General

Posted On: November 1, 2023

Discover Sector Trends and Industry Trends in Real-Time with xCalData

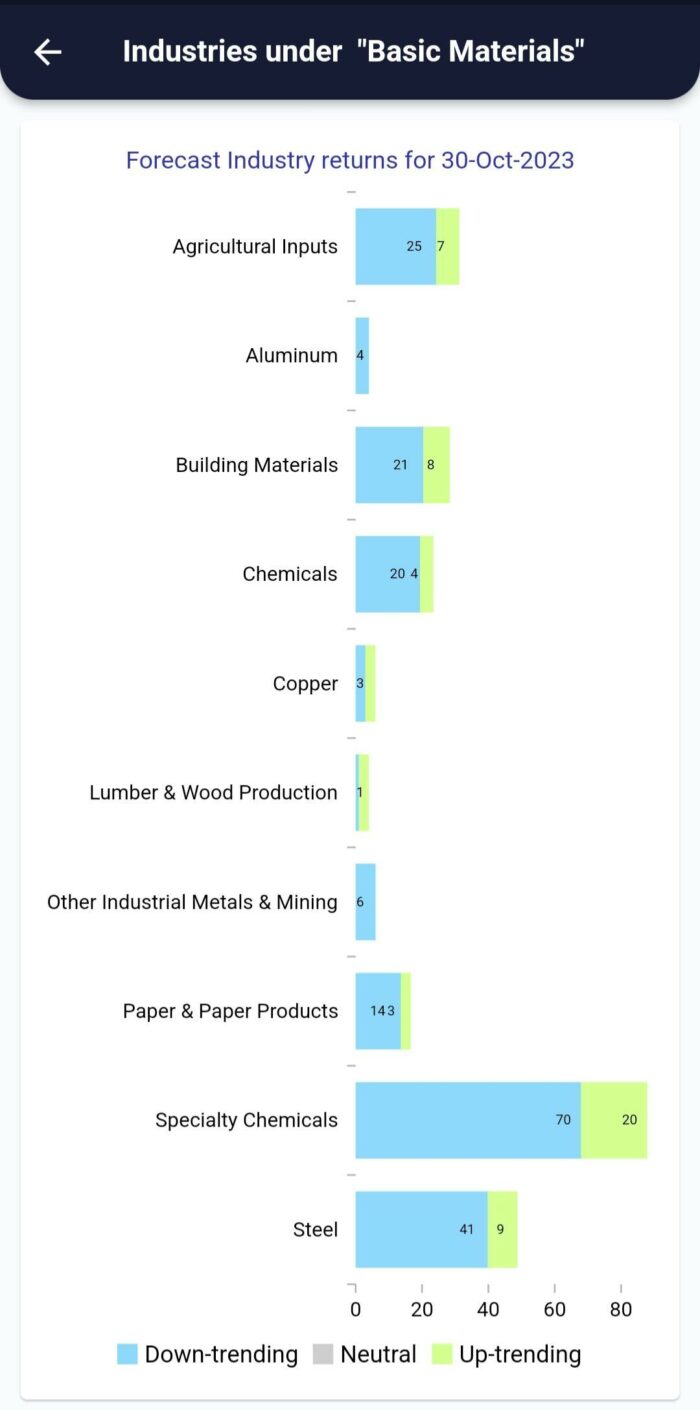

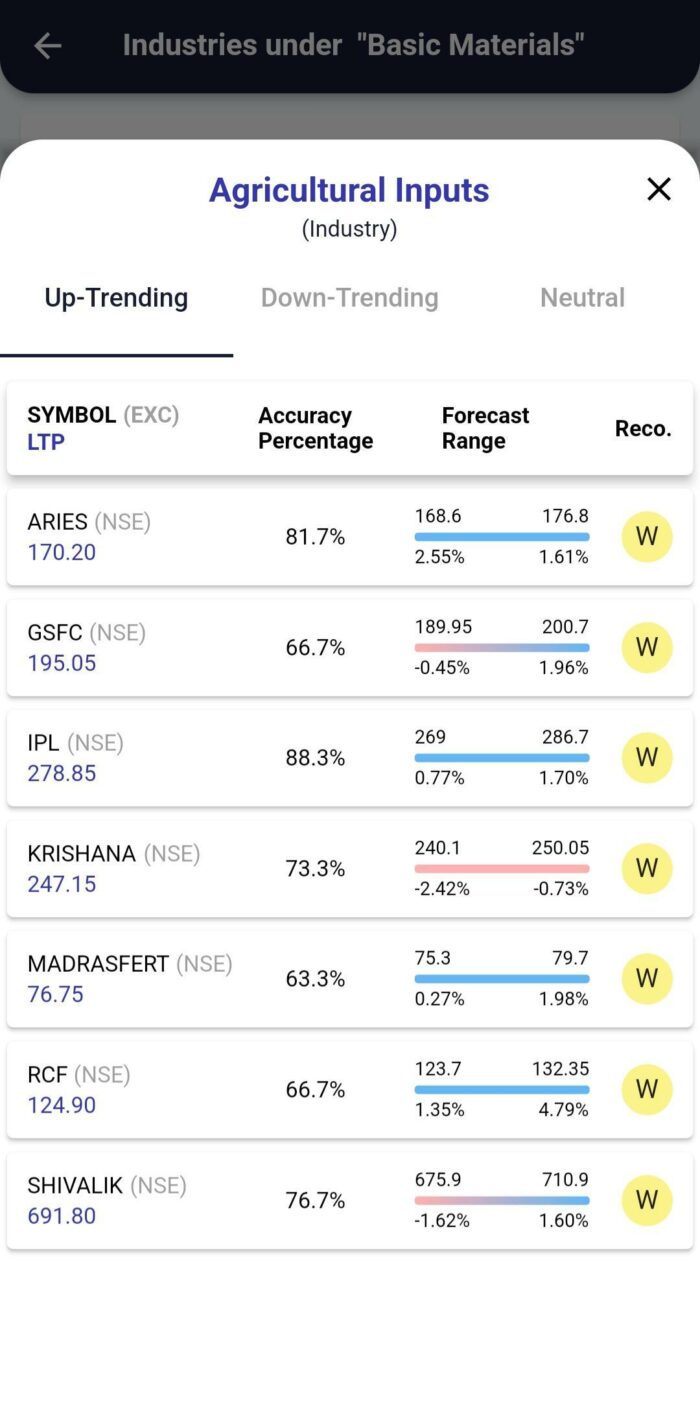

Understanding sector trends and making informed investment decisions within those sectors is a critical component of success in the world of finance. xCalData takes sector analysis to the next level by providing real-time data and insights into up trending, down trending, and neutral stocks within sectors like Basic Materials, Communication Services, Consumer Cyclical, Consumer Defensive, Energy, and more.

In this blog, we will delve into how xCalData’s platform empowers investors and traders to explore sector trends and make data-driven decisions based on the performance of stocks within those sectors.

The Role of Sector Analysis

Sector analysis is essential for building a well-diversified and strategically sound investment portfolio. Identifying trends within sectors and pinpointing stocks that are up trending, down trending, or remaining relatively neutral is key to making informed decisions. Here’s why sector analysis matters:

- Diversification: By assessing sector trends, you can strategically allocate your investments to balance risk and return across various sectors.

- Risk Management: Recognizing up trending, down trending, and neutral stocks within sectors helps you manage risk and optimize your portfolio for current market conditions.

- Opportunity Identification: Knowing which sectors contain up trending stocks provides the opportunity to invest in companies with growth potential.

To see Sector Trends, Open xCalData, Go to Home -> Scans -> Sector Trends

To see Sector Analysis, Open xCalData, Go to Home -> Market Overview -> Sector Analysis

Sector Analysis with xCalData

xCalData’s platform streamlines the process of sector analysis by providing real-time data and insights for stocks within different sectors and Industries. Here’s how we enable you to identify up trending, down trending, and neutral stocks within sectors:

- Uptrending Stocks: Access data on stocks within a sector that are currently experiencing positive price momentum and growth.

- Downtrending Stocks: Discover data on stocks within a sector that are trending downward, potentially signaling underperformance or challenges.

- Neutral Stocks: Identify stocks within a sector that are relatively stable and not exhibiting significant price movements.

- Customization: Tailor your analysis to your unique investment approach, whether you prefer to focus on up trending opportunities or diversify with neutral stocks.

Benefits of Real-Time Sector Analysis

- Informed Decisions: Real-time sector analysis allows you to make decisions based on the most current information, enhancing your ability to capitalize on trends and emerging opportunities.

- Risk Mitigation: By recognizing downtrending stocks, you can make timely adjustments to your portfolio, reducing exposure to underperforming assets.

- Efficient Portfolio Management: Real-time insights facilitate efficient portfolio management, allowing you to align your investments with sector trends.

Conclusion

xCalData’s platform empowers you to explore sector trends and identify up trending, down trending, and neutral stocks within various sectors. Whether you’re an investor looking for long-term growth or a trader seeking short-term opportunities, our real-time data and analysis help you make informed decisions, manage risk effectively, and capitalize on sector trends. Say goodbye to uncertainty and hello to data-driven sector analysis with xCalData. Start your journey to informed decision-making with confidence today!

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight