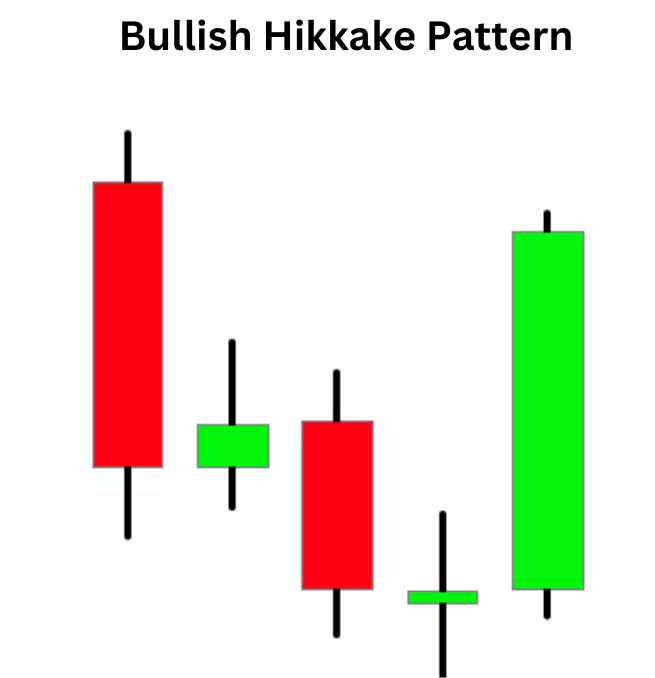

Bullish Hikkake Pattern: Navigating Market Dynamics for Potential Reversals

In the vast realm of financial markets, traders employ a diverse set of technical analysis tools to decipher potential trend reversals and market dynamics. Candlestick patterns, renowned for their ability to provide actionable insights, play a pivotal role in this pursuit. The Bullish Hikkake pattern is one such candlestick formation that merits attention from traders, acting as a signal for potential bullish reversals. In this blog post, we will delve into the concept of the Bullish Hikkake pattern, explore its identification process, and discuss how traders can interpret this pattern to enhance their trading strategies.

The Bullish Hikkake pattern is a two-candlestick formation that often materializes at the end of a downtrend. It suggests that the bears’ control might be waning, potentially leading to a bullish reversal. The pattern consists of a small inside candle (with a higher high and a lower low than the previous candle) followed by a larger candle that engulfs the smaller one, forming a “hikkake” or hook. This formation indicates a possible shift in market sentiment from bearish to bullish.

Identifying the Bullish Hikkake Pattern:

To identify the Bullish Hikkake pattern, traders should pay close attention to the following key features:

- Downtrend: The pattern typically emerges within an ongoing downtrend, indicating potential bullish reversal.

- Inside Candle: The first candle is a small inside candle, meaning it has a higher high and a lower low than the preceding candle, representing market indecision.

- Engulfing Candle: The second candle is larger and engulfs the small inside candle, confirming the reversal signal.

Interpreting the Bullish Hikkake Pattern:

The Bullish Hikkake pattern implies that the bears’ dominance may be weakening, and buyers are potentially gaining control, leading to a trend reversal. It suggests a shift in market sentiment from bearish to bullish. Traders interpret this pattern as a signal to consider initiating long positions or tightening stop-loss levels on existing short positions.

Confirmation and Trade Execution:

While the Bullish Hikkake pattern provides a potential bullish signal, traders often seek supplementary confirmation before entering trades. They may consider the following factors:

- Volume Confirmation: Higher trading volume during the pattern’s formation enhances the credibility of the potential reversal.

- Support and Resistance Levels: Identifying key support and resistance levels can further validate the pattern’s authenticity and guide in setting realistic price targets.

- Technical Indicators: Integrating the Bullish Hikkake pattern with other technical indicators, such as moving averages or oscillators, enriches the trading decision-making process.

Conclusion:

The Bullish Hikkake pattern serves as a valuable tool for traders, offering insights into potential bullish reversals and shifts in market sentiment. By understanding its identification process and adeptly interpreting this pattern, traders can refine their trading strategies.

However, it’s crucial to recognize that no pattern guarantees success, and informed trading decisions necessitate additional verification and comprehensive analysis. As with any trading strategy, risk management and prudent decision-making remain paramount for traders navigating the complexities of financial markets.

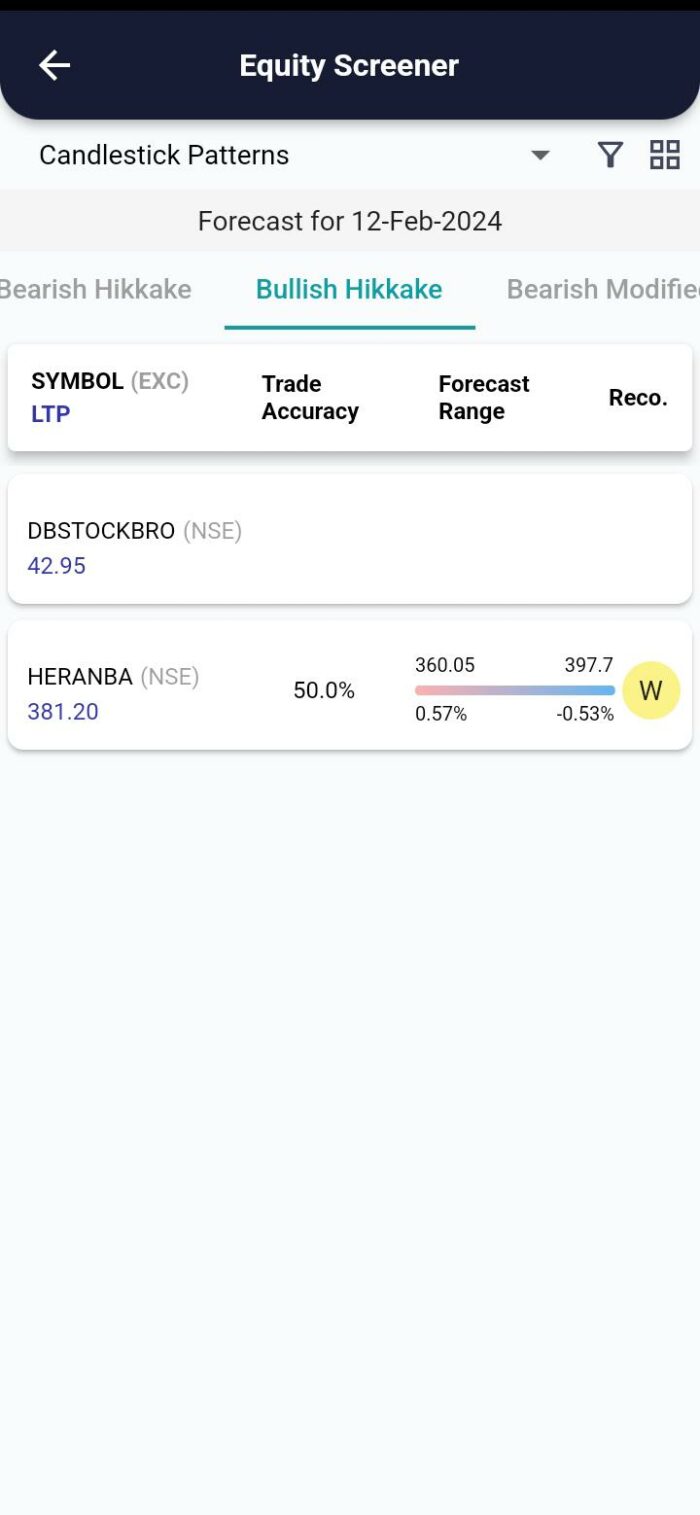

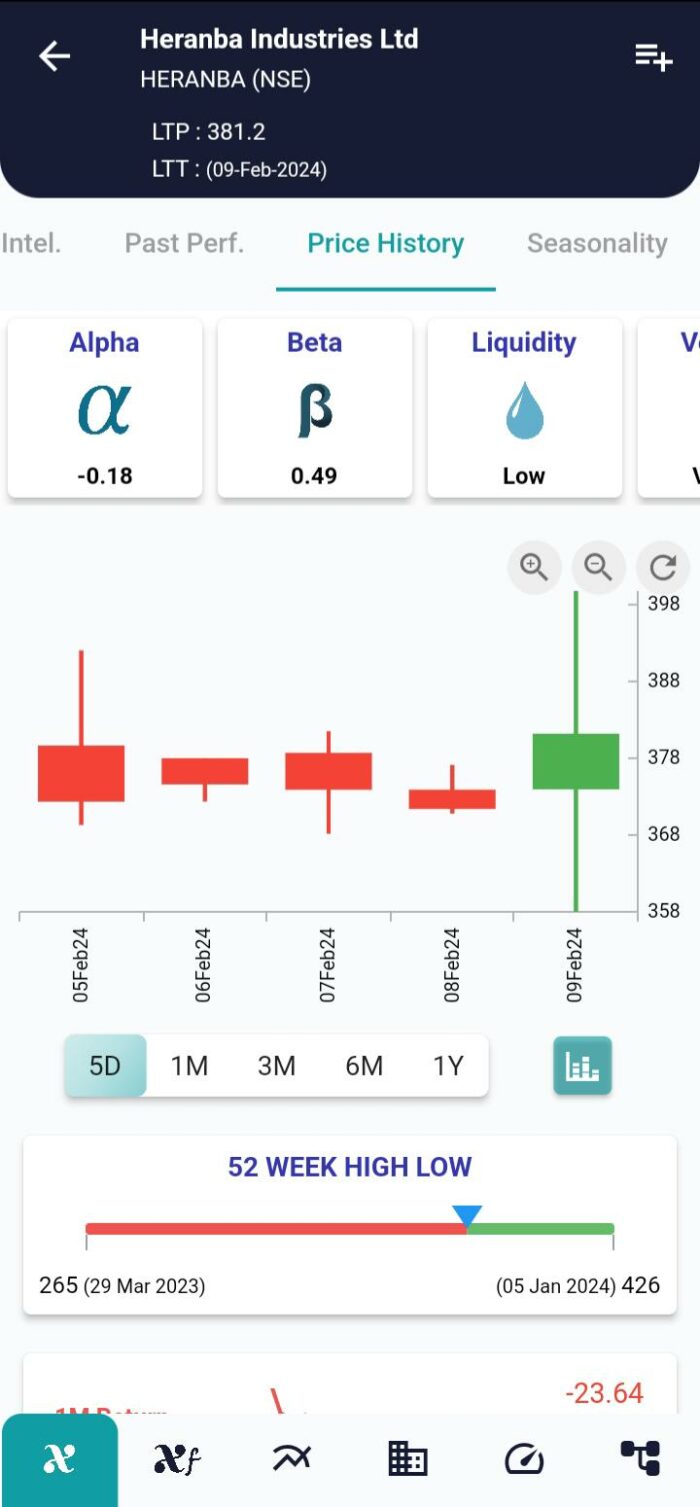

Where can I see further insights on this stock?

xCalData offers unbiased insights into stocks. Download the app from google play. For Actionable Intelligence, subscribe to xCalData app on Android devices: Download here

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Disclaimer: The securities quoted are for illustration only and are not recommendatory.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight