Technical Indicator

Posted On: February 2, 2024

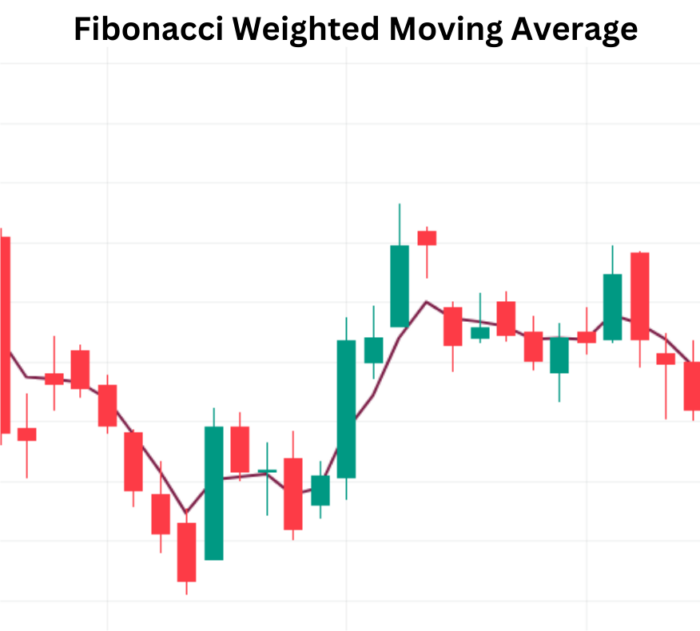

Confirming Market Trends with Fibonacci Weighted Moving Average (FWMA)

Merging Fibonacci and Moving Averages

In the intricate world of financial markets, traders constantly seek innovative tools to decipher trends and make informed decisions. The Fibonacci Weighted Moving Average (FWMA) technical indicator emerges as a unique fusion of traditional moving averages and the timeless Fibonacci sequence. Let’s embark on a journey to unravel the intricacies of FWMA and understand how it can elevate your technical analysis prowess.

Decoding FWMA: The Fibonacci Touch

1. Fibonacci Sequence Integration:

- FWMA incorporates Fibonacci ratios into its calculation, assigning varying weights to data points.

- The Fibonacci sequence’s influence brings a dynamic element to the moving average, enhancing its responsiveness.

2. Responsive and Dynamic Indicator:

- Unlike conventional moving averages, Fibonacci Weighted Moving Average responds more swiftly to changes in price data.

- The dynamic nature of Fibonacci Weighted Moving Average provides traders with a tool capable of capturing subtle market shifts.

Mathematical formula:

Fibo = Fibonacci (Window)

Fwma = adjusted price. Rolling (Window) * Fibo

Where,

Fibonacci = Fibonacci values of (window) /sum of Fibonacci values (window).

Window = 14

Understanding Fibonacci Weighted Moving Average Signals: Navigating Bullish and Bearish Trends

Bullish Signals:

1. FWMA Value on the Rise:

- A shift in Fibonacci Weighted Moving Average value, transitioning into a rising pattern, serves as a compelling buy signal.

- This upward trajectory suggests potential bullish momentum in the market.

Bearish Signals:

1. Falling FWMA Value:

- A decline in Fibonacci Weighted Moving Average value signals a bearish trend, indicating a potential selling opportunity.

- Traders may consider adjusting their strategies to align with the emerging bearish sentiment.

Applying FWMA in Your Trading Strategy: Practical Insights

1. Integration with Fibonacci Levels:

- Combine Fibonacci Weighted Moving Average with key Fibonacci retracement levels to identify potential reversal points.

- The synergy between Fibonacci Weighted Moving Average and Fibonacci levels enhances the precision of trend analysis.

2. Confirmation with Other Indicators:

- Validate FWMA signals by cross-referencing with other technical indicators.

- Confirmation from multiple sources can strengthen the reliability of trading decisions.

3. Risk Management Strategies:

- Leverage Fibonacci Weighted Moving Average signals in conjunction with robust risk management techniques.

- Set stop-loss orders and take-profit targets aligned with the insights derived from FWMA.

Conclusion: Elevate Your Analysis with FWMA

As you navigate the ever-changing currents of financial markets, the Fibonacci Weighted Moving Average (FWMA) stands as a beacon, blending the mathematical elegance of Fibonacci with the practical utility of moving averages. By understanding the nuanced signals provided by FWMA, traders can make more informed decisions, staying ahead of market trends and potential reversals. Embrace the power of FWMA, and let it be a guiding force in your journey to mastering technical analysis.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight