Market report

Posted On: February 19, 2026

Indian IT Sector Analysis Report: Market Trends and Strategic Insights | Feb 2026

Sector Overview

India’s IT & BPM sector is a cornerstone of the economy, contributing USD 283 billion in FY24 (~7.3% of GDP) and projected to reach USD 350 billion by FY26 (~10% of GDP). The sector remains bullish, supported by digital transformation, AI adoption, and global capability centres (GCCs).

The Indian IT sector is expanding rapidly, driven by strong growth factors such as cloud adoption, AI/GenAI integration, rising demand for cybersecurity, and the expansion of Global Capability Centres (GCCs). At the same time, it faces critical risks including global demand volatility, high talent attrition rates, and increasing regulatory compliance requirements. Major trends shaping the industry include automation of processes, strengthening of digital exports, and a growing emphasis on sustainability in IT infrastructure, positioning the sector as both dynamic and resilient in the global market.

Market Size and Growth Metrics

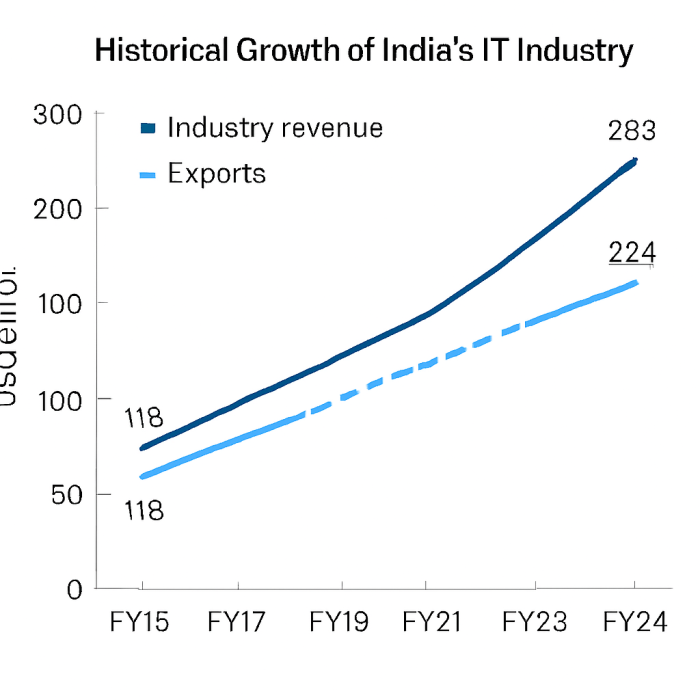

- Market Size (FY24): USD 283 billion.

- Exports: USD 224 billion.

- Historical Growth: From USD 118 billion in FY15 to USD 283 billion in FY24.

- Forecast: USD 350 billion by FY26.

Market Dynamics and Drivers

- Growth Drivers: Cloud adoption, AI/GenAI, digital transformation, GCC expansion.

- Supply Chain: Skilled workforce, digital infrastructure, global delivery networks.

- Technological Trends: Generative AI, cybersecurity, automation, data analytics.

- Consumer Trends: Rising enterprise demand for digital services, remote work, cloud migration.

Competitive Landscape

India’s IT sector is shaped by intense competition among major players like TCS, Infosys, Wipro, and HCL, making industry rivalry high.

While new entrants face moderate barriers such as capital requirements and regulatory compliance, the rise of startups in AI and SaaS is notable.

Supplier power is moderate due to India’s vast skilled workforce, though niche talent shortages increase leverage.

Buyer power remains high, with global clients exerting strong pricing pressure and demanding innovation.

The threat of substitutes is rising, driven by automation platforms and AI-driven solutions that challenge traditional service models. Overall, the sector is competitive and evolving, requiring firms to innovate and differentiate to sustain margins and market share.

Regulatory Measures

MeitY – AI Governance (2025): Introduced national AI guidelines under the India AI Mission, balancing innovation with trust. By addressing risks like deepfakes, bias, and security threats, the framework promotes responsible AI adoption across industries and aligns with Viksit Bharat 2047 goals.

RBI – Payments Oversight (2025): Established the Payments Regulatory Board to strengthen rules for payment and settlement systems. This enhances fraud analytics, resilience, and real-time compliance, creating new opportunities for IT firms in fintech, compliance tech, and transaction monitoring.

OECD – Digital Economy Outlook (2025): Highlighted rising cyber risks and the need for ethical AI. Sovereign cloud initiatives and cross-border data rules are reshaping delivery models, pushing Indian IT firms toward secure infrastructure, data localization, and innovation in AI-driven products.

UNCTAD – World Investment Report (2025): Ranked India 15th globally for FDI inflows in 2024 (USD 27.6B), with strong momentum in digital economy investments. This boosts IT sector growth in areas like sustainable finance, compliance consulting, and digital infrastructure expansion.

Together, these measures strengthen governance, attract investment, and open new service verticals, positioning India’s IT sector for sustained global competitiveness.

Macro environmental Analysis

India’s G20 Digital Economy Working Group participation positions it as a global voice in AI ethics and cross-border data governance.

State governments (e.g., Karnataka, Telangana) are expanding IT parks and SEZs, decentralizing growth beyond Tier-1 cities.

The sector added USD 13.8 billion incremental revenue in FY25, growing by 5.1% despite global headwinds.

Workforce expansion: projected to reach 5.8 million employees in FY25, strengthening India’s labor advantage.

Government-backed skilling programs (FutureSkills Prime) are training rural youth and women in emerging technologies.

Hybrid work adoption is reshaping workplace culture, with GCCs offering flexible models to attract talent.

Engineering R&D (ER&D) and GCCs are becoming major growth drivers, diversifying beyond traditional IT services.

India is investing in semiconductor design and 5G-enabled IT applications, expanding into IoT and smart city solutions.

India’s Digital Personal Data Protection Act (2023) enforces stricter compliance, reshaping outsourcing contracts.

Mandatory ESG disclosures for listed companies are pushing IT firms to integrate sustainability into compliance frameworks.

Sustainability is now a core industry metric, with IT firms investing in renewable-powered data centers.

Climate resilience planning is critical, as IT hubs in coastal regions (Chennai, Kochi) face risks from extreme weather events.

SWOT Analysis – Indian IT Sector

Strengths

- India is the world’s largest IT services exporter, contributing ~18% of global outsourcing.

- Over 5 million IT professionals, supported by strong STEM education and English proficiency.

- IT exports reached USD 224 billion in FY24, with consistent double-digit growth.

- Initiatives like Digital India, Startup India, and National Policy on Software Products (2019) provide structural backing.

- Presence of large firms (TCS, Infosys, Wipro, HCL) and over 1,600 Global Capability Centers (GCCs).

Weaknesses

- Talent retention remains a challenge, especially in niche areas like AI and cybersecurity.

- Global clients exert strong bargaining power, reducing margins.

- Heavy reliance on North America and Europe makes the sector vulnerable to external shocks.

- Domestic IT spending (~USD 160 billion in FY25) is growing but still smaller compared to exports.

Opportunities

- Expected to boost productivity by 43–45% over the next five years (MeitY Digital Economy Report).

- Rising demand for enterprise cloud solutions and secure digital infrastructure.

- Expansion projected to generate 1.2 million new tech jobs by 2027 (NASSCOM).

- Indian software product industry projected to reach USD 100 billion by 2025 (National Policy on Software Products).

- Growth in healthcare IT, fintech, and engineering R&D.

Threats

- Recessionary trends in the US/EU could reduce outsourcing demand.

- Compliance with India’s Digital Personal Data Protection Act (2023) and global standards (GDPR, HIPAA).

- Automation, low-code/no-code platforms, and AI substitutes may reduce demand for traditional IT services.

- Trade tensions, visa restrictions, and cybersecurity threats.

Future Outlook

- ₹10,300 crore allocated under IndiaAI Mission (2024–2029) to strengthen AI capabilities.

- A provision of ₹1,000 crore has been made for ISM 2.0 in FY 2026–27. The initiative supports the development of core electronics manufacturing capabilities that underpin digital infrastructure, including data centres and advanced computing systems.

CONCLUSION

India’s IT sector is set for sustained expansion, with revenues projected to reach USD 350 billion by FY26, driven by cloud adoption, AI integration, cybersecurity demand, and government-backed initiatives, while risks such as global demand volatility, talent attrition, and automation substitutes remain. Consider long-term investment exposure to the Indian IT sector, focusing on its growth potential and resilience, while maintaining caution around global headwinds and margin pressures.

Sources

- Ministry of Electronics & Information Technology (MeitY) – Digital Economy Reports

- NASSCOM Annual Strategic Review 2025 – Industry size, exports, forecasts

- National Policy on Software Products (2019) – Government framework

- Digital Personal Data Protection Act (2023) – Legal compliance

- NAICS Official Classification – Industry coding standards

- invest up.gov.in

What is xCalData?

xCalData is a Made in India AI powered investment research platform called RHOMB.

Using multilayered neural network, RHOMB analyses over 150+ technical ratios, 150+ candlestick chart patterns and over 40 fundamental ratios of each stock.

RHOMB forecasts the stock price movement for the next few days and determines buy , sell , hold or wait.

How accurate is xCalData?

xCalData publishes the accuracy of the past trades for each stock to enable an informed decision.

Is xCaldata an Algo trading platform?

No, xCalData is not an algotrading platform. User decides when to buy or sell including, we only provide inputs for the decision.

Download the app for further stock level insights: https://play.google.com/store/apps/details?id=com.xcaldata.goldennest

Checkout the trades and detailed insights in the app

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight