Strategy

Posted On: January 9, 2024

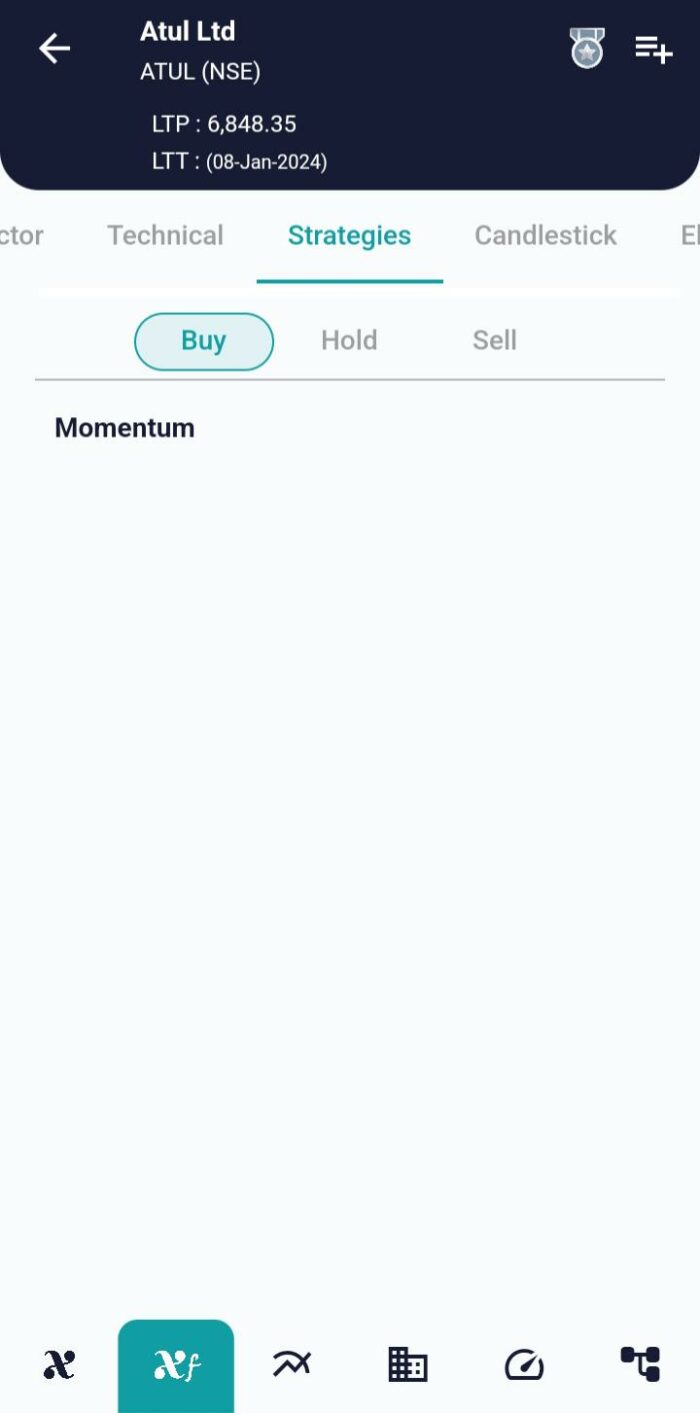

Harnessing Market Momentum: Exploring the Momentum Strategy for Trading Success

In the ever-changing world of financial markets, traders frequently look for methods that follow the direction of price movements over time. As its name implies, the Momentum Strategy is designed with momentum traders and investors in mind. We’ll go into the core ideas of the Momentum Strategy in this blog article, looking at its main components, how it works, and how traders may take advantage of its strength. This blog post will go into the nuances of the Momentum Strategy, breaking down its core ideas and showing you how to use this effective tool using the xCaldata App.

Deciphering the Momentum Strategy:

The Momentum Strategy’s primary goal is to seize the momentum of price movements within a given time frame. This gives the user flexibility and adds a customizable element to the plan because it is not set in stone. When the change over the selected period turns positive and has grown since the previous bar, the Momentum Strategy enters a long position. On the other hand, if the change throughout the period is negative and has dropped since the previous bar, it enters a short position.

Key Components of the Strategy:

The Momentum Strategy can be tailored to different trading styles due to its adjustable time period. In order to identify momentum trends that are either short- or long-term, traders might try out various lengths.

Positive Momentum for Long Entry:

When the change over the user-defined time turns positive and has increased since the previous bar, the strategy finds possibilities for long positions. This is a scenario of increasing momentum.

Negative Momentum for Short Entry:

On the other hand, when the change during the designated period turns negative and has decreased since the previous bar, it indicates a downward momentum for short positions.

In summary:

To sum up, the Momentum Strategy is a potent instrument for traders who are keen on investing or trading based on momentum, according to its name. Because of the strategy’s adaptability, flexibility, and user-defined parameters, traders of different skill levels can employ it. The Momentum Strategy gives traders the ability to ride the waves of market momentum, whether it is used on a preferred symbol or tested over a range of timeframes. The Momentum approach proves to be a useful tool for dealing with the intricacies of financial markets when users experiment with period setting and observe the approach in action.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight