Technical Indicator

Posted On: February 7, 2024

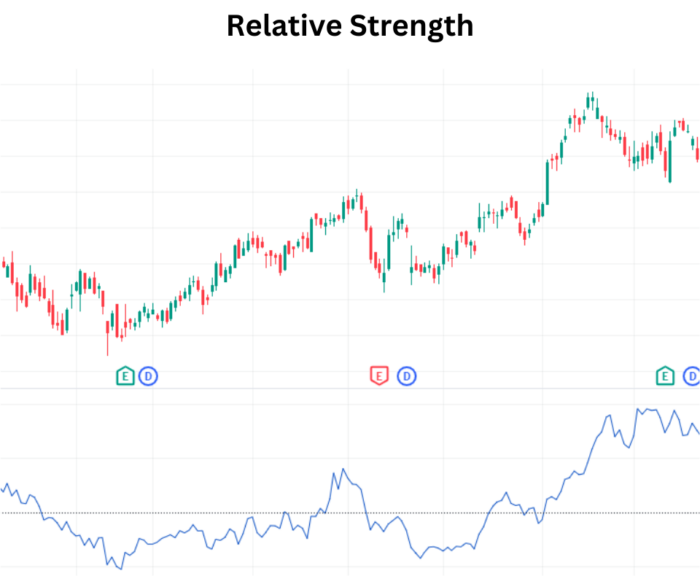

Mastering Relative Strength Investing: A Comprehensive Guide

Introduction:

Relative strength investing is a powerful technical indicator utilized by both technical analysts and value investors to identify promising investment opportunities. By focusing on securities that have outperformed their market or benchmark, relative strength investors aim to capitalize on trends and achieve superior returns. In this comprehensive guide, we’ll delve into the intricacies of relative strength investing, exploring its principles, strategies, and considerations for success.

Understanding Relative Strength Investing:

Relative strength investing is grounded in the principle of momentum, where investors seek to capitalize on the ongoing trends exhibited by specific securities. Unlike traditional value investing, which aims to buy undervalued assets and sell them at a higher price, relative strength investing prioritizes buying assets that have already demonstrated strong performance relative to the market or benchmark. This approach assumes that trends of outperformance will persist, allowing investors to ride the wave of upward momentum.

Identifying Investment Candidates:

To identify potential investment candidates, relative strength investors begin by evaluating a benchmark such as the Nasdaq Composite Index. They focus on securities that have exhibited superior performance compared to their peers within the same market or sector. This outperformance can manifest as either a rapid rise in prices or a slower decline during market downturns. By pinpointing these outperforming securities, investors aim to capitalize on their continued momentum and potential for further growth.

Key Considerations for Success:

While relative strength investing offers the potential for attractive returns, it’s essential for investors to consider certain factors to maximize their success:

- Market Stability: Relative strength investing thrives in stable market conditions with minimal disruption. Chaotic periods, such as financial crises, can lead to sharp reversals in investment trends, posing risks for relative strength investors. It’s crucial to assess market stability and investor sentiment before deploying relative strength strategies.

- Trend Persistence: Success in relative strength investing hinges on the persistence of trends. Investors must carefully monitor the sustainability of trends and be prepared to adjust their strategies in response to changing market dynamics.

- Risk Management: Like any investment strategy, risk management is paramount in relative strength investing. Diversification, stop-loss orders, and position sizing are crucial elements of effective risk management to mitigate potential losses during market downturns or trend reversals.

- Investor Psychology: Relative strength investing is influenced by investor psychology, particularly during periods of market volatility. Investor sentiment can rapidly shift, impacting the performance of previously favored securities. Being aware of investor psychology and sentiment trends can help investors navigate market fluctuations more effectively.

Conclusion:

Relative strength investing offers a dynamic approach to identifying investment opportunities based on momentum and trend analysis. By focusing on securities that have outperformed their market or benchmark, relative strength investors aim to capitalize on ongoing trends and achieve superior returns. However, success in relative strength investing requires careful consideration of market stability, trend persistence, risk management, and investor psychology. By mastering these key elements, investors can harness the power of relative strength investing to enhance their investment portfolios and achieve their financial goals.

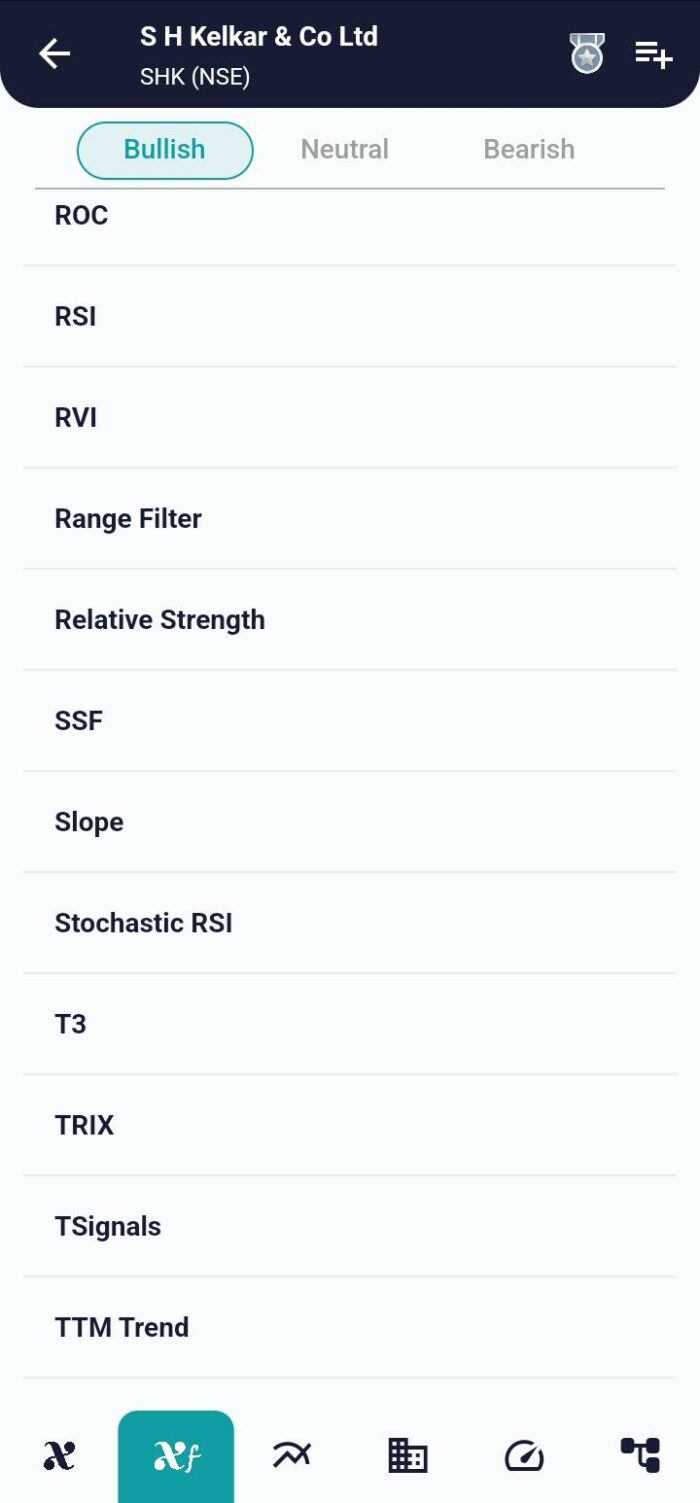

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight