Strategy

Posted On: January 12, 2024

Mastering Market Dynamics: The Pivot Point Strategy Unveiled

The Pivot Point Strategy is a potent tool for traders looking to profit on bounce trades and pinpoint important support and resistance levels in the hectic world of day trading and market making. This blog article will analyze the Pivot Point Strategy, going over its core ideas, outlining its main conclusions, and investigating the range of tactics it covers for long and short positions. With this blog article and demonstrating the use of the xCaldata App, an efficient utility.

Deciphering the Pivot Point Strategy:

The core of the pivot point strategy is the use of pivot points as dynamic, real-time indicators of levels of support and resistance. As the price fluctuates, these levels dynamically adapt, becoming stronger as the trend picks up steam in either direction. Pivot Points serve as critical indicators for transactions that may rebound or be rejected, and every exchange between buyers and sellers emphasizes how important these levels are to the market.

Key Takeaways from Pivot Points

- Real-Time Support and Resistance: Pivot Points (PP) serve as real-time indicators of support and resistance levels. These levels dynamically adapt to price movements, providing traders with valuable insights into potential bounce or rejection zones.

- Strength in Trend Direction: The levels indicated by Pivot Points gain strength as the trend intensifies in either direction. This strength is pivotal for traders looking to gauge the reliability of support or resistance levels.

- Continuous Reinforcement: Each time an asset trades at a Pivot Point and then reverses direction, the level continuously strengthens. This continuous reinforcement makes Pivot Points valuable tools for traders seeking to identify optimal trade times.

Pivot Point Reversal Strategies

Long Entry Rules:

- Standard Long Entry: If the price starts above the Pivot Point, traders often consider buying near the Pivot Point line, anticipating a continuation of the upward trend.

- Conservative Long Entry: Traders may wait for the market to close at a certain distance above the Pivot Point before considering a long trade, ensuring the reliability of the upward trend.

Short Entry Rules:

- Standard Short Entry: If the market starts below the Pivot Point, traders may opt to sell near the Pivot Point line, especially if the price overshot or missed the line, indicating a potential downward trend.

- Conservative Short Entry: Similar to the long strategy, traders may wait for the market to touch the Pivot Point line before considering a short trade, ensuring the stability and reliability of the downward trend.

Stop Loss and Take Profit Rules:

- Long Stop Loss: Placing a stop loss a few pips below the Pivot Point or below Support 1 allows room for trade errors.

- Long Take Profit: Setting a take profit order at Support 2 (S2) or, if the trade reaches Support 1 (S1), transitioning to a stop loss order for balance.

- Short Stop Loss: Placing a stop loss a few pips above the Pivot Point or above Resistance 1 (R1) allows room for trade errors.

- Short Take Profit: Setting a take profit order at Resistance 2 (R2) or, if the price reaches Resistance 1 (R1), transitioning to a stop loss order for balance.

Optimizing the Pivot Point Strategy

Customizing Pivot Point Levels:

- Traders can experiment with different timeframes and settings to optimize the Pivot Point levels for specific symbols or market conditions.

Adapting to Volatility:

- Consider adjusting strategies based on market volatility, as higher volatility may require wider stop loss and take profit levels.

Conclusion: Navigating Trends with Precision

In conclusion, the Pivot Point Strategy serves as a dynamic guide for traders navigating trends and seeking opportune entry and exit points. Whether executing bounce trades or identifying key support and resistance levels, the Pivot Point Strategy empowers traders with real-time insights. As traders fine-tune their approach, experiment with different parameters, and adapt to market conditions, the Pivot Point Strategy becomes an invaluable asset in their toolkit for mastering market dynamics.

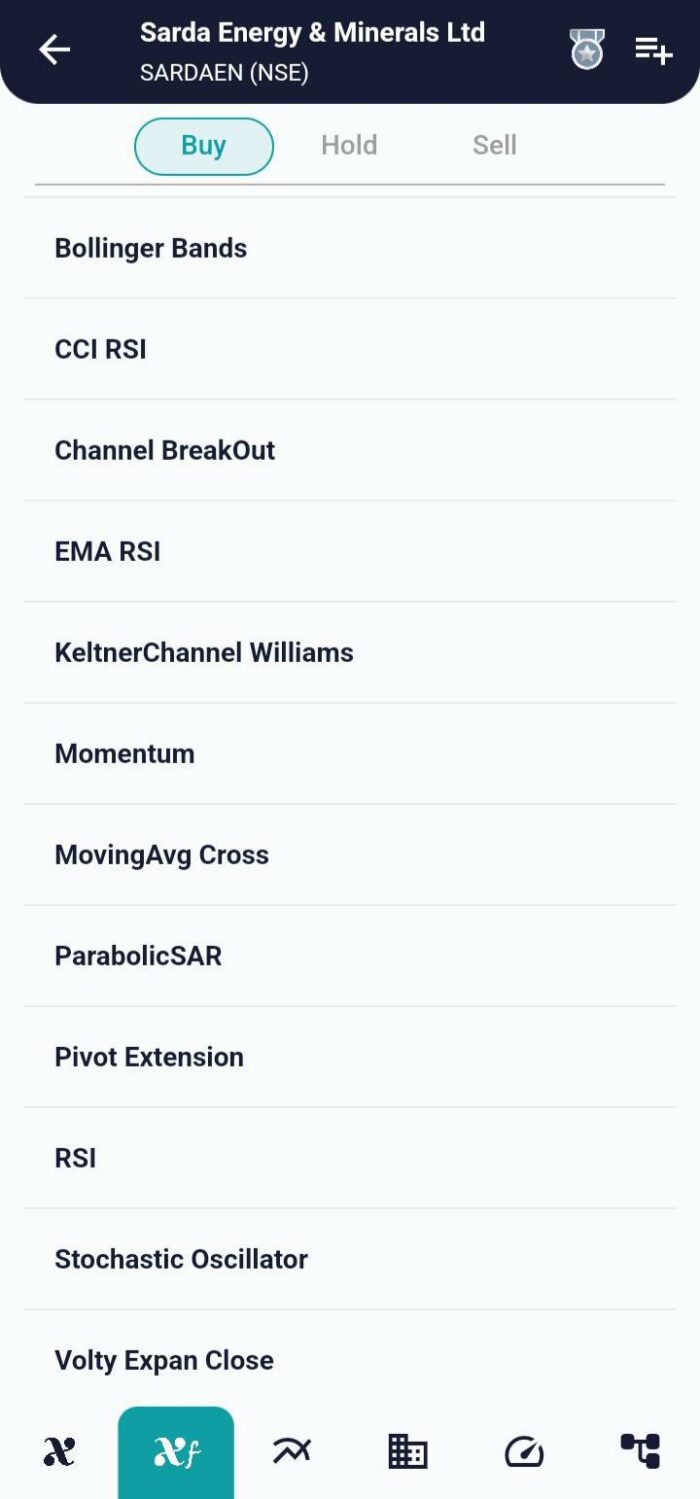

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight