Technical Indicator

Posted On: February 5, 2024

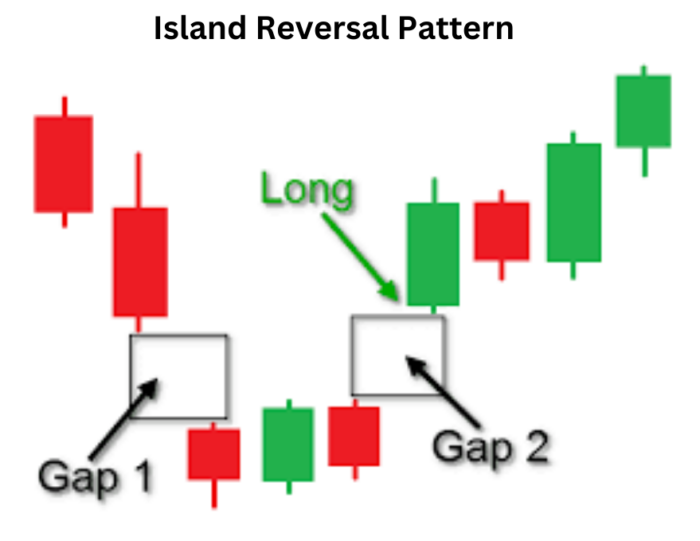

Deciphering Island Reversals: A Comprehensive Guide

Island reversals are intriguing price technical indicator that offer insights into potential trend reversals. In this in-depth exploration, we will unravel the intricacies of identifying both Bullish and Bearish Island Reversals. The process involves a meticulous examination of trends, gaps, and volume dynamics. Let’s embark on the journey of understanding and implementing these patterns in your trading strategy.

Bullish Reversal Pattern:

Conditions for Detection:

- Initiating Downtrend:

- Detect a downtrend between two consecutive points (specified by

TREND_STARTING_POINTandTREND_ENDING_POINT).

- Detect a downtrend between two consecutive points (specified by

- Continuation of Downtrend:

- Confirm the continuation of the downtrend at another point (specified by

BULLISH_DOWNTREND).

- Confirm the continuation of the downtrend at another point (specified by

- Gap Down Occurrence:

- Check for a gap down at the point specified by

BULLISH_GAPDOWN_POINT.

- Check for a gap down at the point specified by

- Sideways Movement:

- Identify sideways movement between points specified by

SIDEWAY_STARTING_POINTandSIDEWAY_ENDING_POINT.

- Identify sideways movement between points specified by

- Volume Surge:

- Verify that the volume during the sideways movement is higher than the average volume before the downtrend.

- Uptrend and Gap Up:

- Confirm an uptrend at the point specified by

BULLISH_UPTRENDand a gap up at the point specified byBULLISH_GAPUP_POINT.

- Confirm an uptrend at the point specified by

Result:

- Mark the Island Reversals as a “Bullish Reversal.”

Bullish Pattern:

Conditions for Detection:

- Continuing Downtrend:

- Identify a continuing downtrend at the point specified by

BULLISH_DOWNTREND.

- Identify a continuing downtrend at the point specified by

- Sideways Movement:

- Confirm sideways movement between points specified by

SIDEWAY_STARTING_POINTandSIDEWAY_ENDING_POINT.

- Confirm sideways movement between points specified by

- Gap Up or Ongoing Uptrend:

- Mark the occurrence as “Bullish” if there is a gap up at the point specified by

BULLISH_GAPUP_POINTor an ongoing uptrend.

- Mark the occurrence as “Bullish” if there is a gap up at the point specified by

Bearish Reversal Pattern:

Conditions for Detection:

- Initiating Uptrend:

- Detect an uptrend between two consecutive points (specified by

TREND_STARTING_POINTandTREND_ENDING_POINT).

- Detect an uptrend between two consecutive points (specified by

- Continuation of Uptrend:

- Confirm the continuation of the uptrend at another point (specified by

BEARISH_UPTREND).

- Confirm the continuation of the uptrend at another point (specified by

- Gap Up Occurrence:

- Check for a gap up at the point specified by

BEARISH_GAPUP_POINT.

- Check for a gap up at the point specified by

- Sideways Movement:

- Identify sideways movement between points specified by

SIDEWAY_STARTING_POINTandSIDEWAY_ENDING_POINT.

- Identify sideways movement between points specified by

- Volume Surge:

- Verify that the volume during the sideways movement is higher than the average volume before the uptrend.

- Downtrend and Gap Down:

- Confirm a downtrend at the point specified by

BEARISH_DOWNTRENDand a gap down at the point specified byBEARISH_GAPDOWN_POINT.

- Confirm a downtrend at the point specified by

Result:

- Island Reversals the occurrence as a “Bearish Reversal.”

Bearish Pattern:

Conditions for Detection:

- Continuing Uptrend:

- Identify a continuing uptrend at the point specified by

BEARISH_UPTREND.

- Identify a continuing uptrend at the point specified by

- Sideways Movement:

- Confirm sideways movement between points specified by

SIDEWAY_STARTING_POINTandSIDEWAY_ENDING_POINT.

- Confirm sideways movement between points specified by

- Gap Down or Ongoing Downtrend:

- Mark the occurrence as “Bearish” if there is a gap down at the point specified by

BEARISH_GAPDOWN_POINTor an ongoing downtrend.

- Mark the occurrence as “Bearish” if there is a gap down at the point specified by

Neutral Occurrence:

- If none of the Bullish or Bearish conditions are met, the function marks the occurrence as “Neutral.”

Conclusion:

Incorporating the Island Reversal detection algorithm into your trading strategy requires a keen eye for trend dynamics, gaps, and volume fluctuations. As you navigate the intricacies of Bullish and Bearish patterns, remember to adapt these signals to your broader market analysis. May your trading journey be guided by the nuanced insights of Island Reversals!

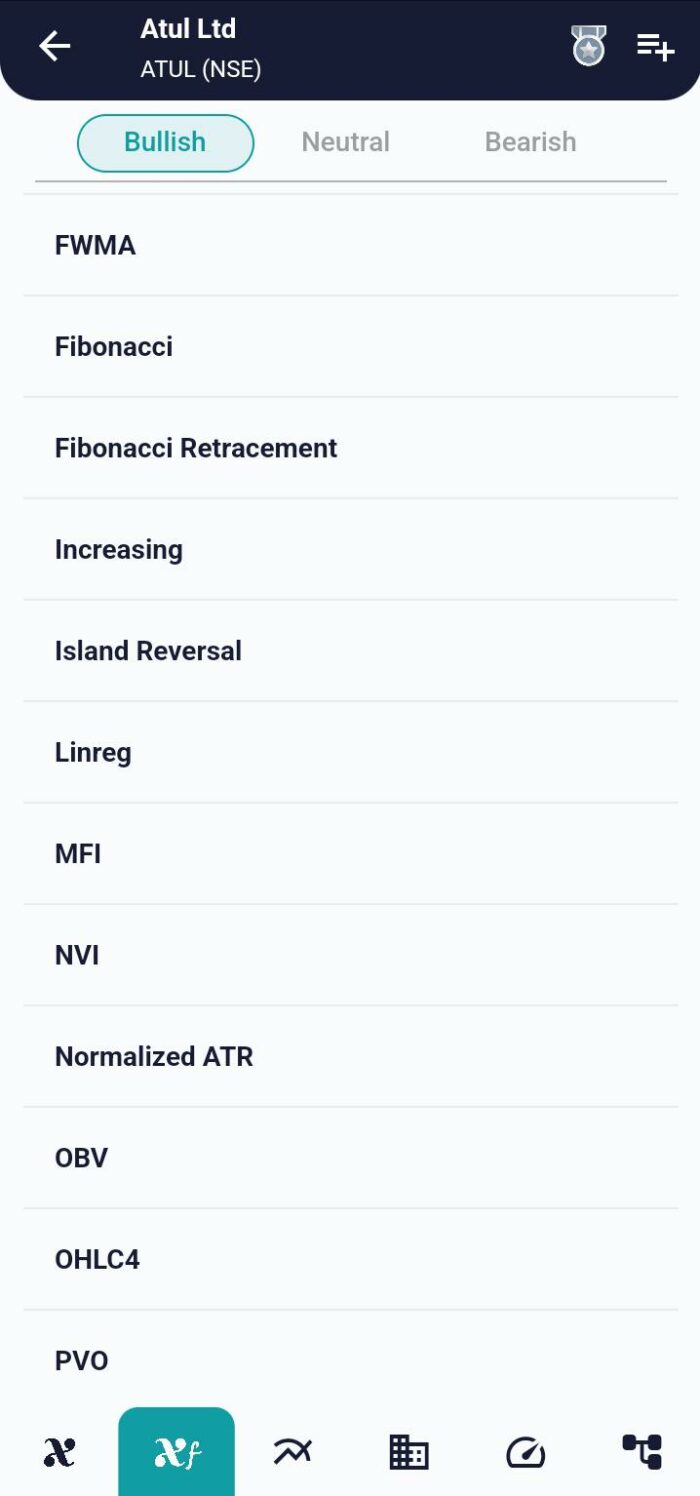

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight