Technical Indicator

Posted On: January 31, 2024

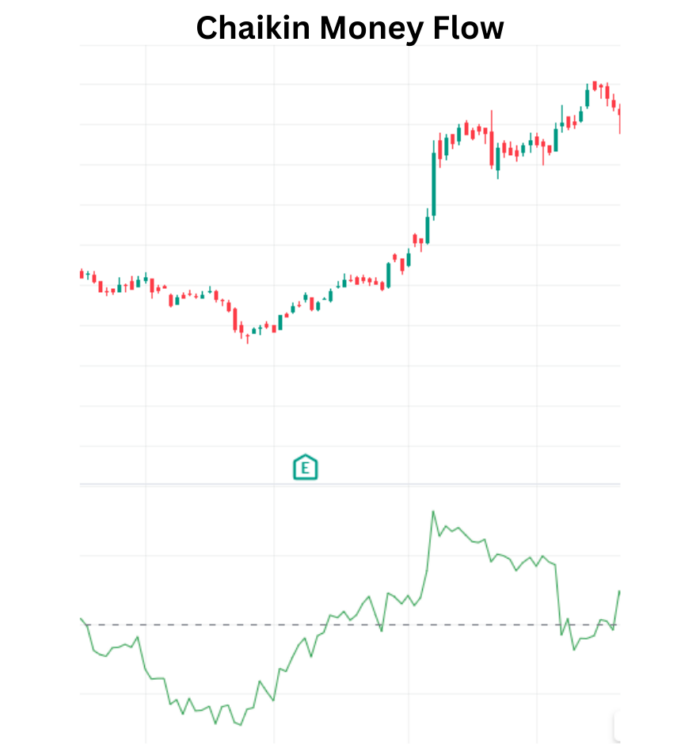

Navigating Market Trends with Chaikin Money Flow (CMF)

Unveiling the Chaikin Money Flow Indicator

Developed by the financial expert Marc Chaikin in the 1980s, the Chaikin Money Flow (CMF) is a potent technical indicator designed to monitor the accumulation and distribution of a stock over a specified period. As a key component of technical analysis, CMF aids traders in gauging buying and selling momentum, providing valuable insights into potential trend reversals.

The Anatomy of Chaikin Money Flow

The calculation of CMF involves several steps to capture the dynamics of money flow within a stock:

- Money Flow Multiplier:

Money Flow Multiplier=((Close value – Low value) – (High value – Close value)) / (High value – Low value) - Money Flow Volume:

Money Flow Volume=Money Flow Multiplier × Volume for the Period - Chaikin Money Flow (CMF):

CMF=21-day Average of the Daily Money Flow / 21-day Average of the Volume

Interpreting Chaikin Money Flow

Bullish Signals

- If CMF > 0, it indicates a bullish signal.

- This suggests that the money flow into the stock is positive, signifying potential buying momentum.

Bearish Signals

- When CMF < 0, it generates a bearish signal.

- This implies negative money flow, indicating potential selling pressure.

Why Chaikin Money Flow?

- Accumulation and Distribution: CMF excels in tracking the accumulation (buying) and distribution (selling) of a stock, offering a nuanced view of market sentiment.

- Momentum Identification: By identifying changes in money flow, CMF assists traders in spotting shifts in buying or selling momentum.

- Comprehensive Insight: The indicator provides a comprehensive view of market dynamics, integrating price movements with volume data.

Implementing Chaikin Money Flow in Your Strategy

- Confirmation Tool: CMF can be used as a confirmation tool alongside other technical indicators to validate potential trend changes.

- Divergence Analysis: Divergence between CMF and price movements can signal potential reversals, enhancing the predictive power of the indicator.

- Trend Strength Assessment: CMF readings not only indicate trend direction but also provide insights into the strength of the trend.

Conclusion

In the ever-evolving landscape of financial markets, having tools that offer a deeper understanding of money flow is crucial. Chaikin Money Flow stands as a reliable ally for traders, providing valuable signals for both bullish and bearish market conditions. By incorporating CMF into your technical analysis toolkit, you can navigate market trends with greater confidence and potentially improve your overall trading outcomes.

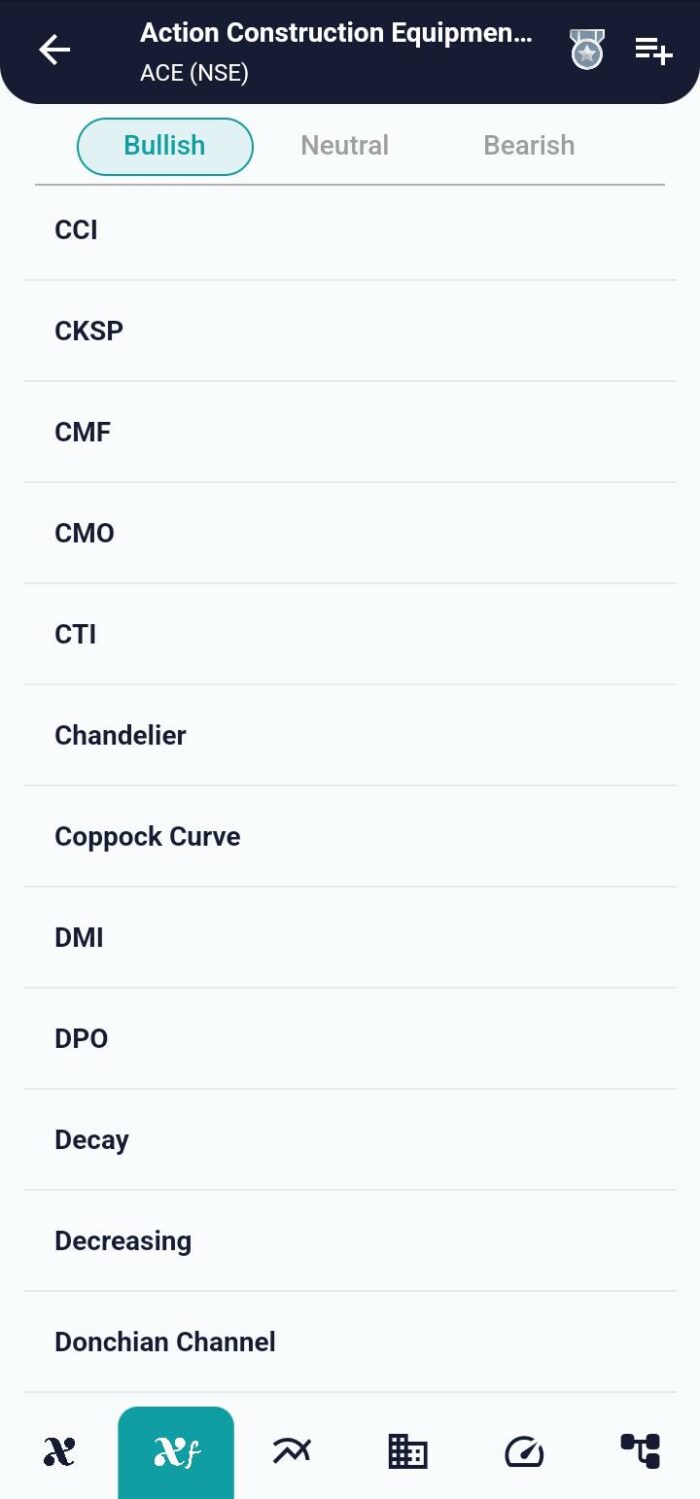

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight