Candlestick Pattern

Posted On: September 14, 2023

Mastering the Shooting Star Candlestick Pattern in Trading

A Guide to Identifying and Interpreting Price Reversal Signals in Candlestick Patterns

In the world of financial markets, traders and investors utilize various techniques and strategies to make informed decisions. One such method involves analyzing candlestick patterns, which provide valuable insights into market sentiment. Among these patterns, the “shooting star” stands out as a significant indicator of potential reversals in price trends. In this blog post, we will delve into the concept of shooting stars, explore their characteristics, and discuss how traders can identify and interpret them.

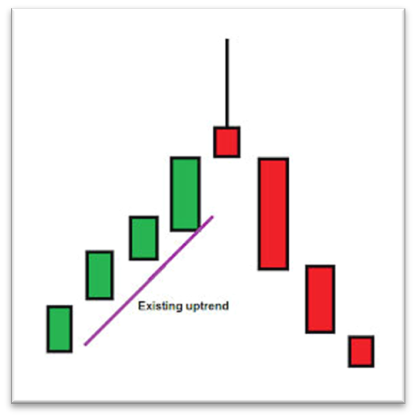

The Shooting Star is a single candlestick pattern that typically occurs at the end of an uptrend. It is characterized by a small body, with a long upper shadow and a short or non-existent lower shadow. The pattern resembles a star with a long tail, hence its name. The key feature of the Shooting Star is the significant difference between the opening and closing prices.

Characteristics of Shooting Stars:

To better identify a shooting star, it is important to understand its key characteristics:

- Long upper shadow: The length of the upper shadow indicates that the bulls initially had control of the market, driving prices higher during the session.

- Little to no lower shadow: The absence or minimal presence of a lower shadow signifies that there was limited buying pressure or support near the opening price.

- Small real body: The real body (the difference between the opening and closing prices) is typically small, or in some cases, it may even be bearish.

Interpreting Shooting Stars:

Shooting stars are significant because they indicate a shift in market sentiment from bullish to bearish. When a shooting star pattern forms, it suggests that the buyers, despite their initial control, were unable to maintain the upward momentum. The long upper shadow represents a rejection of higher prices and a potential exhaustion of buying pressure. Consequently, traders interpret this pattern as a warning sign that a trend reversal or a corrective pullback might occur soon.

Confirmation and Trading Strategies:

As with any candlestick pattern, it’s essential to seek confirmation before making trading decisions based solely on the Shooting Star. Traders often use additional technical indicators, such as trendlines, support and resistance levels, or other candlestick patterns, to strengthen their analysis. Once confirmed, traders may consider opening short positions or tightening stop-loss levels on existing long positions.

- Volume Confirmation: Higher trading volume accompanying the pattern’s formation bolsters the validity of the potential trend reversal.

- Support and Resistance Levels: Identifying key support and resistance levels can further validate the pattern and aid in establishing appropriate price targets.

- Technical Indicators: Combining the Hanging Man pattern with other technical indicators, such as moving averages or RSI, can provide supplementary confirmation and enhance trading decisions.

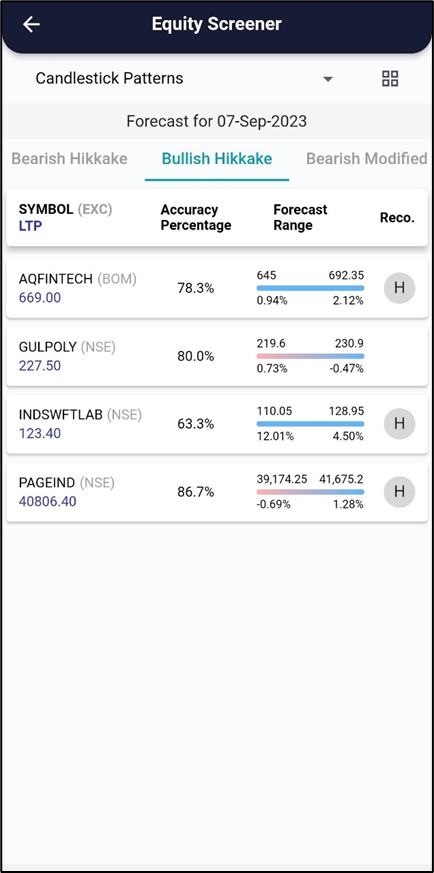

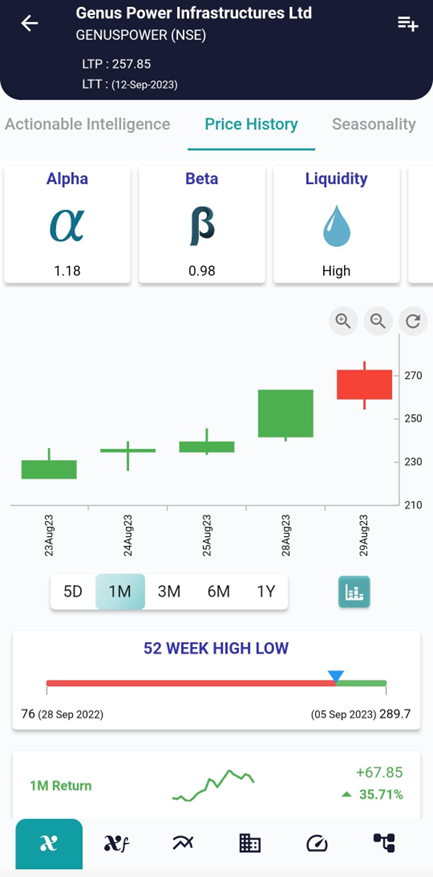

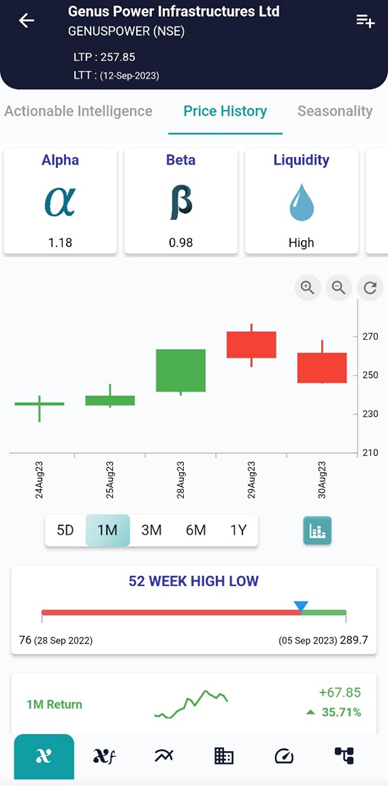

xCalData analyses the candles of individual stocks daily and identifies the stocks forming various patterns. Checkout xCalData app to know all the candle stick patterns formed by the stock of your interest.

Example, on 29 Aug the stock showed the Shooting Star Candlestick Pattern and on 30 Sep the stock started going down(Bullish to Bearish) as can be seen in the interpretation above.

Conclusion:

Shooting stars serve as valuable tools for traders, providing insights into potential trend reversals and shifts in market sentiment. Identifying these bearish candlestick patterns and understanding their characteristics can empower traders to make informed decisions.

However, it is essential to remember that no single indicator or pattern guarantees accurate predictions in the dynamic world of trading. Therefore, it is recommended to combine shooting star patterns with other technical analysis tools to increase the probability of successful trades.

Trading always involves risk, and it is crucial to develop a well-rounded trading strategy, including risk management techniques, to increase your productivity and achieve long-term success in the financial markets, Visit and download xCalData.

Where can I see further insights on this stock?

xCalData offers unbiased insights into stocks. Download the app from google play. For Actionable Intelligence, subscribe to xCalData app on Android devices: Download here

Disclaimer: The securities quoted are for illustration only and are not recommendatory.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight