Market report

Posted On: June 24, 2022

CGCL – stock of interest 24 Jun 2022

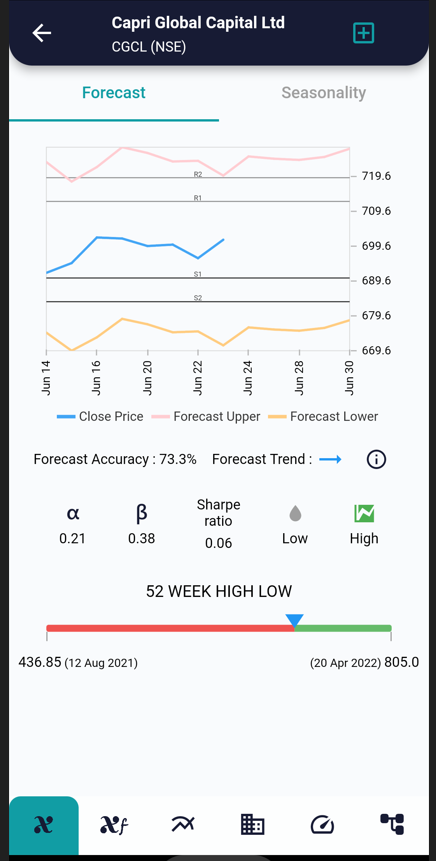

xCalData forecasts the prices for next 5 days between 679 and 720.

The low alpha indicates stock is performing in line with the sector.

Beta less than 1 means stock is less volatile compared to market.

The stock price is above the midway between the 52-week low and high

indicating it is likely on upward trajectory.

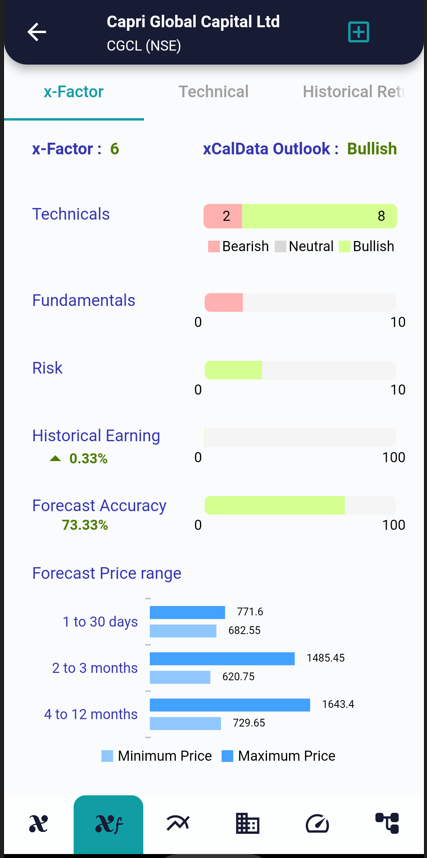

xFactor is a Proprietary score xCalData provides for each stock.

xFactor is 6 and xFactor Outlook is Bullish.

The forecast price range for various time horizons is shown in the graph as well .

Historical forecast accuracy is 73%.

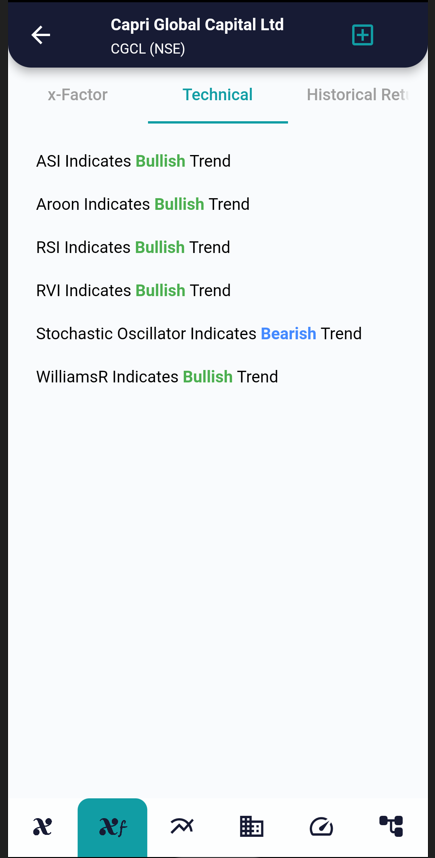

Reviewing the list of technical indicators, we see all the ratios

show a bullish trend.

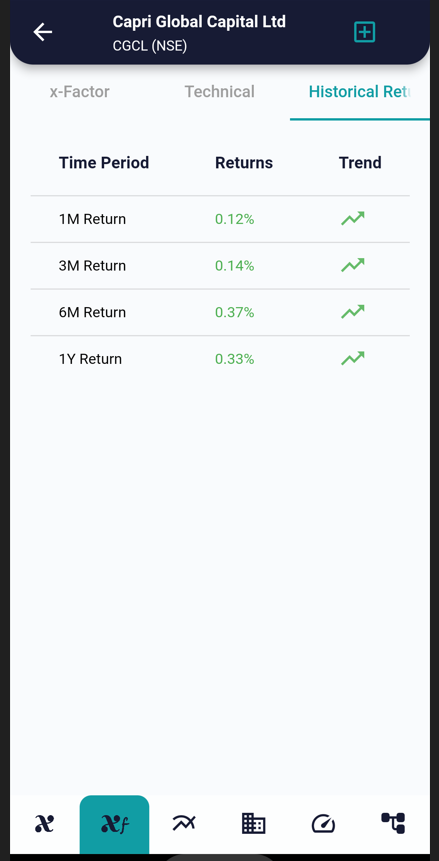

Returns in all time frames within past 1 year have been positive.

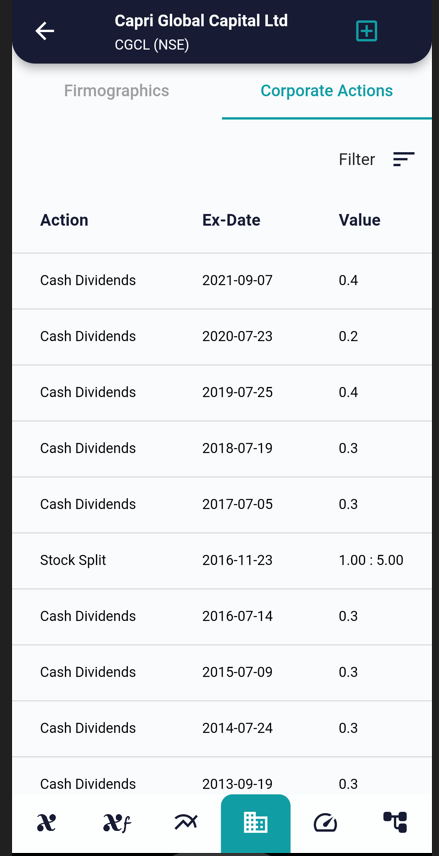

Stock has given a consistent annual dividend in the past.

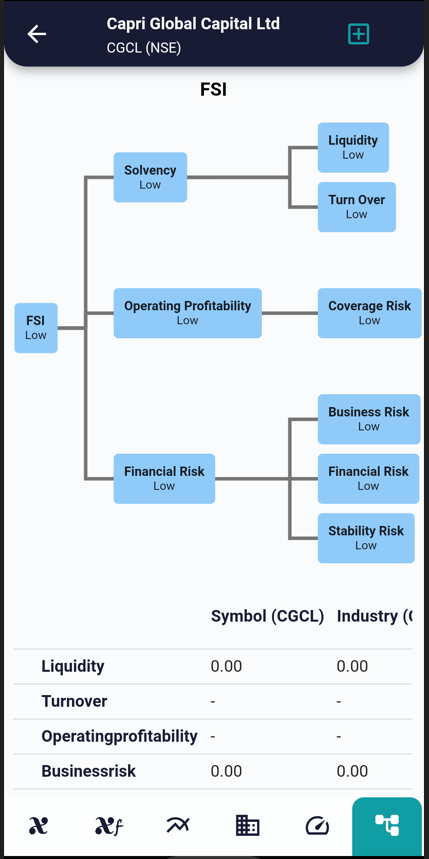

FSI is a proprietary view of xCalData to review the

fundamentals of the stock quickly.

Stock has a “LOW” FSI score contributed by low operating profit.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight