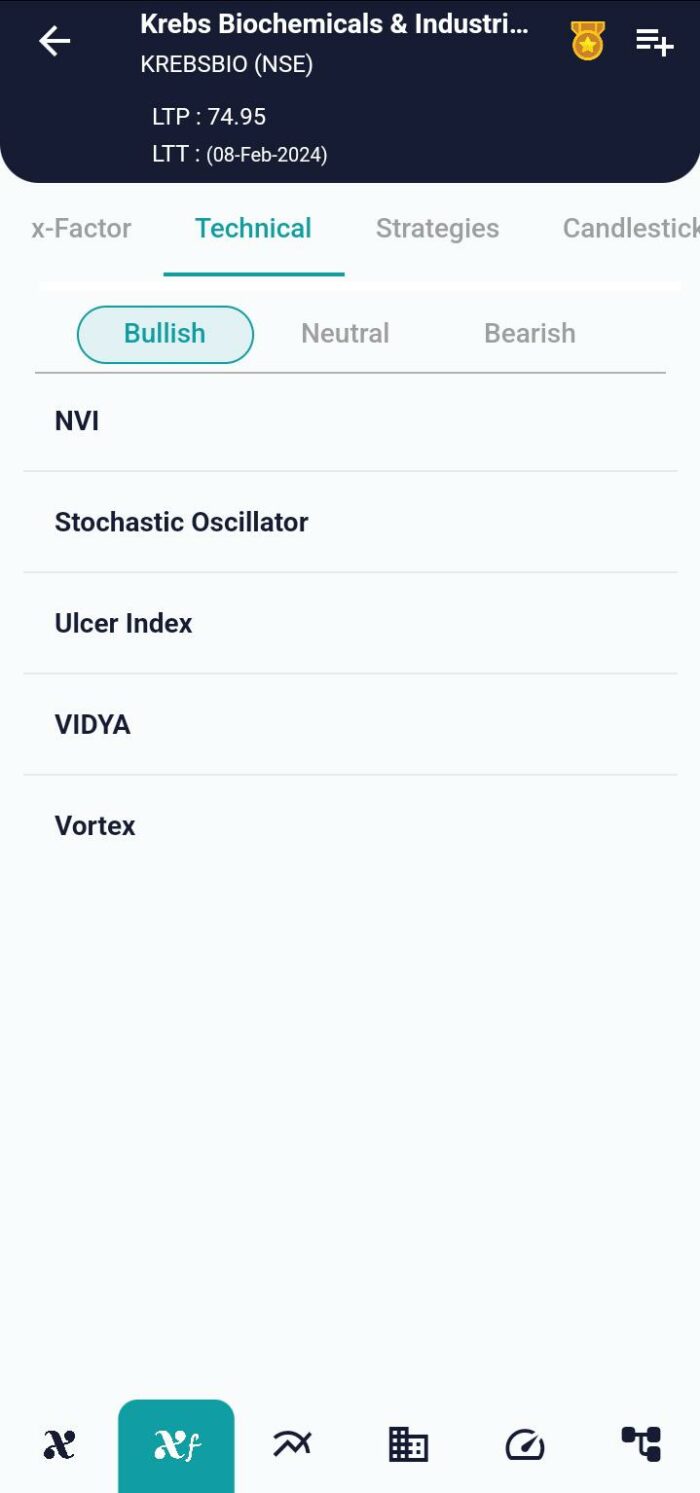

Technical Indicator

Posted On: February 9, 2024

Navigating Markets with VIDYA – Variable Index Dynamic Average

Introduction:

In the ever-evolving landscape of financial markets, mastering the art of adaptability is a hallmark of successful trading. Tushar Chande’s creation, the Variable Index Dynamic Average (VIDYA), stands as a testament to this principle. Positioned as an improvement over traditional exponential moving averages, VIDYA is not just a smoothing technical indicator ; it’s an adaptive force in the face of market volatility. Let’s delve into the nuances of VIDYA and understand how it guides traders through bullish and bearish scenarios.

Key Principles of VIDYA:

- Adaptability through Volatility:

- VIDYA’s core strength lies in its adaptability to market volatility. Unlike static moving averages, VIDYA adjusts its sensitivity based on prevailing market conditions.

- This adaptability allows traders to navigate through varying degrees of volatility, ensuring that the moving average remains responsive to the pace of price changes.

- Bullish Signal – Rising VIDYA:

- One of the key strategies embedded in VIDYA is the identification of bullish signals.

- When the VIDYA value ascends from its previous level, it signals a shift towards higher market activity. This upward momentum serves as a buy signal, prompting traders to consider favorable positions.

- Bearish Signal – Falling VIDYA:

- Conversely, VIDYA offers insights into bearish signals through a decline in its values.

- A decrease in the VIDYA value from its previous state indicates a potential downturn in market activity. Traders interpret this as a sell signal, exercising caution in the face of a shifting market landscape.

Interpretation Framework:

- Adaptive Smoothing:

- VIDYA’s ability to dynamically adjust its smoothing mechanism sets it apart. This adaptability ensures that the moving average responds effectively to the nuances of market volatility.

- Market Timing with Signals:

- The bullish and bearish signals derived from VIDYA empower traders with valuable market timing indicators.

- These signals guide traders in aligning their positions with the prevailing trends, enhancing decision-making accuracy.

Conclusion:

As traders navigate the complexities of financial markets, having a dynamic ally like VIDYA becomes pivotal. Tushar Chande’s creation transcends the limitations of traditional moving averages, offering a responsive and adaptive tool for market participants. The ability to identify bullish and bearish signals, coupled with adaptive smoothing, positions VIDYA as a valuable asset in the trader’s toolkit.

In a realm where market conditions can swiftly transition, VIDYA’s capacity to adjust to volatility provides traders with a strategic advantage. It is not merely a moving average; it is a reflection of resilience and responsiveness in the face of market dynamics. As traders seek tools that resonate with the pulse of the markets, VIDYA stands tall as a beacon of adaptability and precision.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight