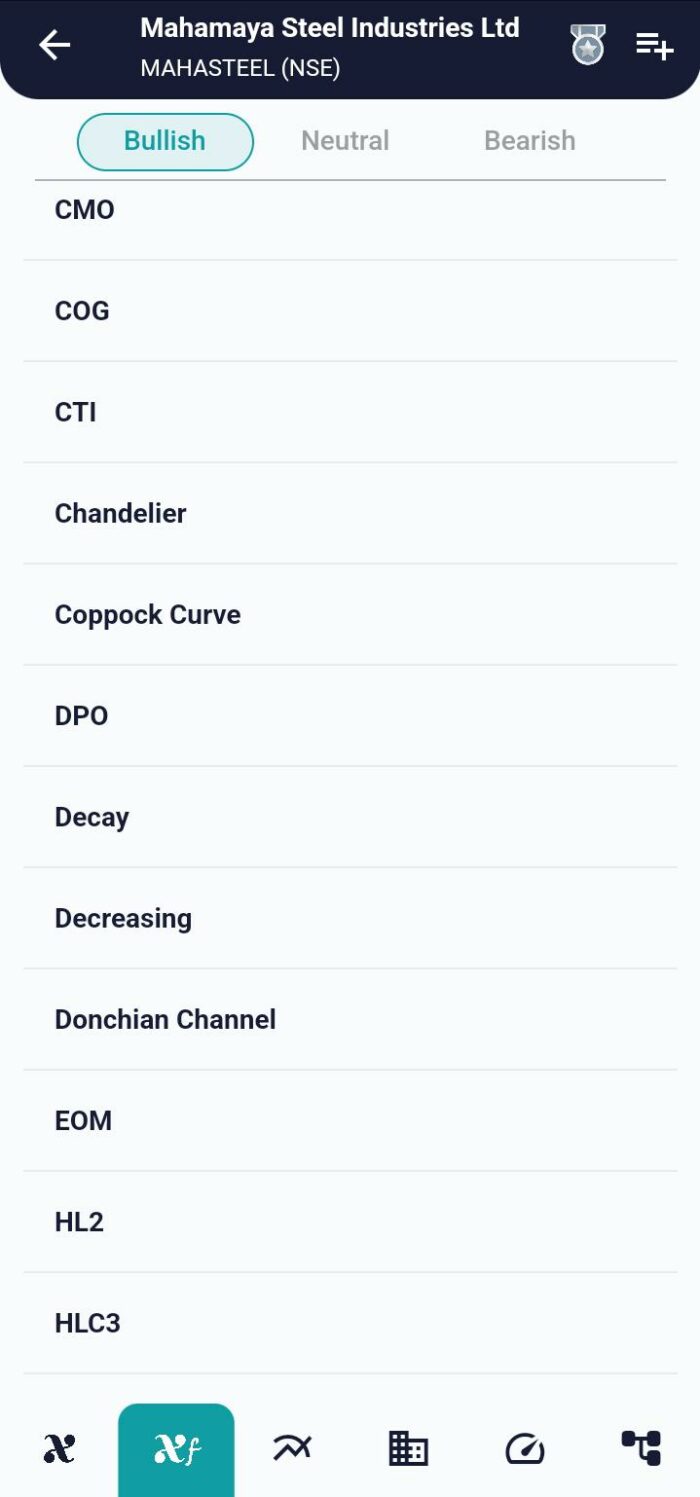

Technical Indicator

Posted On: January 31, 2024

Harnessing the Power of Decay for Market Advantage

Embracing Decay for Enhanced Signal Propagation

In the realm of algorithmic trading and machine learning, the concept of Decay stands as a powerful technical indicator that bridges the gap between historical data and future signals. This simple yet effective tool serves as a catalyst for propagating signals from the past into the unknown territory of the future.

The Core Formula: Unveiling the Essence of Decay

The mathematical underpinning of this indicator is elegantly captured by the formula:

Decay = max(close, (close[1] - 1/decay_window), 0)

Here, the decay window is set at 5, providing a window of insight into the past five periods. Now, let’s dissect the formula to comprehend its significance:

close: The current closing price.close[1]: The closing price from the previous period.1/decay window: A fraction representing the factor, ensuring a gradual decrease in influence over past values.max: A function selecting the maximum value between the current close and the adjusted close.decay window= Default is 5.

Deciphering the Interpretation: Riding the Trends

The beauty of this Indicator unfolds in its straightforward interpretation, empowering traders to discern prevailing trends:

- Up Trend Signal:

- When the current close equals the Decay value, it triggers an Up Trend Signal. This suggests a continuation or confirmation of an ongoing upward trend.

- Down Trend Signal:

- If the Decay value surpasses the current close, it signals a Down Trend. This indicates a potential reversal or reinforcement of a downward trend.

Integrating Decay into Algorithmic Strategies

- Trend Confirmation:

- Leverage this indicator to confirm existing trends, offering a systematic approach to identifying upward or downward trajectories.

- Signal Propagation:

- Use this indicator to propagate historical signals into the future, enhancing the responsiveness of your algorithmic trading system.

- Dynamic Windows:

- Experiment with different this indicator windows to adapt the indicator’s sensitivity to varying market conditions. A shorter window may capture more immediate shifts, while a longer window provides a broader perspective.

Conclusion: Empowering Algorithmic Wisdom

As algorithms and machine learning algorithms continue to shape the landscape of trading, this indicator emerges as a valuable ally. Its ability to gracefully propagate signals while adapting to market dynamics adds a layer of sophistication to algorithmic strategies. Whether you’re a seasoned quant or delving into the world of algorithmic trading, embracing Decay can be a game-changer in your quest for informed and agile decision-making.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight