Technical Indicator

Posted On: February 9, 2024

Decoding Trends with Vortex Indicator (VI)

Introduction of Vortex Indicator:

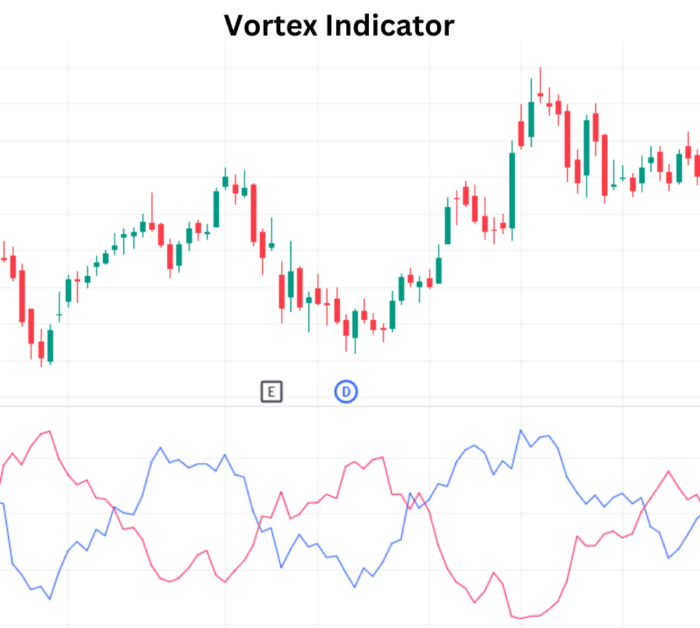

In the dynamic realm of financial markets, the ability to discern and confirm trends is paramount. The Vortex technical indicator (VI) emerges as a valuable tool in this pursuit, offering a dual-line approach to identify both uptrends and downtrends. With its distinctive green (VI+) and red (VI-) lines, the Vortex Indicator provides traders with a visual representation of trend strength and potential reversals.

Key Components:

- Dual Lines – VI+ and VI-:

- The Vortex Indicator consists of two essential lines – VI+ (uptrend indicator) and VI- (downtrend indicator).

- VI+ is often depicted in green, signaling positive price movement and potential uptrends.

- VI-, represented in red, denotes negative price movement and serves as an indicator for potential downtrends.

- Trend Reversals and Confirmations:

- The primary role of the Vortex Indicator is to identify trend reversals and validate existing trends.

- Traders observe the relationship between VI+ and VI- to gauge the prevailing market sentiment.

Mathematical formula:

VORTEX Positive=sum (high-Prev low) N periods / sum (True range) N periods

VORTEX Negative= sum (low -Prev high) N periods / sum (True range) N periods

Where, N=14

Interpretation Framework:

- Bullish Signal – VI+ Dominance:

- When VI+ (green line) surpasses VI- (red line), it signals a bullish trend.

- This scenario suggests that positive price movements and uptrends are gaining strength, prompting traders to consider bullish positions.

- Bearish Signal – VI- Dominance:

- Conversely, when VI- (red line) outpaces VI+ (green line), it indicates a bearish trend.

- The dominance of negative price movements suggests potential downtrends, prompting traders to exercise caution and consider bearish positions.

Visual Cues and Decision-Making:

- Color-Coded Visualization:

- The color-coded representation of VI+ and VI- enhances the visual interpretation of trends.

- Green and red lines provide traders with an intuitive understanding of the prevailing market dynamics.

- Confirmation of Trends:

- Traders use the Vortex Indicator not only for trend identification but also for trend confirmation.

- When the relationship between VI+ and VI- aligns with price movements, it reinforces the confidence in the current market trend.

Conclusion:

In the intricate tapestry of market analysis, the Vortex Indicator stands out as a tool that brings clarity to trend dynamics. Its dual-line structure, accompanied by color-coded visuals, simplifies the process of identifying and confirming trends. Whether signaling bullish strength with VI+ dominance or cautioning against bearish trends with VI- dominance, this indicator equips traders with valuable insights.

As markets evolve and trends undergo transitions, the Vortex Indicator serves as a reliable companion for traders seeking to navigate with precision. By embracing both the green and red lines of VI, traders can align their strategies with the ever-changing currents of financial markets.

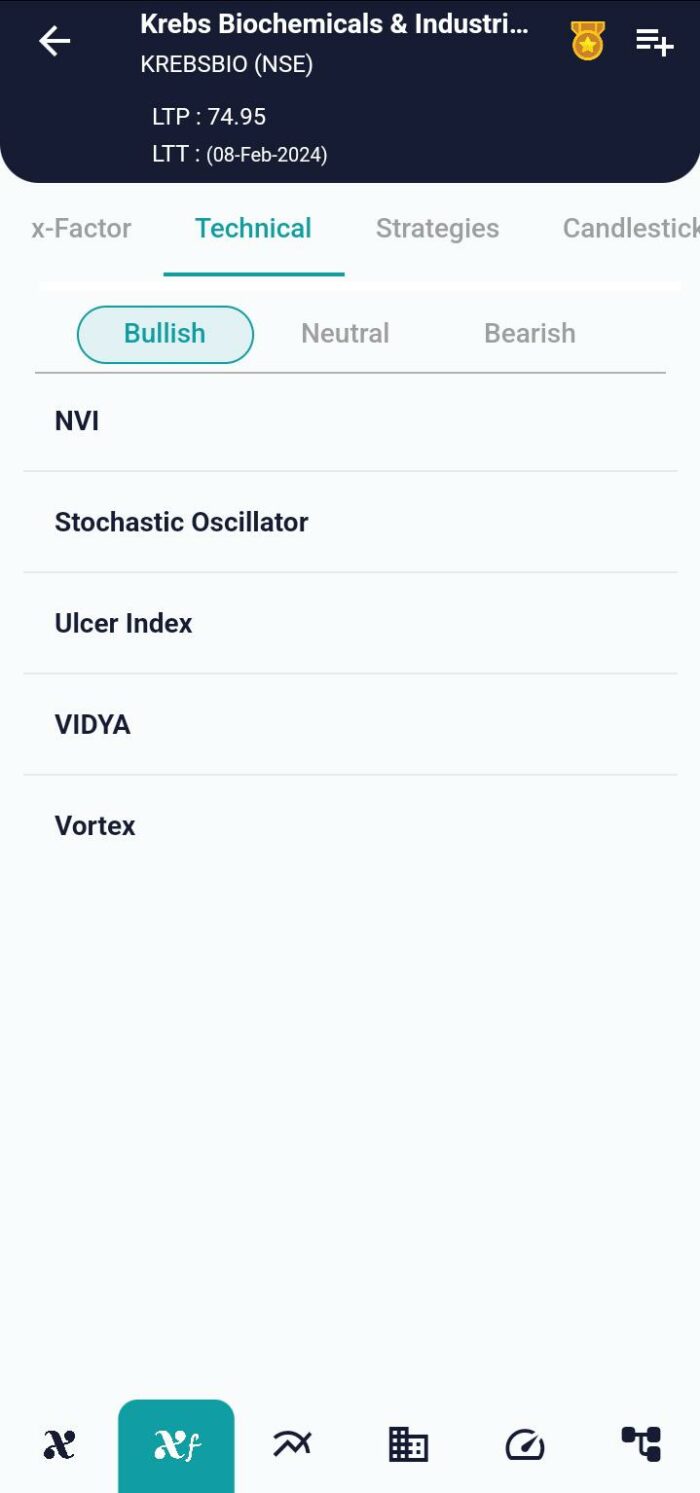

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight