Technical Indicator

Posted On: February 6, 2024

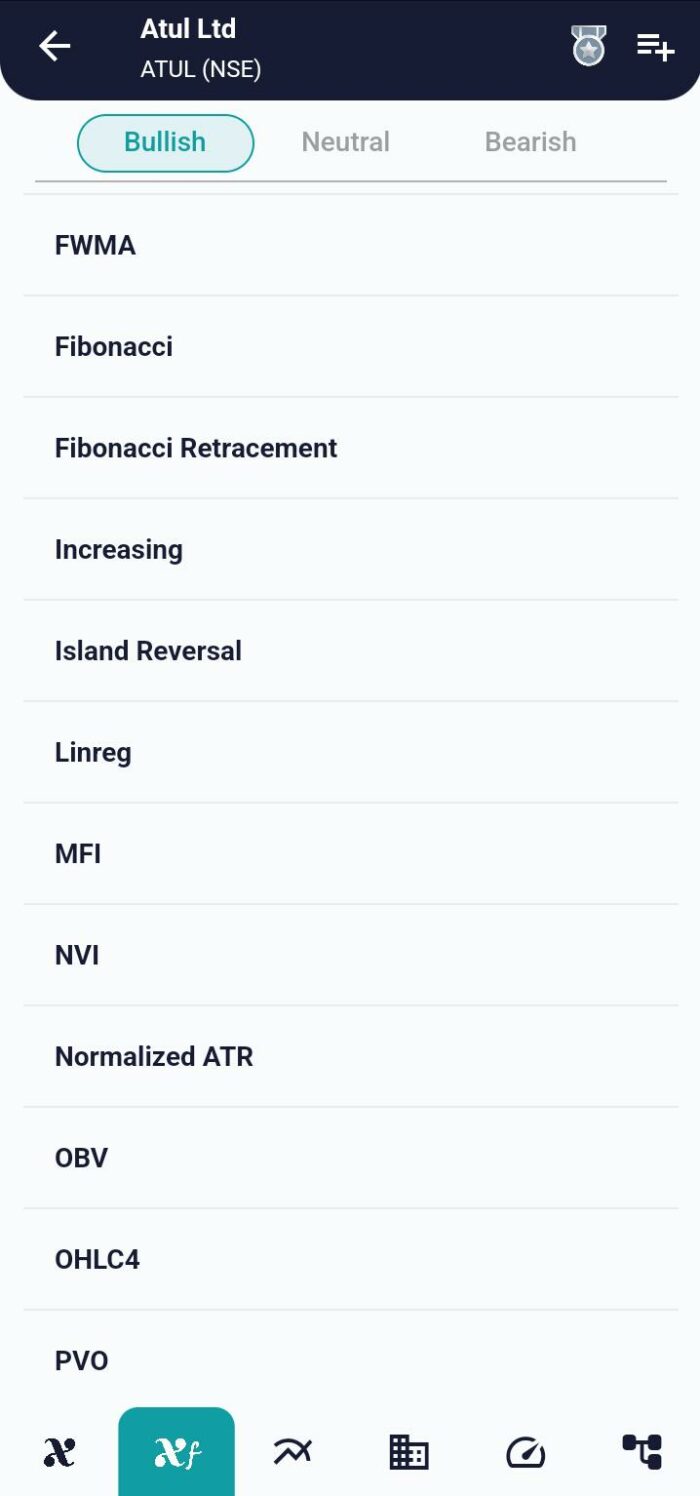

Market Miraculous with OHLC4 Indicator

Introduction :

OHLC4 Indicator : In the dynamic world of financial markets, traders employ a variety of tools to decipher price movements and identify potential opportunities. One such tool that holds significance in technical analysis is the OHLC4 technical indicator. This indicator, derived from Open, High, Low, and Close data, provides insights into market dynamics for different time frames. In this article, we explore the principles behind the OHLC4 indicator and how traders can leverage its signals for informed decision-making.

Understanding OHLC4 Indicator:

The OHLC4 indicator, an extension of the traditional OHLC data, condenses market information into a single value for a specified time frame. By considering the Open, High, Low, and Close prices, the OHLC4 indicator encapsulates key aspects of market activity. Traders often use this indicator to gauge trends, identify potential reversals, and make strategic decisions.

Mathematical formula:

OHLC4 = (Open + High + Low + Close) / 4

Interpreting OHLC4 Signals:

The OHLC4 indicator generates signals based on the interaction between its value and the prevailing market conditions. Here’s a breakdown of how traders interpret these signals:

- Uptrend Signal (Buy):

- If yesterday’s OHLC4 value is above yesterday’s Close Price.

- The current OHLC4 value is equal to or lesser than the current Close Price.

- Downtrend Signal (Sell):

- If yesterday’s OHLC4 value is above yesterday’s Close Price.

- The current OHLC4 value is equal to or less than the current Close Price.

- Hold Signal:

- If none of the above conditions are met.

Implementation in Trading Strategies:

- Confirmation of Trends: Traders use OHLC4 signals to confirm the strength and direction of existing trends. A Buy or Sell signal aligned with the prevailing trend can serve as a confirmation for strategic entries or exits.

- Reversal Identification: OHLC4 signals can aid in identifying potential reversals in the market. Divergence between OHLC4 and price movements may indicate an impending shift in market sentiment.

- Risk Management: Incorporating OHLC4 analysis into risk management strategies helps traders make well-informed decisions. Understanding the prevailing trend and potential reversal points is crucial for managing risk exposure.

Conclusion:

The OHLC4 indicator stands as a valuable tool in the arsenal of technical analysis, providing traders with a concise representation of market dynamics. By considering Open, High, Low, and Close prices, this indicator distills crucial information into actionable signals. Whether confirming trends, identifying reversals, or managing risks, traders can harness the power of the OHLC4 indicator for more informed decision-making in the complex landscape of financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight