Technical Indicator

Posted On: January 31, 2024

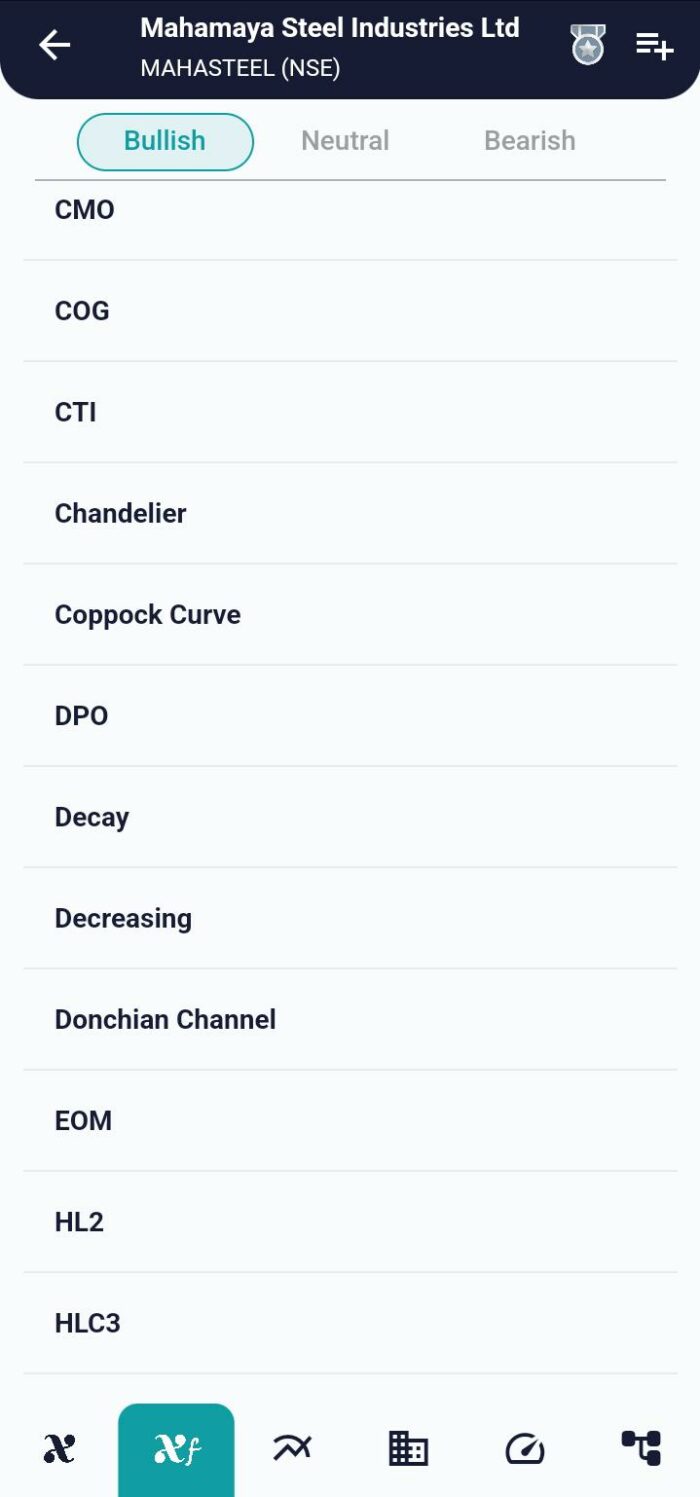

Exploring the Power of the Decreasing Indicator

Navigating Trends: A Dive into the World of Decreasing

In the intricate realm of financial markets, the Decreasing technical indicator emerges as a fundamental tool, wielding the power to seamlessly carry signals from the past into the future. This simple yet robust function plays a crucial role in deciphering the ever-evolving landscape of trading dynamics.

Peeling Back the Layers: Understanding the Decreasing Formula

The core of this indicator is encapsulated in a concise formula:

Decreasing = close.diff(Decreasing_window) < 0

Let’s dissect this formula to uncover its essence:

close: Represents the closing prices, a pivotal metric in market analysis..diff(): Denotes the difference between consecutive values, capturing the rate of change.Decreasing window: Set at 1, indicating a focus on the change from the previous period to the current one.< 0: Evaluates whether the difference is negative, indicating a decrease in value.

Illuminating Interpretation: Navigating Trends with Decreasing

As traders embark on the journey of interpreting this indicator , the following insights come to light:

- Up Trend Signal:

- If

Decreasingequals 0, it unfurls an Up Trend Signal. This suggests a continuity or affirmation of an ongoing upward trend, as the rate of decrease is minimal or nonexistent.

- If

- Down Trend Signal:

- When

Decreasingequals 1, it signals a Down Trend. This implies a potential reversal or strengthening of a downward trend, as the rate of decrease is evident.

- When

Integration into Trading Strategies: Harnessing the Power of Decreasing

- Trend Confirmation:

- Leverage this indicator to validate existing trends, providing a systematic approach to recognizing and confirming upward or downward trajectories.

- Dynamic Trend Analysis:

- Use the function to dynamically assess changing trends, allowing your trading strategy to adapt to evolving market conditions.

- Threshold Exploration:

- Experiment with different threshold levels to fine-tune the sensitivity of this indicator to market fluctuations. A lower threshold may capture subtle shifts, while a higher one can filter for more pronounced trends.

Conclusion: Empowering Traders with Decreasing Wisdom

In the ever-shifting landscape of financial markets, the this indicator function emerges as a stalwart companion for traders seeking to decipher trends and anticipate market movements. Its ability to distill complex dynamics into actionable signals makes it a valuable addition to any trader’s toolkit. Whether you’re a seasoned market veteran or a budding trader, embracing this indicator can be a pivotal step toward a more informed and nuanced approach to market analysis.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight