General

Posted On: October 16, 2023

Leveraging Firmographics for Informed Trading Decisions

Introduction

In the world of trading, data is paramount. It’s not just about tracking stock prices or technical indicators; it’s also about understanding the underlying businesses that drive those stock prices. This is where firmographics come into play. Firmographics provide valuable insights into the businesses behind the stocks, and traders can harness this data to make more informed and strategic trading decisions. In this blog post, we’ll explore how firmographics can be a game-changer for traders and provide a competitive edge in the dynamic world of financial markets.

What are Firmographics in Trading?

Firmographics in trading involve gathering and analyzing data related to the companies whose stocks are traded on the market. This data encompasses various characteristics, including:

- Industry: Understanding the sector or industry to which a company belongs is essential. Different industries have unique dynamics that can impact a company’s stock performance.

- Size: A company’s size, often measured by metrics like market capitalization or revenue, is a critical factor in trading decisions. Smaller companies may have more volatile stocks, while larger ones may be more stable.

- Location: A company’s geographic location can influence its performance. International and national events can affect businesses differently.

- Ownership: Whether a company is privately owned, publicly traded, or a subsidiary of another company can influence how information is disclosed and the level of regulatory oversight.

- Financial Health: Assessing factors like profitability, debt levels, and overall financial stability is crucial in trading. It can help traders gauge a company’s risk profile.

Leveraging Firmographics for Trading Success

Understanding firmographics in trading can lead to better decision-making and improved trading strategies. Here are ways traders can leverage firmographics for success:

- Sector-Specific Strategies: Different industries have distinct characteristics and risks. Tailoring trading strategies to suit the industry can be highly effective. For example, cyclical industries may require different strategies than defensive ones.

- Earnings Announcements: Keep an eye on the earnings reports of companies in your trading portfolio. Firmographics data can help you gauge the potential impact of these reports on stock prices.

- Market Capitalization-Based Strategies: Consider creating trading strategies that focus on stocks of a particular market capitalization size. Smaller-cap stocks may offer more significant growth potential but come with increased risk.

- Geographic Considerations: Be aware of the geopolitical and economic events that can affect companies in different regions. Firmographics can help you understand the global footprint of the businesses you’re trading.

- Risk Assessment: Use firmographics data to assess the financial health of companies. This can help you avoid risky investments and select stocks that align with your risk tolerance.

- Peer Comparison: Analyze firmographics data to compare a company with its industry peers. This can provide insights into relative strength or weaknesses.

- Market Sentiment: Assess how firmographic factors influence market sentiment. For instance, certain sectors may be favored during economic downturns, while others thrive during upturns.

Where can I find Firmographics for Trading?

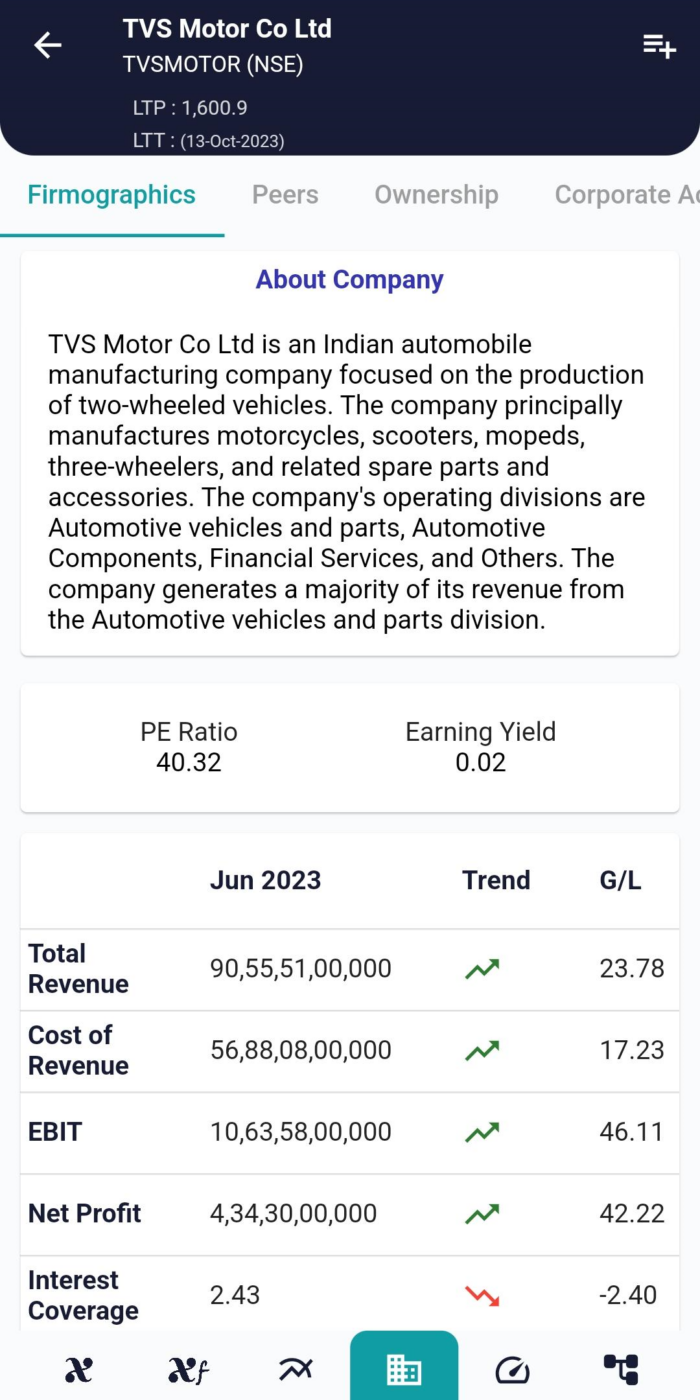

XCalData delivers vital firmographics, including total revenue, cost of revenue, EBIT, Net Profit, Interest Coverage, PE Ratio, and Earning Yield. With real-time access to this data, traders gain a competitive edge, enabling informed decisions and strategic market insights. Stay ahead in the dynamic trading landscape with XCalData comprehensive firmographics.

Conclusion

In conclusion, firmographics provide traders with a wealth of information to make more strategic and well-informed trading decisions. Understanding the businesses behind the stocks and the characteristics that drive their performance is a powerful tool in the trader’s toolbox. By integrating firmographics into your trading analysis, you can enhance your ability to spot trading opportunities, manage risk, and achieve success in the dynamic and competitive world of financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight