Technical Indicator

Posted On: February 7, 2024

Deciphering Market Flows with Price Volume Trend (PVT) Indicator

Introduction:

In the realm of technical analysis, the Price Volume Trend (PVT) technical indicator stands out as a powerful tool for assessing the inflow or outflow of volume in a financial instrument. This guide unravels the intricacies of the PVT study, exploring its calculation methodology, interpretation, and its role in signaling opportune moments to buy or sell.

Unveiling the Price Volume Trend (PVT) Indicator:

The Price Volume Trend (PVT) is designed to quantify the volume’s impact on an instrument by evaluating the close of the current period relative to the close of the previous period. This evaluation is then accumulated to create a continuous total of volume.

Understanding PVT Signals:

Sell Signal:

- Condition: If the current day’s PVT value is less than the current day’s PVT_MA, and the previous day’s PVT value is greater than the previous day’s PVT.

- Interpretation: This scenario triggers a Sell signal, indicating a potential shift towards selling pressure in the market.

Buy Signal:

- Condition: If the current day’s PVT value is greater than the current day’s PVT_MA, and the previous day’s PVT value is less than the previous day’s PVT.

- Interpretation: This situation prompts a Buy signal, suggesting a potential influx of buying activity.

Hold:

- Condition: If none of the above conditions are met.

- Interpretation: The absence of specific conditions implies a neutral stance, advising traders to hold their current positions.

Strategies for Implementation:

- Confirmation of Trend Reversals:

- Utilize Price Volume Trend signals to confirm potential trend reversals, especially when the PVT value transitions from being greater to lesser than the PVT_MA, or vice versa.

- Incorporation into Trading Strategies:

- Integrate Price Volume Trend signals into broader trading strategies, incorporating them as supplementary insights to bolster decision-making.

- Risk Management:

- Employ Price Volume Trend indications to assess risk levels and adjust positions, aligning with prevailing market dynamics.

Conclusion:

The Price Volume Trend (PVT) indicator serves as a valuable ally for traders seeking to gauge the influence of volume on price movements. By interpreting the relationship between close prices and cumulative volume, the PVT study provides actionable signals, empowering traders to make informed decisions in the dynamic landscape of financial markets.

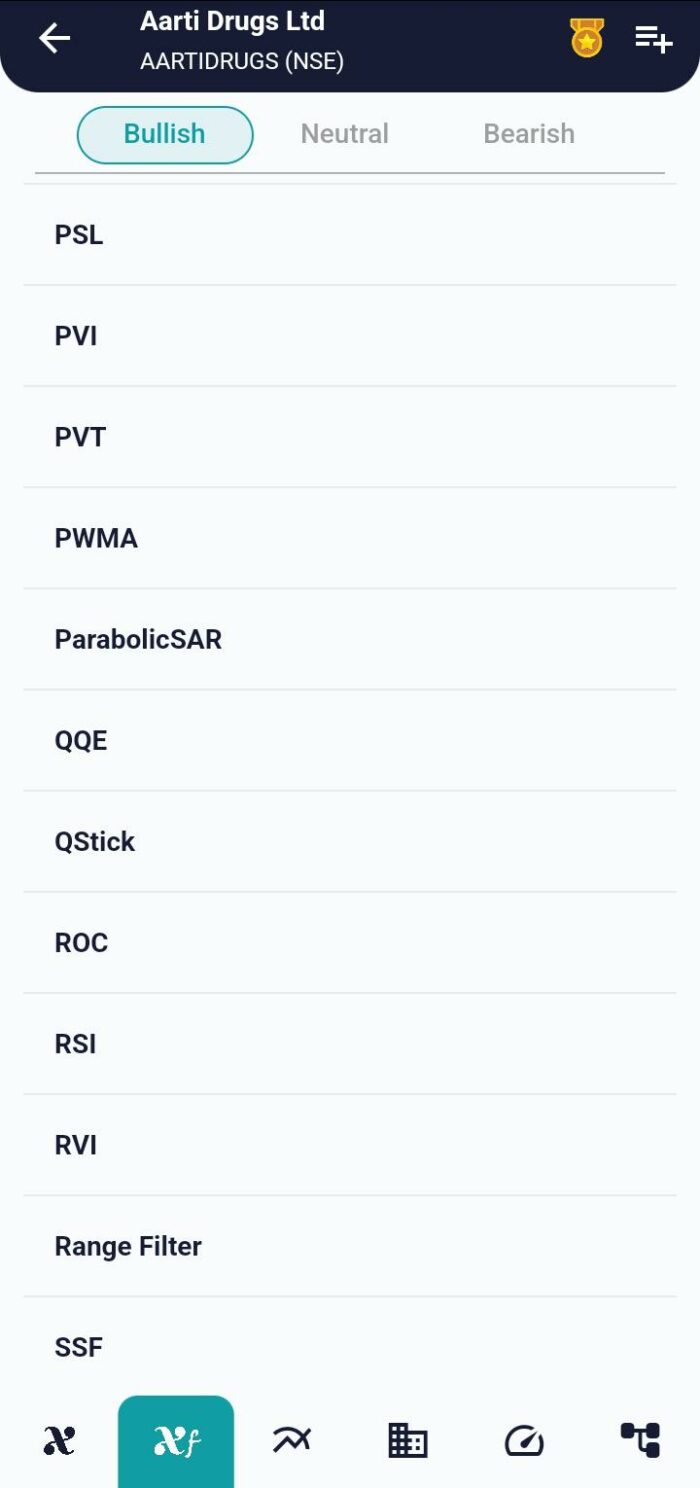

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight