Technical Indicator

Posted On: February 2, 2024

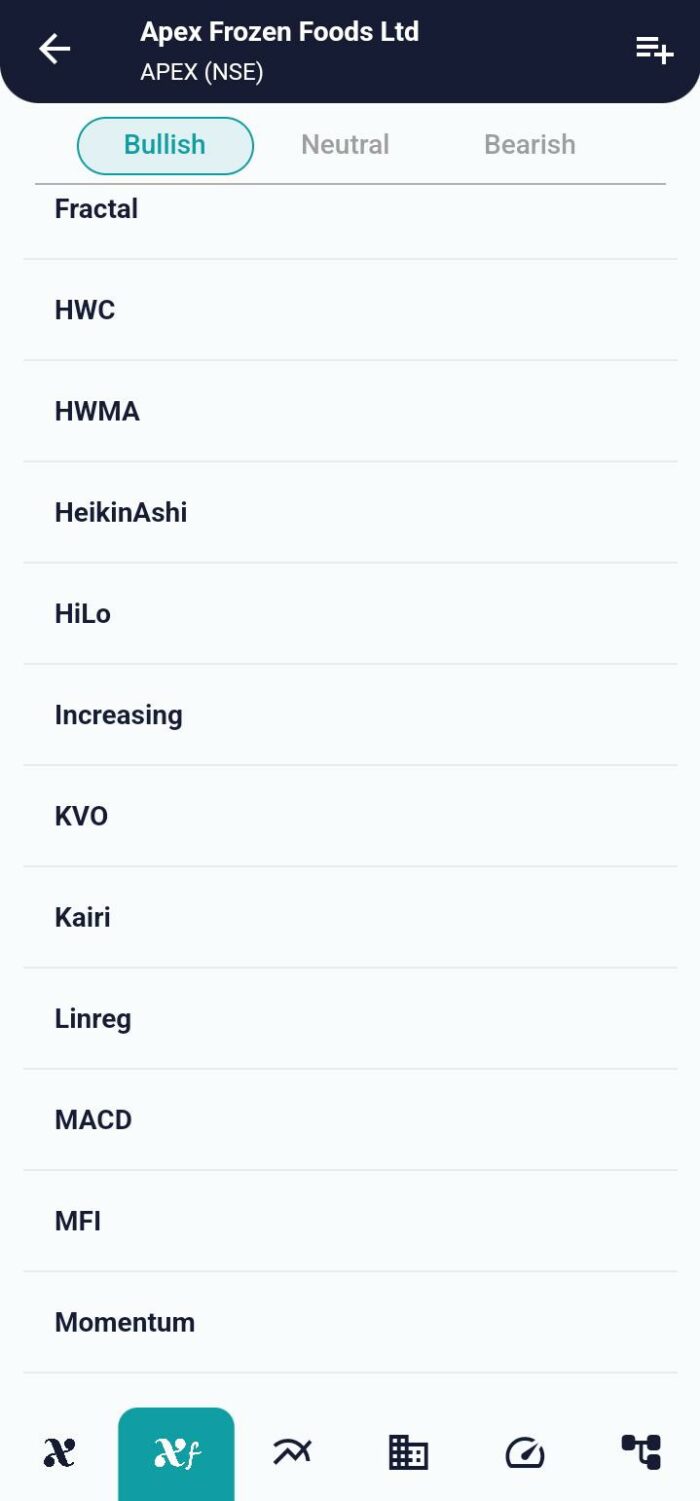

Deciphering Gann HiLo For Positive Trading Insights

Unveiling Gann Hilo: W.D. Gann’s Trailblazing Indicator

W.D. Gann, a legendary figure in the realm of technical analysis, bestowed upon traders the Gann Hilo technical indicator – a potent tool designed to unravel market trends and identify potential reversals. Let’s embark on a journey to comprehend the intricacies of Gann Hilo, empowering you to navigate financial markets with confidence.

Unraveling the Components of Gann Hilo

1. Gann Hilo Activator (GHA):

- Trend Identification: GHA serves as a moving average-based indicator, aiding in trend identification.

- Buy Signal: A rising GHA indicates a potential bullish trend, signaling an opportune time to consider buying.

2. Gann Hilo Histogram:

- Momentum Measurement: The histogram component gauges market momentum.

- Sell Signal: A falling histogram suggests a potential bearish trend, offering a signal to consider selling.

Navigating Gann Hilo Signals: A Trader’s Compass

Bullish Signals:

1. Rising Gann Hilo Activator:

- A consistent ascent in GHA serves as a strong bullish signal.

- Traders can interpret this as an indication of a sustained upward trend.

2. Positive Momentum Histogram:

- A positive histogram reinforces the bullish sentiment.

- Successive positive histogram bars underscore the strength of the prevailing uptrend.

Bearish Signals:

1. Falling Gann Hilo Activator:

- A declining GHA points towards a potential bearish trend.

- Traders may consider this a signal to explore selling opportunities.

2. Negative Momentum Histogram:

- A negative histogram signals bearish momentum.

- A series of negative histogram bars highlights the strength of the downward trend.

Gann Hilo in Action: Integrating Practical Insights

1. Confirmation with Other Indicators:

- Validate Gann Hilo signals by cross-referencing with other indicators like RSI or MACD.

- Multiple confirmations enhance the reliability of trading decisions.

2. Setting Stop-Loss and Take-Profit:

- Implement robust risk management by strategically placing stop-loss orders based on Gann Hilo signals.

- Identify potential take-profit levels to secure gains in alignment with the prevailing trend.

3. Periodic Review of Gann Hilo Settings:

- Periodically assess the effectiveness of Gann Hilo by reviewing its settings in different market conditions.

- Adjust parameters to align with evolving trends and market dynamics.

Conclusion: Gann Hilo as Your Trading Ally

As you embark on your trading journey, Gann Hilo stands as a stalwart ally, providing insights into market trends and potential reversal points. Master the art of interpreting Gann Hilo signals, and let this powerful indicator guide you in making informed decisions. Whether you’re a seasoned trader or a newcomer to technical analysis, Gann Hilo’s multifaceted components offer a nuanced perspective on market movements, unlocking opportunities in the dynamic world of finance.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight