Candlestick Pattern

Posted On: February 13, 2024

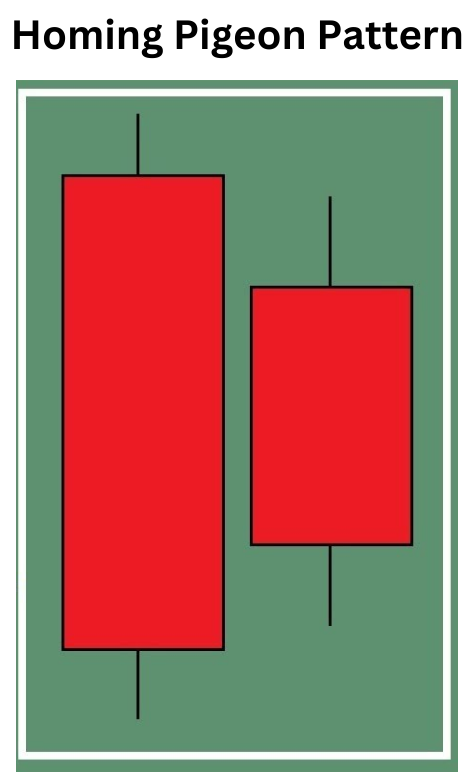

Homing Pigeon Pattern: A Flight Towards Potential Reversals in Trading

In the vast expanse of financial markets, traders utilize a myriad of technical analysis tools to decipher potential trend reversals and market dynamics. Candlestick patterns renowned for their ability to provide actionable insights, play a crucial role in this endeavor. The Homing Pigeon pattern is one such candlestick formation that deserves attention from traders, acting as a signal for potential bullish reversals. In this blog post, we will explore the concept of the Homing Pigeon pattern, delve into its identification process, and discuss how traders can interpret this pattern to refine their trading strategies.

The Homing Pigeon pattern is a two-candlestick formation that typically manifests during a downtrend, signaling a potential reversal to the upside. The pattern consists of a large bearish candle followed by a smaller bullish candle, where the latter’s body resides within the range of the bearish candle.

Identifying the Homing Pigeon Pattern:

To identify the Homing Pigeon pattern, traders should pay close attention to the following key features:

- Downtrend: The pattern usually emerges within an ongoing downtrend, indicating potential bullish reversal.

- Large Bearish Candle: The first candlestick is bearish and signifies prevailing selling pressure in the market.

- Smaller Bearish Candle: The second candlestick is bearish, with its body residing within the range of the bearish candle.

Interpreting the Homing Pigeon Pattern:

The Homing Pigeon pattern implies a potential weakening of bearish momentum and a shift in market sentiment from bearish to bullish. The smaller bullish candle within the range of the preceding bearish candle suggests that buyers are gaining control, possibly leading to a trend reversal. Traders interpret this pattern as a signal to consider initiating long positions or tightening stop-loss levels on existing short positions.

Confirmation and Trade Execution:

While the Homing Pigeon pattern provides a potential bullish signal, traders often seek supplementary confirmation before entering trades. They may consider the following factors:

- Volume Confirmation: Higher trading volume during the pattern’s formation enhances the credibility of the potential reversal.

- Support and Resistance Levels: Identifying key support and resistance levels can further validate the pattern’s authenticity and guide in setting realistic price targets.

- Technical Indicators: Integrating the Homing Pigeon pattern with other technical indicators, such as moving averages or oscillators, enriches the trading decision-making process.

Conclusion:

The Homing Pigeon pattern serves as a valuable tool for traders, offering insights into potential bullish reversals and shifts in market sentiment. By understanding its identification process and adeptly interpreting this pattern, traders can refine their trading strategies.

However, it’s crucial to recognize that no pattern guarantees success, and informed trading decisions necessitate additional verification and comprehensive analysis. As with any trading strategy, risk management and prudent decision-making remain paramount for traders navigating the complexities of financial markets.

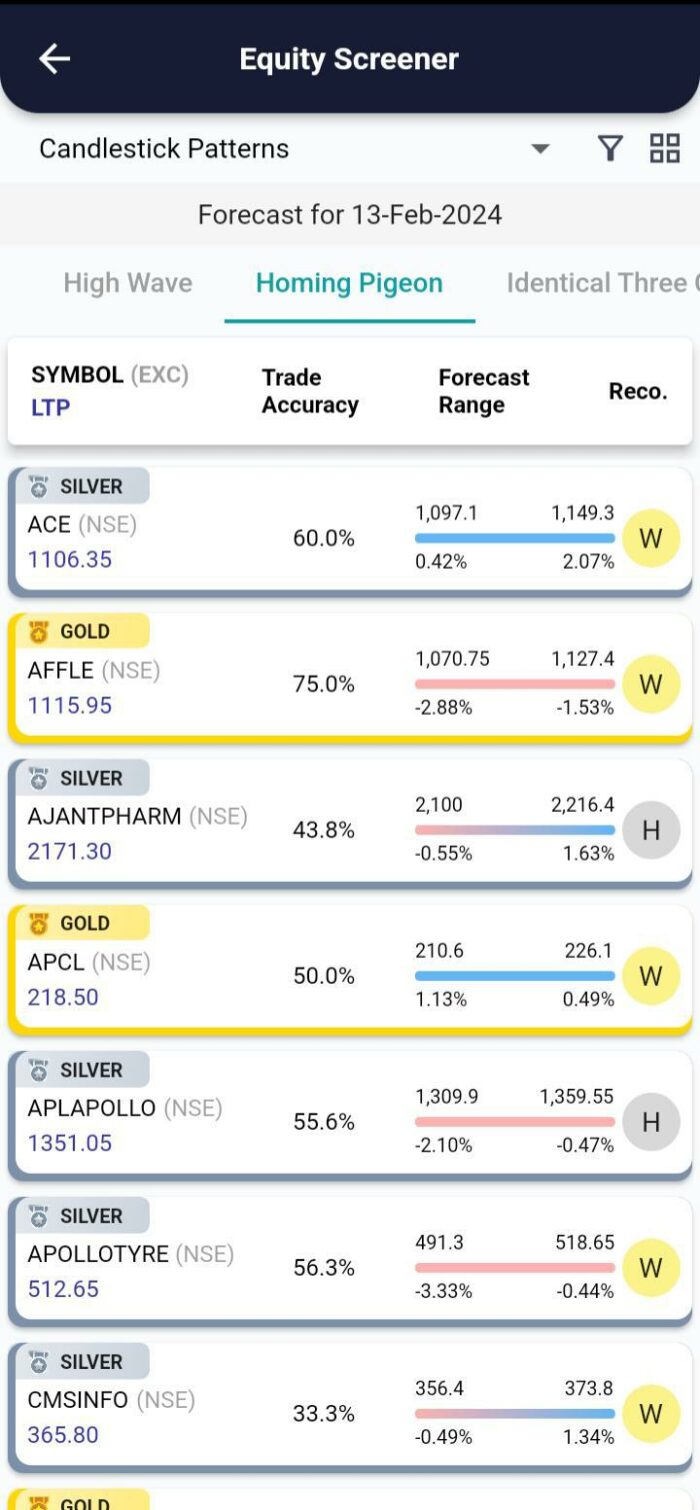

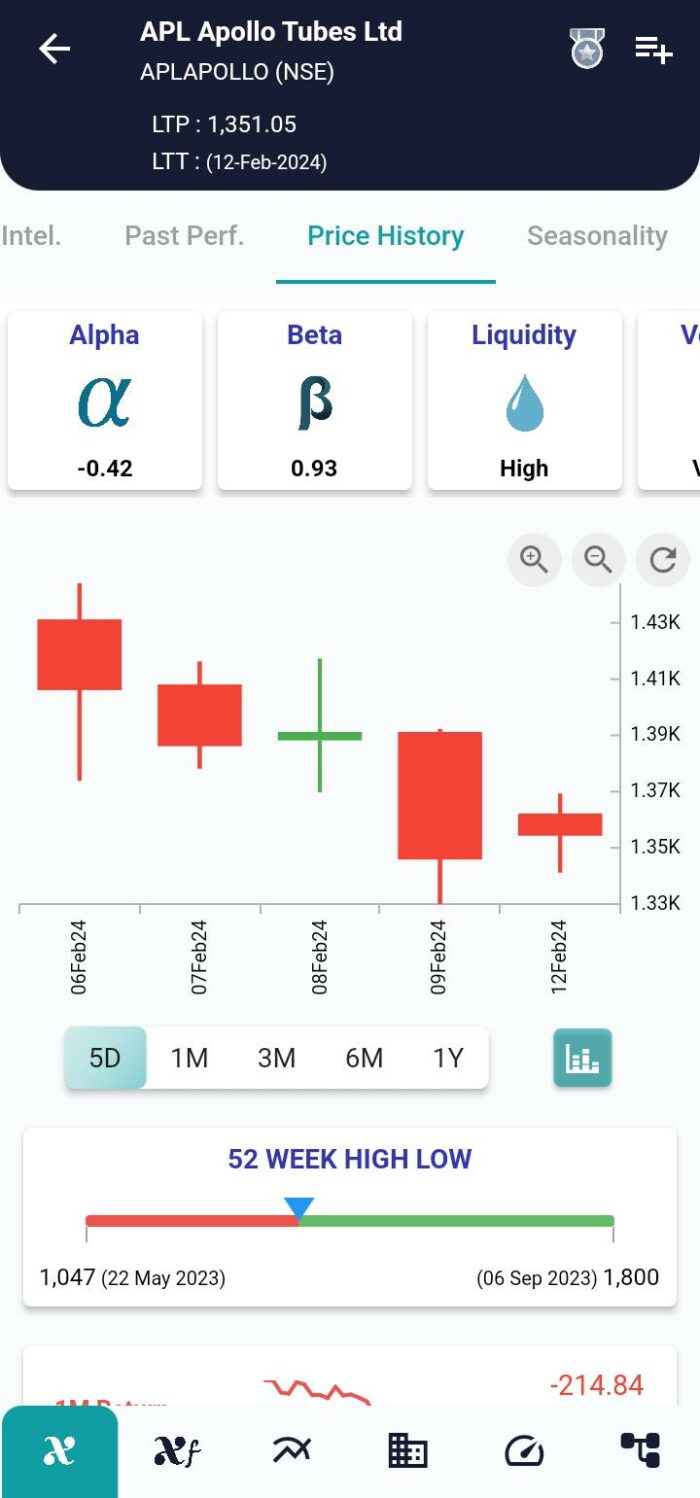

Where can I see further insights on this stock?

xCalData offers unbiased insights into stocks. Download the app from google play. For Actionable Intelligence, subscribe to xCalData app on Android devices: Download here

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Disclaimer: The securities quoted are for illustration only and are not recommendatory.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight