Technical Indicator

Posted On: January 29, 2024

Mastering Market Trends: The 210 DMA Crossover Unveiled

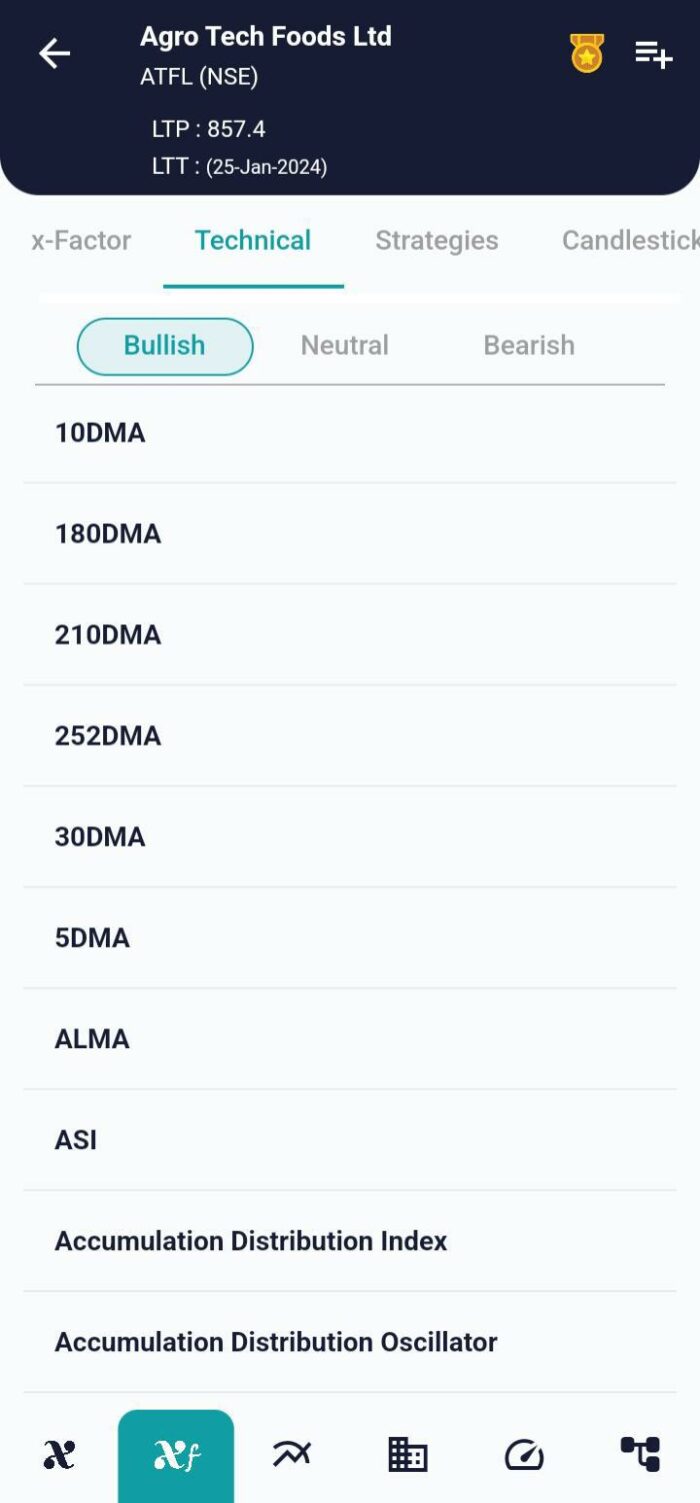

In the intricate world of financial markets, traders continually seek tools that provide nuanced insights into market dynamics. One such potent technical indicator is the 210 DMA Crossover (210-day Moving Average), offering crucial signals for potential bullish or bearish movements. In this comprehensive blog post, we unravel the significance of the 210 DMA Crossover, exploring its definition, calculations, and how traders can leverage its insights within the xCalData app.

Understanding the 210 DMA Crossover

Definition:

The 210 DMA Crossover centers around the interplay between the current price of an asset and its 210-day Moving Average. Functioning as a trend-following indicator, the 210 DMA smoothens out price data over a 210-day period, providing a more comprehensive view of the prevailing trend. Its fundamental principle is straightforward: when the current price is above the 210 DMA, it signals a bullish trend; conversely, when it’s below, it indicates a bearish trend.

Calculations:

The 210 DMA is computed by summing up the closing prices of the last 210 days and dividing the result by 210. This dynamic moving average adjusts as new daily data is incorporated, with the oldest day being excluded. The crossover occurs when the current price intersects either above or below this 210 DMA line.

Mathematical Calculation:

210DMA=(Sum of Closing Prices of Last 210 Days)/210

Implementing the 210 DMA Crossover Technical Indicator

Bullish Signal:

A bullish signal arises when the current price of an asset moves above the 210 DMA. This suggests that recent price movements are stronger than the average of the past 210 days, indicating potential upward momentum. Traders often interpret this as a buying opportunity, anticipating further price appreciation.

Bearish Signal:

Conversely, a bearish signal emerges when the current price falls below the 210 DMA. This implies that recent price movements are weaker than the average of the past 210 days, hinting at potential downward pressure. Traders may perceive this as a signal to consider selling positions or even initiating short positions.

Significance of the 210 DMA Crossover Technical Indicator

- Extended Trend Analysis:

- The 210 DMA provides an extended perspective on trends, spanning a more prolonged timeframe compared to shorter-term moving averages. This aids traders in comprehending overarching market sentiment.

- Major Trend Confirmation:

- As a major trend confirmation tool, the 210 DMA Crossover helps traders validate whether the current price movement aligns with the longer-term trend indicated by the 210 DMA.

- Strategic Positioning:

- Traders can strategically position themselves based on the 210 DMA Crossover signals, aligning their trades with the prevailing trend and potentially avoiding counter-trend movements.

Real-World Application

In a hypothetical scenario, consider a stock consistently maintaining a price above the 210 DMA. Traders observing this alignment might interpret it as a bullish signal, indicating sustained upward momentum over the long term. Conversely, if the stock’s price consistently falls below the 210 DMA, it could be seen as a bearish signal, suggesting a potential long-term downtrend.

Conclusion: Navigating Trends with Wisdom

In the dynamic world of financial markets, wisdom in decision-making is invaluable, and the 210 DMA Crossover technical indicator embodies this principle. By distilling complex price movements into clear signals based on the interaction with a 210-day Moving Average, traders gain a powerful tool for trend identification on an extended horizon. As traders leverage the insights from the 210 DMA Crossover, it becomes imperative to complement this indicator with a holistic analysis, considering additional indicators and market dynamics.

The xCalData app, available for Android devices, offers a robust platform for unbiased insights into stocks, empowering investors to make informed decisions. Download the app from Google Play to access actionable intelligence and enhance your decision-making with the 210 DMA Crossover: Download xCalData.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

For traders seeking a broader view and extended trend analysis, the 210 DMA Crossover becomes an indispensable ally in navigating ever-changing trends and making well-informed decisions in the dynamic world of finance.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight

-

Stock of Interest . August 23, 2024

31 May 2022 – India Premarket research report