Candlestick Pattern

Posted On: December 10, 2025

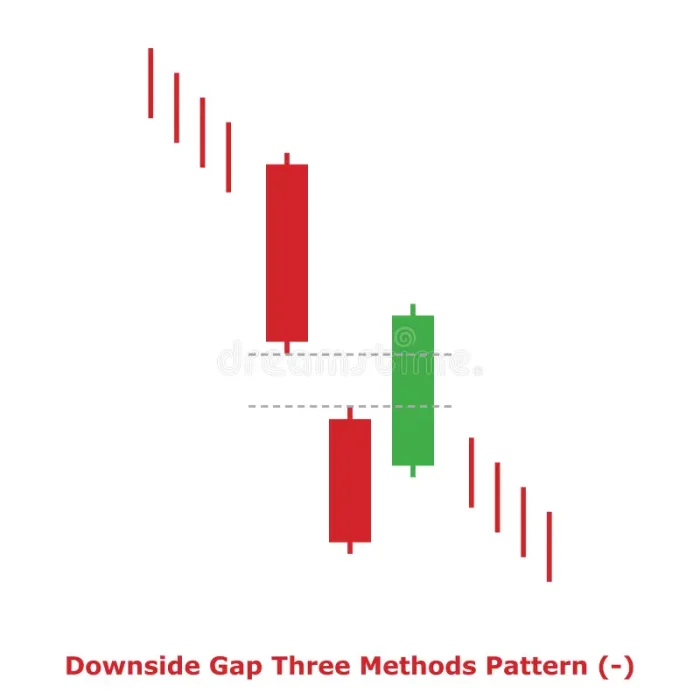

Downside Gap Three Methods: The Hidden Signal Behind Strong Downtrends

The Downside Gap Three Methods is a bearish continuation pattern that forms during a downtrend. It shows that the selling pressure remains strong even if the market experiences a small temporary pullback.

This pattern helps traders confirm that the downtrend is likely to continue.

The first two strong bearish candles with a downside gap confirm heavy selling. The third candle shows a small upward move (pullback), but the recovery is weak. Buyers are not strong enough to fill the entire gap or reverse the downtrend. This signals the downtrend is likely to continue after the brief pause.

How to identify The Downside Gap Three Methods

First Candle

A strong bearish candle

Appears during an existing downtrend

Second Candle

Another bearish candle

Opens below the low of the first candle (creates a downside gap)

Shows strong bearish sentiment

Third Candle

A bullish or small candle that moves upward into the gap

But does NOT close above the first candle’s close

This is a minor retracement but not strong enough to reverse the trend

Conclusion

The Downside Gap Three Methods is a reliable bearish continuation pattern that forms during a strong downtrend. The downside gap between the first two candles reflects increasing selling pressure, while the third candle’s limited upward retracement shows buyer weakness. Since the gap remains unfilled and the bullish movement fails to break resistance, the pattern confirms that bears still control the market. Traders use this formation to identify opportunities to enter short positions and continue following the prevailing downtrend.

Where can I see further insights on this stock?

xCalData offers unbiased insights into stocks. Download the app from google play. For Actionable Intelligence, subscribe to xCalData app on Android devices: Download here

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight