Strategy

Posted On: January 12, 2024

Mastering Breakouts: The Price Channel Strategy Unveiled

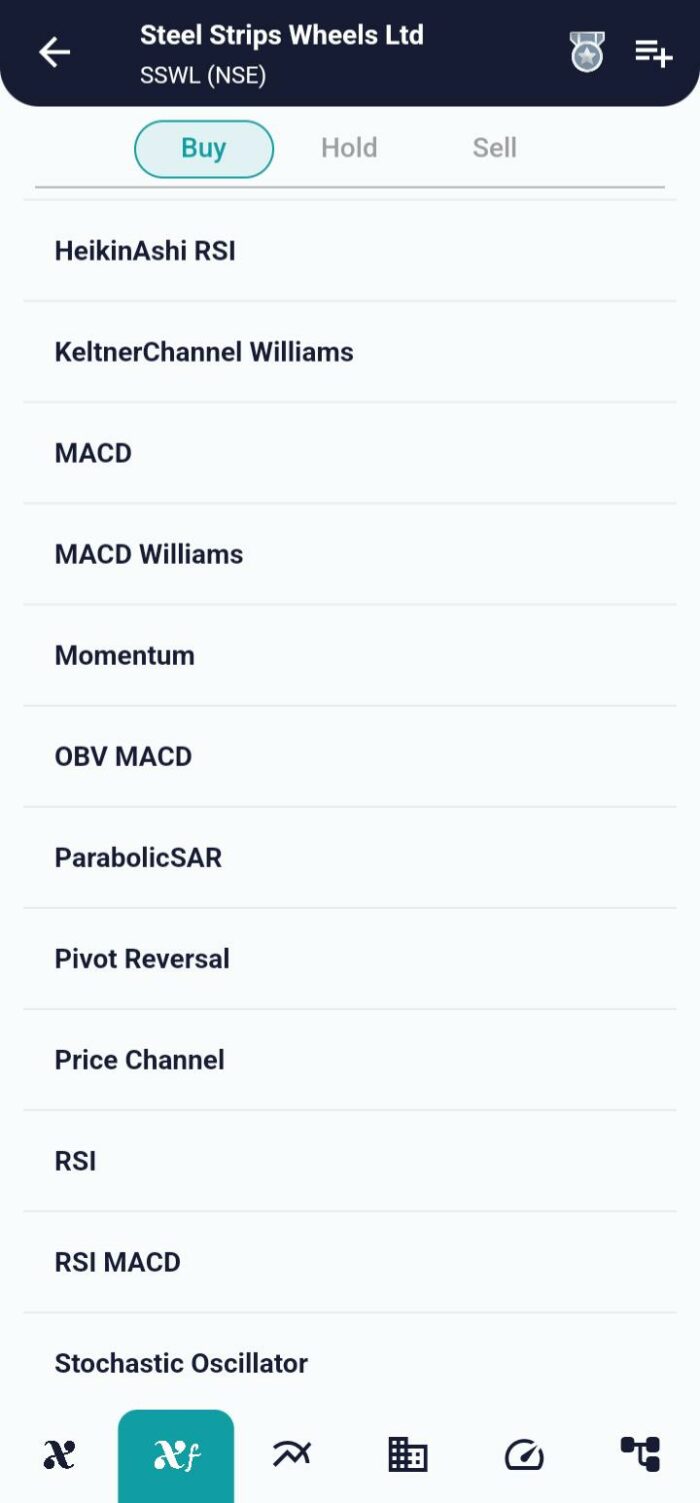

When it comes to trading techniques, the Price Channel Strategy is one of the most powerful tools available to traders who want to profit from breakouts and breakdowns within particular channels. This blog post will explain the Price Channel Strategy in detail, including a definition, a summary of its working principles, and an explanation of how it can be used by swing and momentum traders in this blog post and showing you how to use this effective tool using the xCaldata App.

Understanding the Price Channel Strategy:

Key Components of the Strategy

- Channel Formation: The strategy establishes a channel with upper and lower bands, determined by the highest and lowest values over the last X bars, where X is the 20 ‘Length’ default setting.

- Long Entry Condition: A long position is initiated when the high of the current bar equals the upper channel band of the previous bar. This condition indicates a potential breakout to the upside.

- Short Entry Condition: Conversely, a short position is entered when the low of the current bar equals the lower channel band of the previous bar, signaling a potential breakdown to the downside.

Optimizing the Price Channel Strategy

Customizing Length Setting:

- Traders can optimize the strategy by experimenting with different values for the ‘Length’ setting. Shorter lengths may capture more frequent but potentially smaller breakouts, while longer lengths may filter for more significant market movements.

Adapting to Market Conditions:

- Consider adjusting the strategy’s sensitivity based on prevailing market conditions. Higher volatility may necessitate wider channel bands, while lower volatility may warrant narrower bands.

Application for Momentum and Swing Traders

Momentum Trading:

- Momentum traders can leverage the Price Channel Strategy to identify and capitalize on breakouts that align with the prevailing market momentum. The strategy’s dynamic nature allows for adaptability to changing momentum conditions.

Swing Trading:

- Swing traders, seeking to capture price swings within defined ranges, can use the Price Channel Strategy as a framework for identifying potential breakout and breakdown points. The strategy’s reliance on recent price history makes it well-suited for swing trading strategies.

Conclusion: Navigating Breakouts with Precision

In conclusion, the Price Channel Strategy emerges as a versatile tool for traders navigating the dynamic terrain of breakouts and breakdowns. Whether applied by momentum traders seizing opportunities aligned with market momentum or swing traders capturing price swings within established ranges, the strategy’s adaptability and precision make it a valuable asset. As traders fine-tune the ‘Length’ setting, experiment with different market conditions, and adapt their approach, the Price Channel Strategy becomes an essential component of their toolkit for mastering breakouts with precision in the ever-evolving financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight