Technical Indicator

Posted On: February 6, 2024

Mastering Market Trends with On-Balance Volume (OBV)

Introduction:

In the dynamic realm of technical trading, Joseph Granville introduced a groundbreaking concept in 1963 that would revolutionize how traders interpret market momentum—On-Balance Volume (OBV). This momentum technical indicator leverages volume flow to forecast changes in stock prices, offering a unique perspective on crowd sentiment. This article delves into the intricacies of OBV, exploring its origins, principles, and how traders can harness its predictive power for informed decision-making.

Understanding On-Balance Volume (OBV):

Joseph Granville, a pioneer in technical analysis, conceived OBV as a means to unravel the mysteries of market moves through the lens of volume. The core idea is that significant shifts in markets are heralded by changes in volume, and OBV serves as a predictive spring, anticipating potential upward or downward leaps in stock prices.

Key Principles of OBV:

- Volume as the Driving Force: Granville’s philosophy positions volume as the driving force behind market movements. On-Balance Volume is designed to capture and project major moves based on the interplay between volume and price.

- Sentiment Projection: OBV – On-Balance Volume serves as a reflection of crowd sentiment. When volume surges without a proportional change in stock price, it suggests an impending directional shift, either upwards or downwards.

- Comparative Analysis: Granville advocated for comparing the relative actions of price bars and OBV. This approach generates more actionable signals than traditional volume histograms, providing a nuanced understanding of market dynamics.

OBV Calculation:

The calculation of On-Balance Volume is straightforward and centers around three scenarios:

- If today’s closing price is higher than yesterday’s, the current OBV is calculated as the previous OBV plus today’s volume.

- If today’s closing price is lower than yesterday’s, the current OBV is calculated as the previous OBV minus today’s volume.

- If today’s closing price equals yesterday’s, the current OBV remains unchanged.

Incorporating OBV in Trading Strategies:

- Confirmation of Price Trends: On-Balance Volume acts as a valuable tool to confirm the strength of prevailing price trends. When OBV aligns with price movements, it validates the sustainability of the trend.

- Divergence Analysis: Traders can identify potential trend reversals by analyzing divergences between On-Balance Volume and price. Divergent movements may signal an imminent shift in market sentiment.

- Volume Confirmation: On-Balance Volume offers a unique perspective on volume dynamics, providing insights into the conviction behind price movements. Confirming price trends with OBV signals can enhance decision-making.

Conclusion:

On-Balance Volume (OBV) stands as a testament to the pivotal role that volume plays in deciphering market momentum. Joseph Granville’s visionary creation has become an indispensable tool for traders seeking to understand crowd sentiment and predict significant market moves. By incorporating OBV into your technical analysis toolkit, you embark on a journey to master market momentum and make more informed trading decisions. Explore the predictive power of OBV as you navigate the complexities of the financial markets.

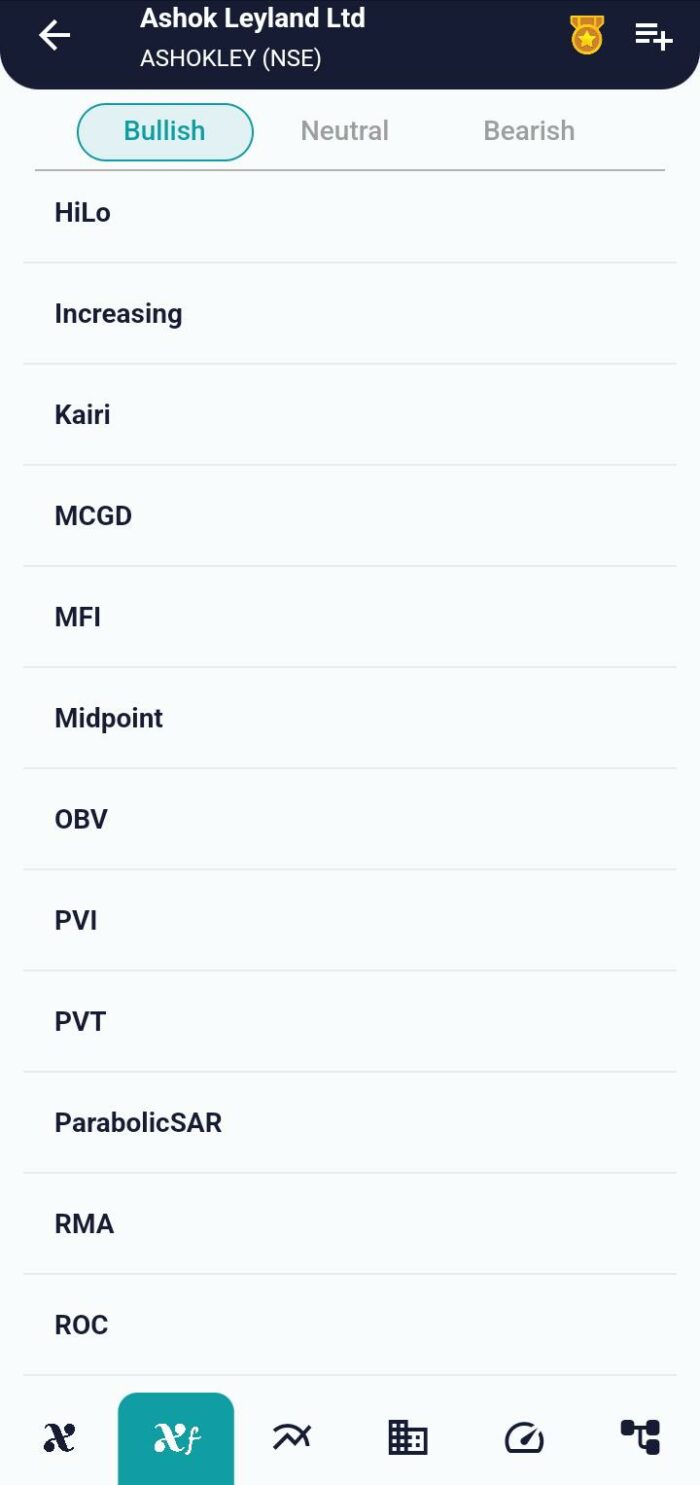

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight