Stock of Interest

Posted On: October 14, 2024

#INTELLECT (NSE) Stock Report | 14 Oct 2024

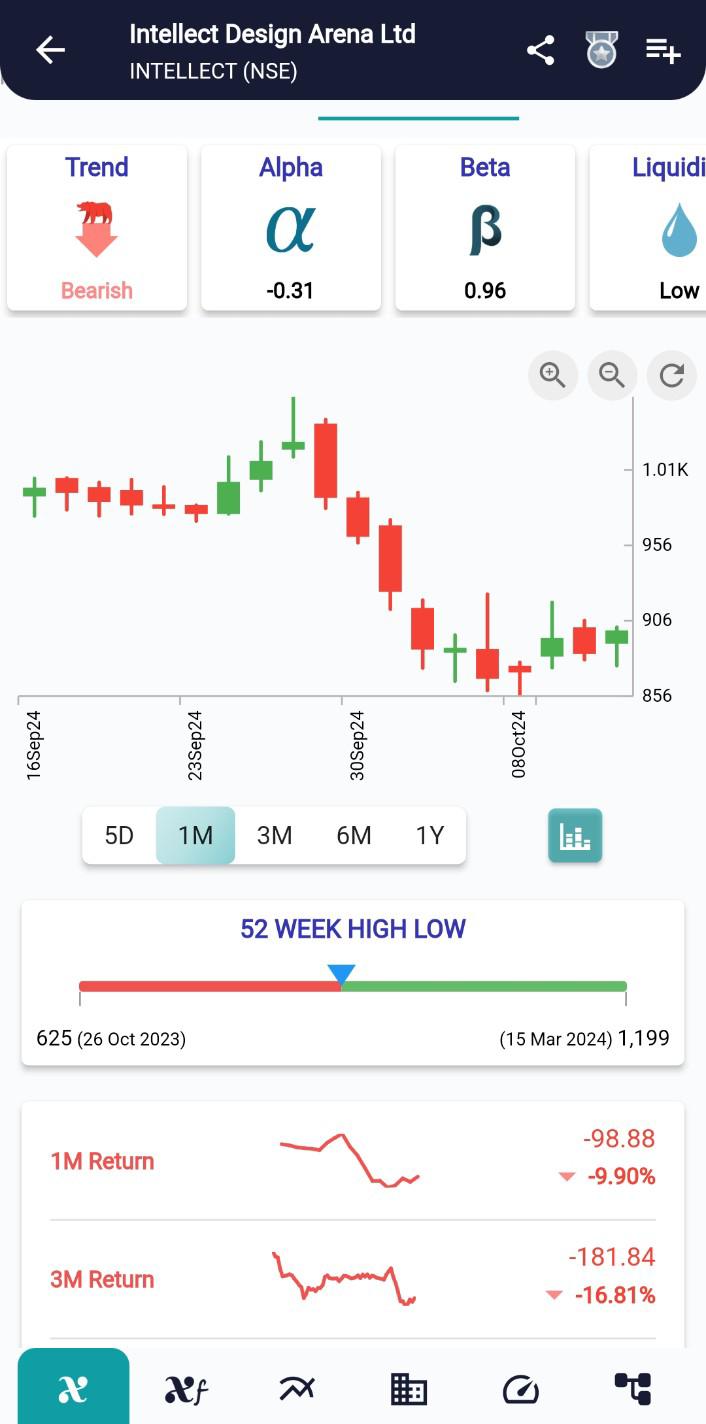

Outlook: Bearish

Sector: Information Technology

Industry: IT – Software

About INTELLECT:

Intellect Design Arena Ltd is an Indian IT software services company. It is engaged in the business of software and financial technology development for banking, insurance, and other financial services. The company operates under the primary business segment of Software Product Licence and related services. It derives revenue from the operations comprising income from its four business verticals, Global consumer banking and central banking; Risk; Treasury and markets; and Global transaction banking and insurance. The company products include Digital cards, Digital lending, Capital cube, Xponent, Digital core, Payments, Wealth Qube, and others.

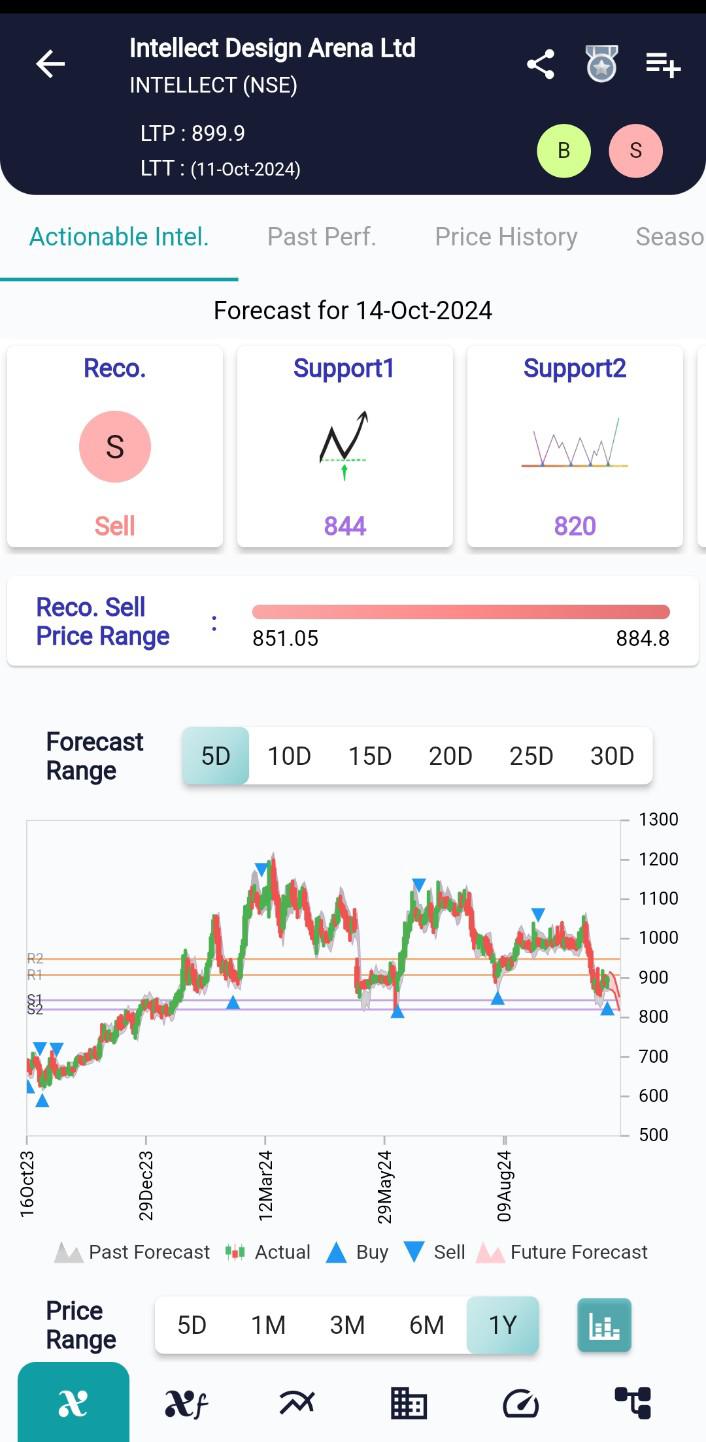

Forecast and Trend of the Stock:

Forecasting in investment involves historical data and analysis to make predictions about future market trends, asset prices, and economic conditions. Investors utilize this tool to assess risks and opportunities, allocate their capital wisely, and determine the most suitable investment strategies. Additionally, forecasting helps investors adjust their portfolios to align with their financial goals and risk tolerance.

#xCalData predicts that #INTELLECT will continue its bearish phase over the next five days and trend within the range of 818 to 915.

Price History of the Stock:

In comparison to the previous month, the price of the stock has experienced a decline of 9.9% indicating a bearish.

Historical stock prices can reveal patterns and trends that help investors make informed decisions. Studying past performance can provide valuable insights into potential future movements.

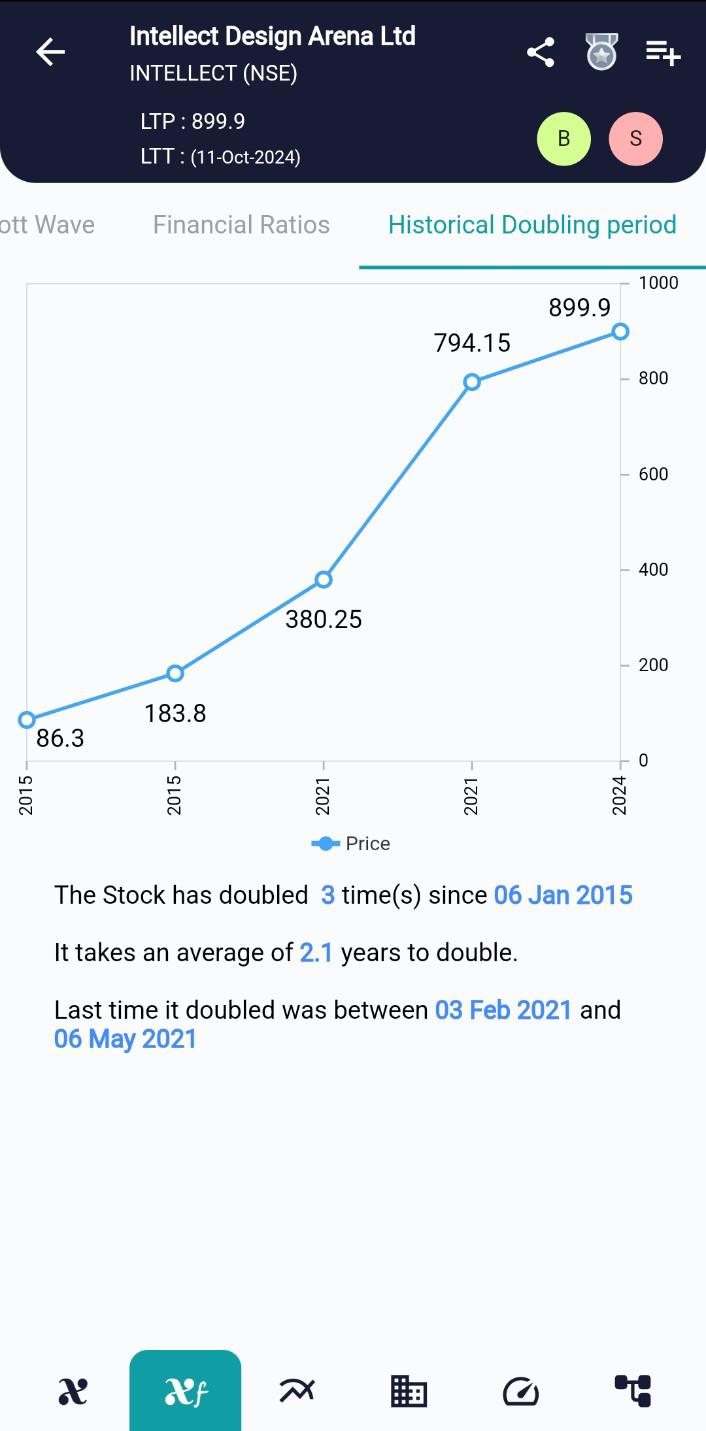

Historical Doubling Period:

The INTELLECT Stock has doubled thrice since 06 Jan 2015 and took an average of 2.1 years to double.

The historical doubling period, within the realm of finance, serves as a metric to gauge the duration it took for an investment, whether it’s a stock or any other asset, to increase in value twofold over a specified historical timeframe. It provides valuable insight into the growth rate and performance of an investment during that specific period.

Seasonality:

The stock has shown seasonality trend in the past.

Reviewing the returns for the past 5 years for the same week, we see the stock has given negative returns in 1 years in the past.

Seasonality in the stock market is a fascinating phenomenon that has intrigued investors and analysts for generations. It involves the recurring patterns and trends in stock prices at specific times of the year. Understanding stock market seasonality can offer valuable insights for investors, guiding them in making informed decisions and optimizing their investment strategies. In this blog, we’ll explore what seasonality means in the context of the stock market and provide real-world examples to illustrate its significance.

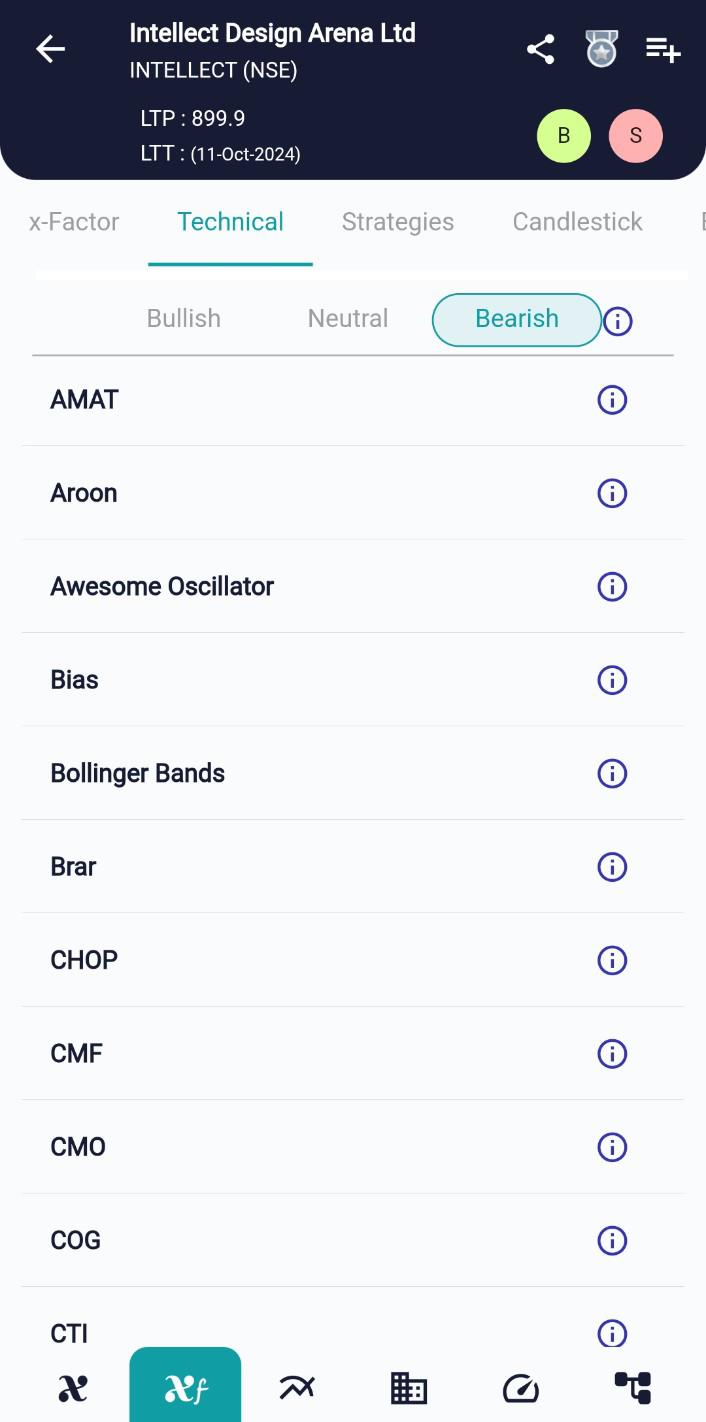

Technical Indicators:

Majority of the technical ratios trend towards Bearish side of the spectrum. Only some of the technical indicators namely WMA indicate Bullish view.

Collectively, xCalData suggests the stock would be in Bearish zone for next 5 days.

Technical indicators are essential tools used in technical analysis to help traders and investors make informed decisions in the financial markets. These indicators are typically derived from price, volume, or open interest data and are used to forecast future price movements or trends. They offer valuable insights into market behavior and can assist in entry and exit points for trading strategies.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight