Technical Indicator

Posted On: February 8, 2024

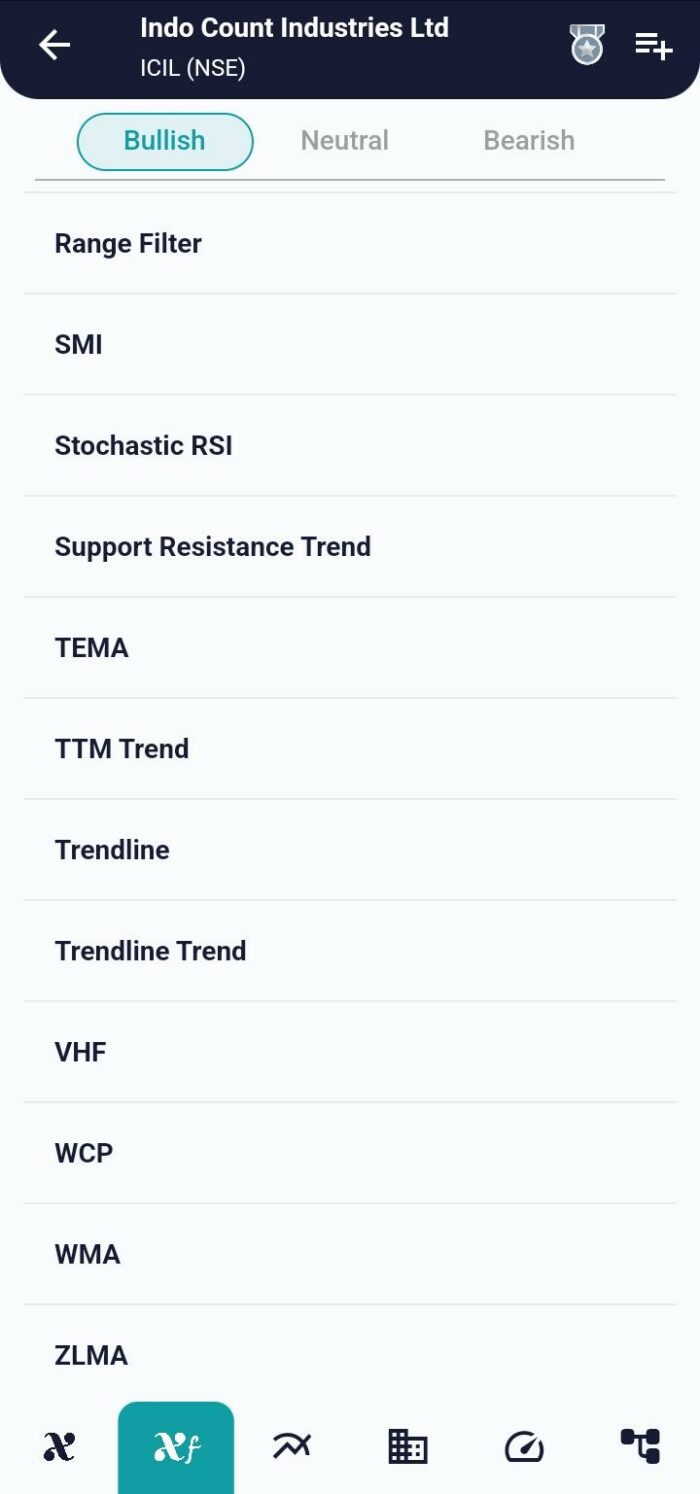

Mastering Trends with TEMA: A Comprehensive Guide

Empowering Traders with TEMA:

The Triple Exponential Moving Average (TEMA) stands as a sophisticated technical indicator meticulously crafted to elevate trend identification by minimizing the lag inherent in traditional moving averages. This comprehensive guide unveils the essence of TEMA, shedding light on its design, functionality, and application in generating actionable buy and sell signals.

Deciphering TEMA:

Smoothing Price Fluctuations:

TEMA is strategically engineered to mitigate price fluctuations, providing traders with a smoother representation of underlying trends.

Its design aims to overcome the lag associated with conventional moving averages, offering a more responsive and accurate trend indicator.

Triple Exponential Composition:

The uniqueness of TEMA lies in its triple exponential composition.

It involves calculating multiple exponential moving averages (EMA) of the original EMA, contributing to a refined and responsive trend depiction.

Mathematical formula:

Triple Exponential Moving Average (TEMA)=(3∗EMA 1 )−(3∗EMA 2 )+EMA 3

where:

EMA 1 =Exponential Moving Average (EMA)

EMA 2 =EMA of EMA 1

EMA 3 =EMA of EMA 2

TEMA Signals for Informed Trading:

- Buy Signal (TEMA Rising):

- A compelling buy signal is triggered when the TEMA value transitions into a rising trajectory.

- This upward movement signals a potential bullish trend, prompting traders to consider initiating or holding long positions.

- Sell Signal (TEMA Falling):

- Conversely, a robust sell signal emerges when the TEMA value descends.

- A falling TEMA suggests a potential bearish trend, indicating a strategic moment for traders to contemplate selling positions or adopting a defensive stance.

Strategic Implementation of TEMA:

- Reducing Lag, Enhancing Responsiveness:

- TEMA’s primary advantage lies in its ability to substantially reduce lag compared to traditional moving averages.

- Traders leveraging TEMA gain a competitive edge in promptly identifying trend shifts and potential reversal points.

- Integration with Comprehensive Analysis:

- While TEMA excels in trend identification, its optimal usage involves integration with broader technical and fundamental analyses.

- Traders are encouraged to consider TEMA signals within the context of market conditions, key support and resistance levels, and additional indicators.

Conclusion:

The Triple Exponential Moving Average (TEMA) emerges as a dynamic tool for traders seeking a refined approach to trend analysis. By combining the responsiveness of multiple exponential moving averages, TEMA significantly reduces lag, providing traders with timely and accurate signals. The buy and sell signals generated by TEMA empower traders to navigate evolving market trends with confidence. As with any technical analysis tool, prudent application and integration with comprehensive market insights contribute to harnessing the full potential of TEMA in the pursuit of trading success.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight