Posted On: January 23, 2024

#DYNAMATECH (NSE) Stock Report | 23 Jan 2024

Industry: Industrial Manufacturing

About DYNAMATECH:

Dynamatic Technologies Ltd is engaged in the business of manufacturing automotive components, hydraulics components, aerospace components and wind farm power generation. The company is organized into three main business segments namely Hydraulics (HEC); Automotive and Metallurgy; Aerospace and defence (ASP) and Others. It majorly generates its revenue from the Automotive and Metallurgy segment.

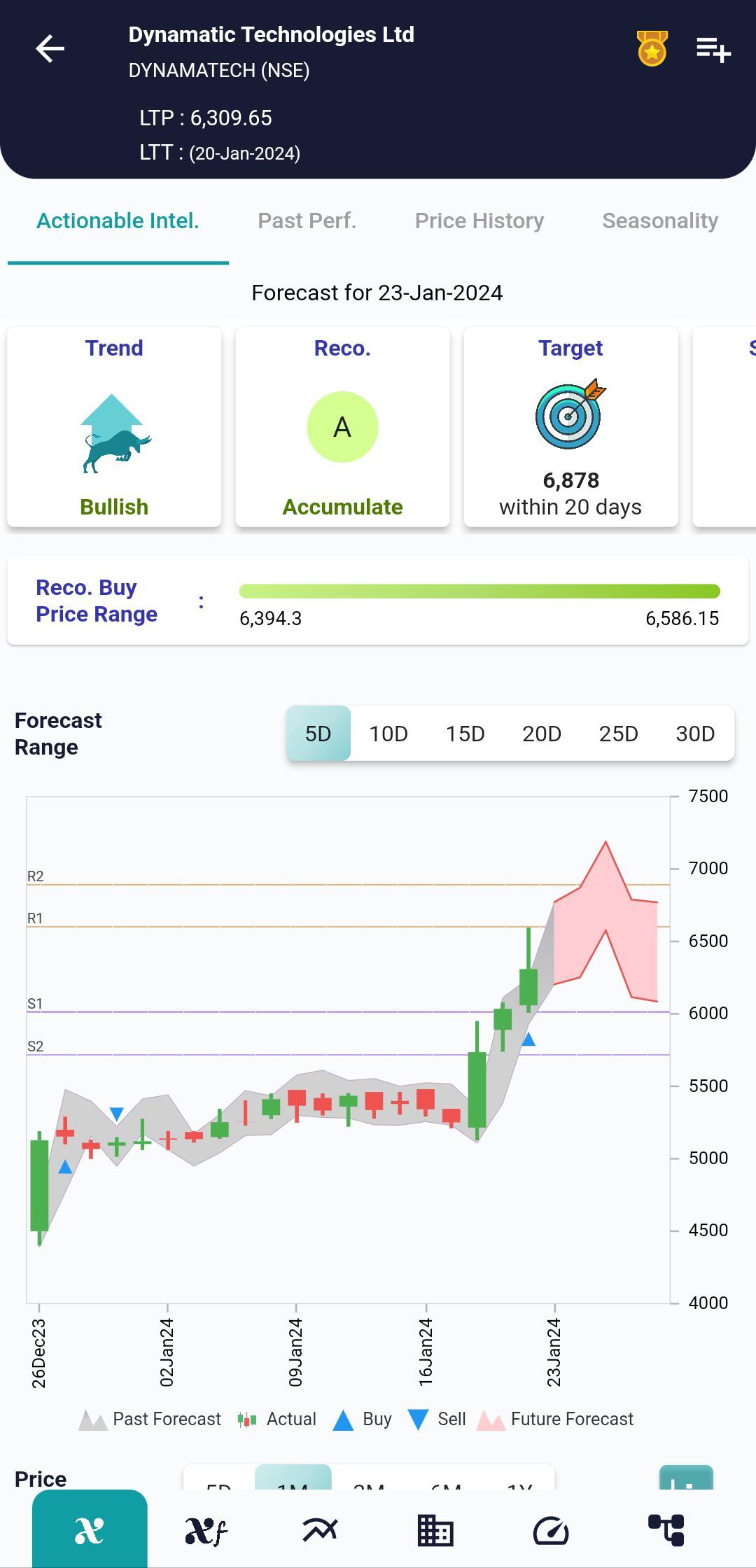

Forecast and Trend of the Stock:

Forecasting in investment involves historical data and analysis to make predictions about future market trends, asset prices, and economic conditions. Investors utilize this tool to assess risks and opportunities, allocate their capital wisely, and determine the most suitable investment strategies. Additionally, forecasting helps investors adjust their portfolios to align with their financial goals and risk tolerance.

#xCalData predicts that #DYNAMATECH will continue its bullish phase over the next five days and trend within the range of 6085 to 7188.

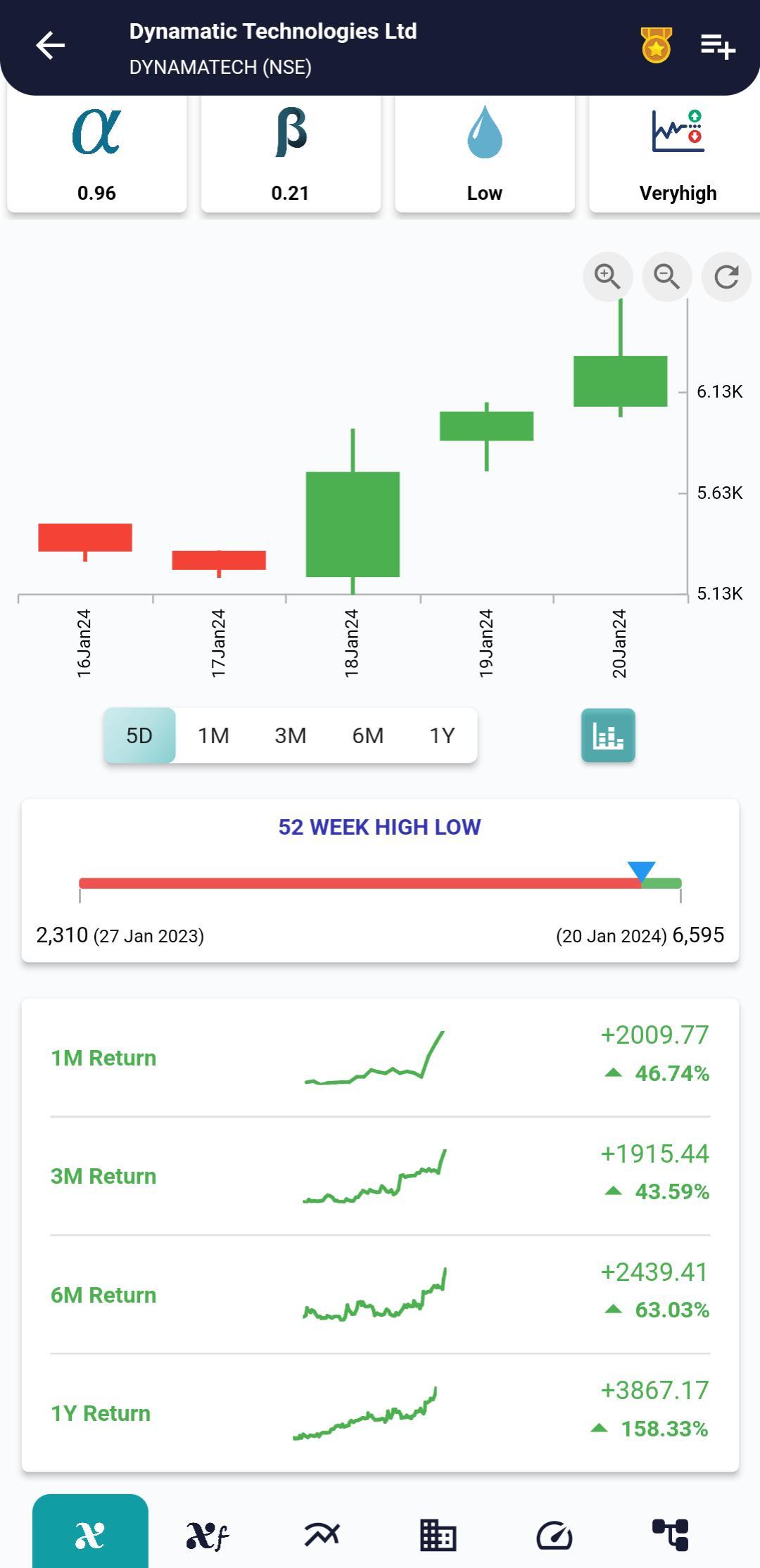

Price History of the Stock:

In comparison to the previous month, the price of the stock has experienced an increase of 46.74% indicating a bullish.

Historical stock prices can reveal patterns and trends that help investors make informed decisions. Studying past performance can provide valuable insights into potential future movements.

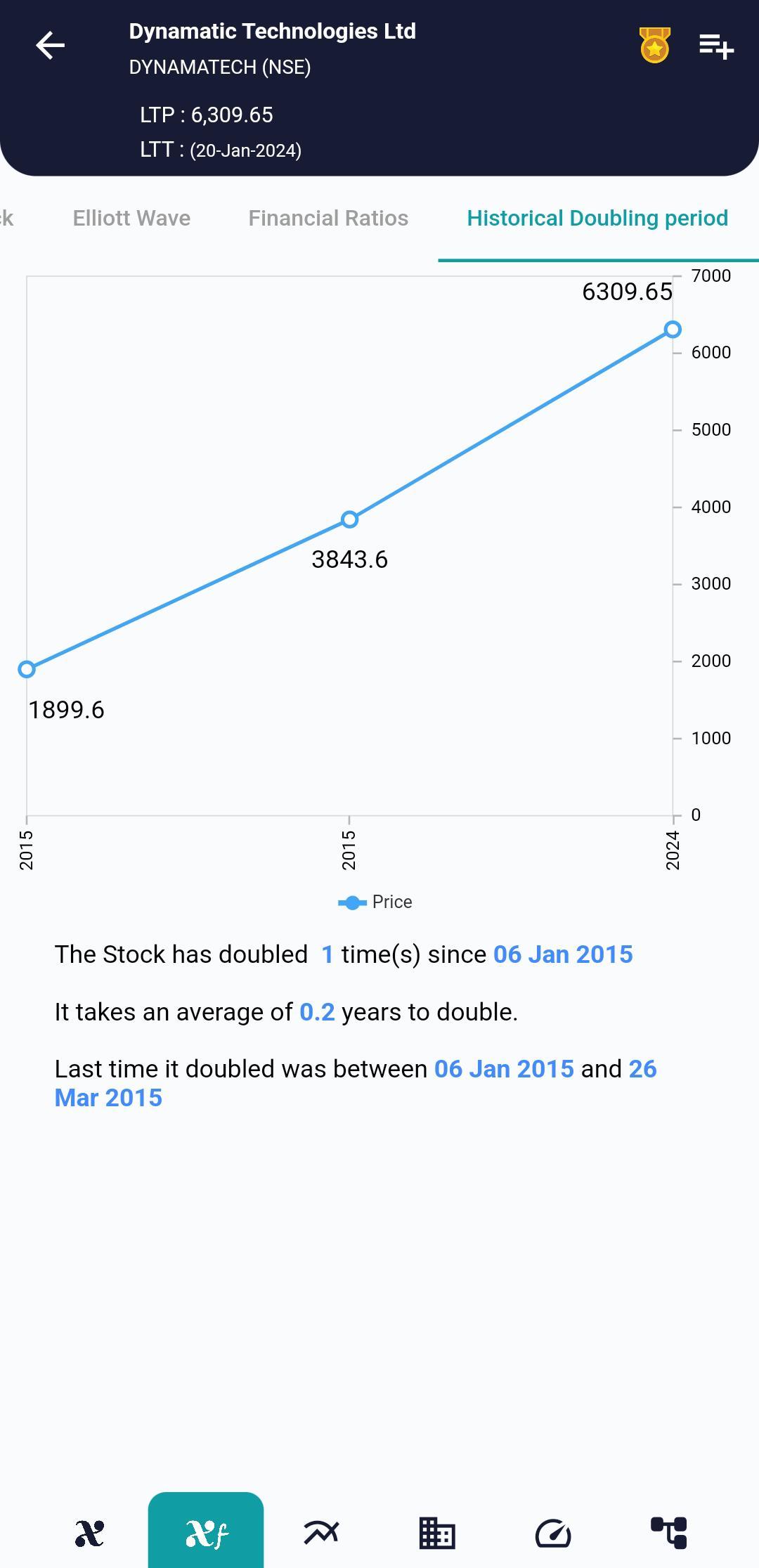

Historical Doubling Period:

The DYNAMATECH Stock has doubled once since 06 Jan 2015 and took an average of 0.2 years to double.

The historical doubling period, within the realm of finance, serves as a metric to gauge the duration it took for an investment, whether it’s a stock or any other asset, to increase in value twofold over a specified historical timeframe. It provides valuable insight into the growth rate and performance of an investment during that specific period.

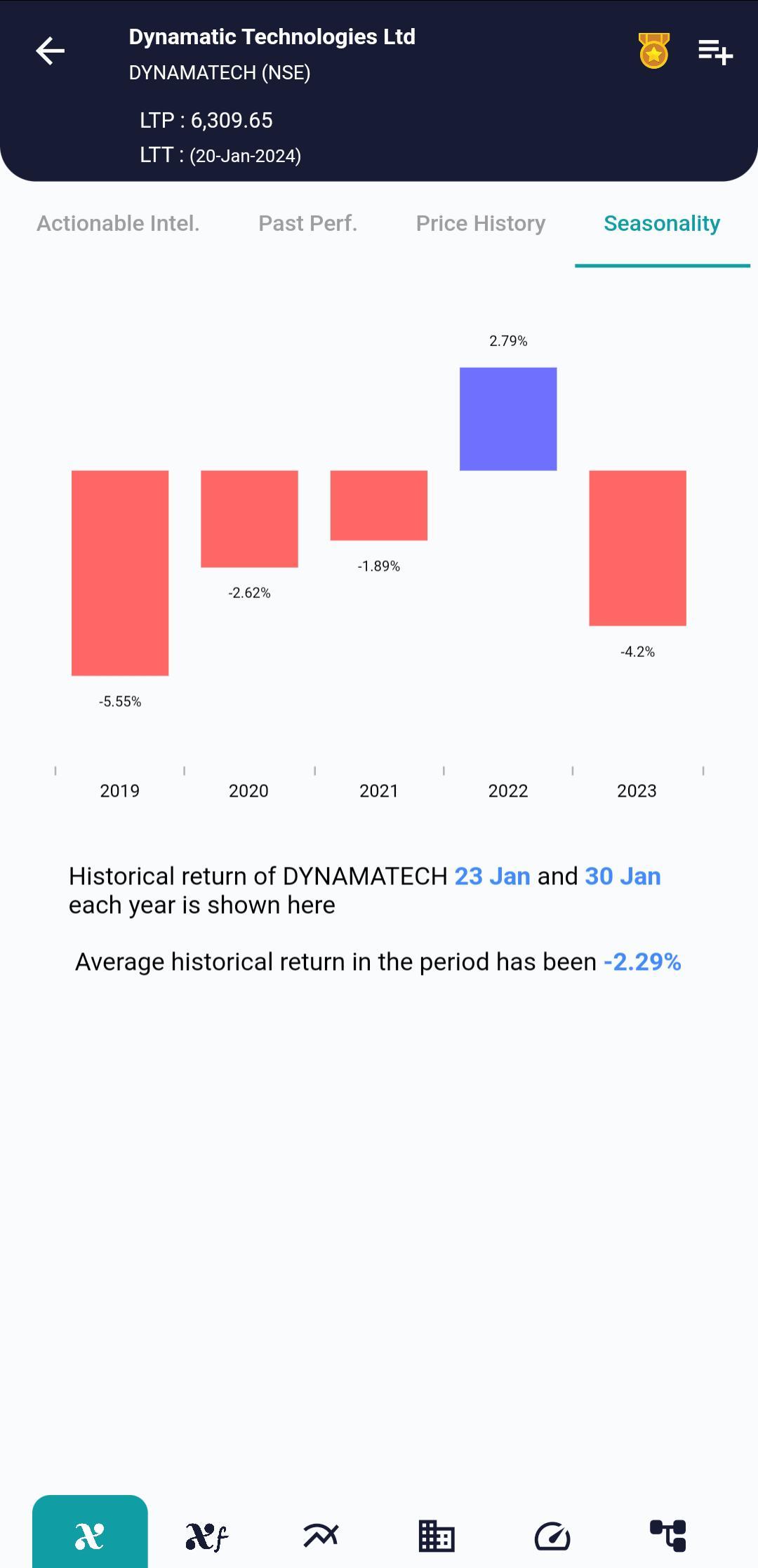

Seasonality:

The stock has shown seasonality trend in the past.

Reviewing the returns for the past 5 years for the same week, we see the stock has given negative returns in 4 years in the past.

Seasonality in the stock market is a fascinating phenomenon that has intrigued investors and analysts for generations. It involves the recurring patterns and trends in stock prices at specific times of the year. Understanding stock market seasonality can offer valuable insights for investors, guiding them in making informed decisions and optimizing their investment strategies. In this blog, we’ll explore what seasonality means in the context of the stock market and provide real-world examples to illustrate its significance.

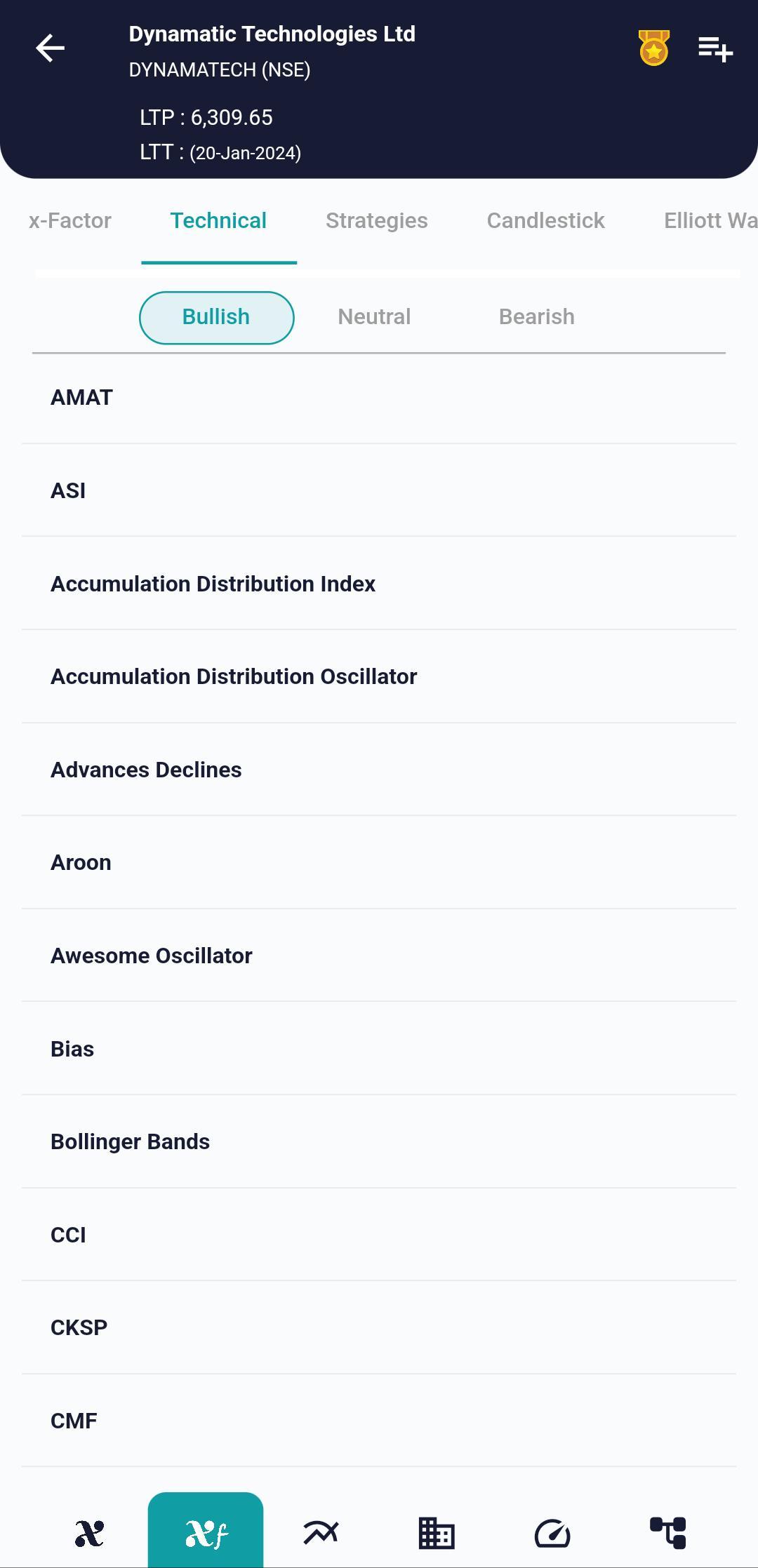

Technical Indicators:

Majority of the technical ratios trend towards Bullish side of the spectrum. Only some of the technical indicators namely Normalized ATR indicate Bearish view.

Collectively, xCalData suggests the stock would be in Bullish zone for next 5 days.

Technical indicators are essential tools used in technical analysis to help traders and investors make informed decisions in the financial markets. These indicators are typically derived from price, volume, or open interest data and are used to forecast future price movements or trends. They offer valuable insights into market behavior and can assist in entry and exit points for trading strategies.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData