Candlestick Pattern

Posted On: December 10, 2025

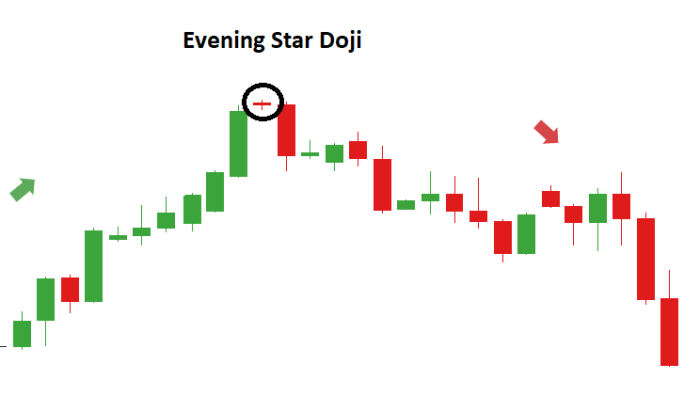

From Uptrend to Downtrend: The Evening Star Doji Pattern

The Evening Star Doji is a strong bearish reversal pattern that appears at the top of an uptrend. It signals that bullish momentum is weakening and the market may be preparing to move downward.

It is a variation of the classic Evening Star, but the presence of a Doji (a candle with almost no body) makes it more powerful, because it shows complete indecision and exhaustion in buyers.

How to identify the Evening Star Doji

First Candle – Bullish Candle

Strong bullish candle in an uptrend

Shows strong upward momentum

Second Candle – Doji Candle

The most important part of this pattern Very small body (open and close are almost the same)

Indicates indecision and weakening buying power

Often gaps up from the first candle

Third Candle – Bearish Candle

A strong bearish candle

Closes well inside or below the body of the first candle

Confirms trend reversal

Conclusion

The Evening Star Doji is a reliable bearish reversal pattern indicating a potential end to an uptrend. The Doji in the middle highlights strong indecision and signals that buyers are losing strength. When followed by a strong bearish candle, it confirms the shift in momentum from buyers to sellers, making it a valuable tool for traders to anticipate downward price movement.

Where can I see further insights on this stock?

xCalData offers unbiased insights into stocks. Download the app from google play. For Actionable Intelligence, subscribe to xCalData app on Android devices: Download here

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight