Technical Indicator

Posted On: January 31, 2024

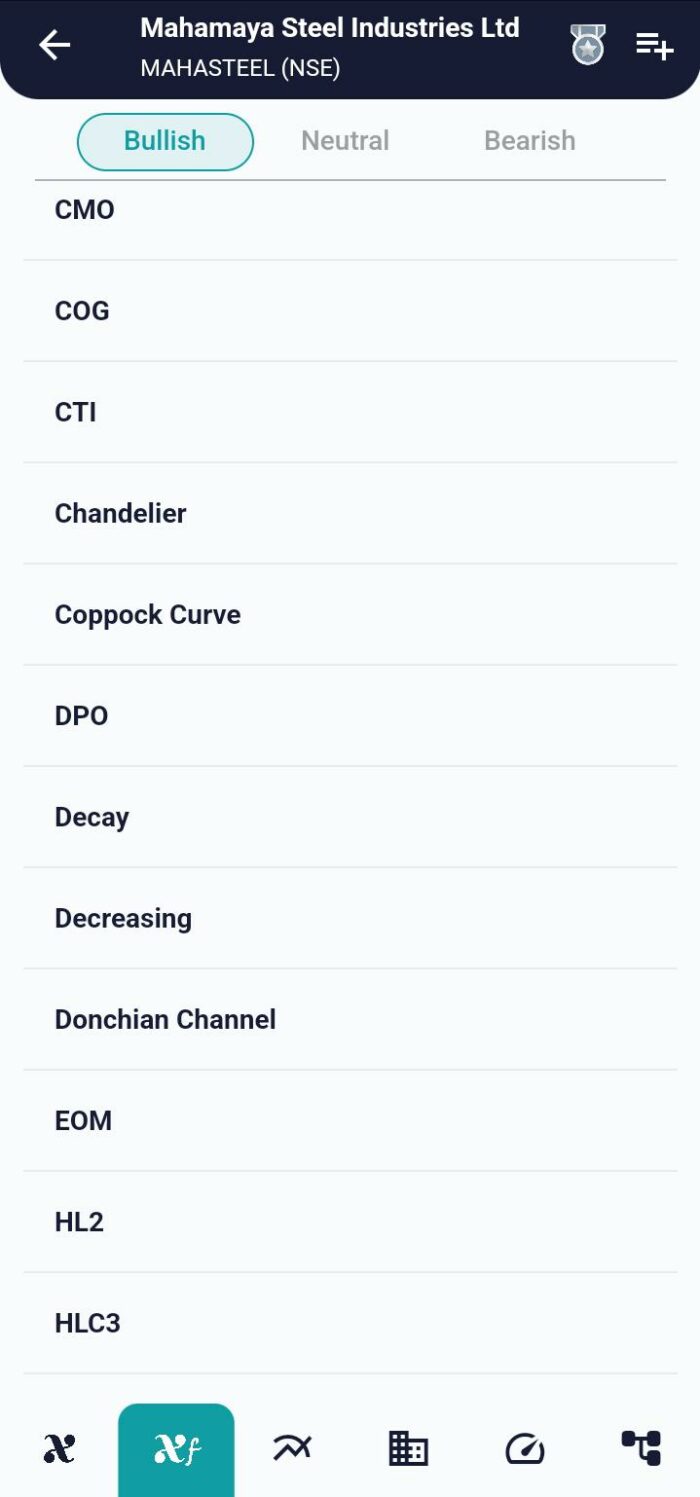

Donchian Channels: Guide to Trading Success

Overview

In the intricate realm of financial markets, having a reliable indicator to gauge price movements is indispensable. Enter the Donchian Channels, an insightful technical indicator that goes beyond conventional measures. Let’s embark on a journey to understand the dynamics of Donchian Channels and explore their strategic applications in trading.

Grasping the Essentials: Anatomy of Donchian Channels

- Three-Tiered Structure:

- Upper Band: Marks the highest price of a security over a specified period (N periods).

- Lower Band: Marks the lowest price of a security over the same N periods.

- Midrange or Median Band: The median value between the upper and lower bands, forming the heart of the Donchian Channel technical indicator .

- Interpreting Price Touchpoints:

- A Buy signal emerges when the price touches the upper band, and the preceding price did not touch it.

- A Sell signal materializes when the price touches the lower band, and the preceding price did not touch it.

Crafting Entry and Exit Strategies: Donchian Precision

- Buy Signal Execution:

- Initiate a Buy position when the current price touches the upper band, and the prior price did not.

- Sell Signal Execution:

- Execute a Sell position when the current price touches the lower band, and the prior price did not.

- Strategic Holding:

- If the price does not meet the criteria for Buy or Sell signals, adopt a “Hold” stance.

Harnessing the Midline Crossing: Donchian Dynamics

- Buy on Midline Cross (Upward):

- When the adjusted price crosses the Donchian midline value from below, a Buy signal is warranted.

- Sell on Midline Cross (Downward):

- Conversely, when the adjusted price crosses the Donchian midline value from above, a Sell signal is prompted.

- Holding Midline Stability:

- In the absence of midline crossings, maintain a “Hold” position, indicating market stability.

Integrating Donchian Channels: A Tactical Approach

- Trend Confirmation:

- Donchian Channels serve as potent tools to affirm prevailing trends, providing traders with valuable insights.

- Dynamic Entry and Exit Points:

- Leveraging Donchian signals allows traders to strategically time their entries and exits, optimizing risk management.

Conclusion: Empowering Traders with Donchian Precision

As traders navigate the complexities of financial markets, Donchian Channels emerge as invaluable allies. Their ability to pinpoint strategic entry and exit points, coupled with midline dynamics, empowers traders to make informed decisions. Whether you’re a seasoned trader or a novice investor, embracing the precision of Donchian Channels opens new avenues for strategic trading. It’s time to chart your course with confidence and navigate the markets with Donchian precision.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight