Technical Indicator

Posted On: February 9, 2024

Navigating Markets with Volume-Weighted Average Price (VWAP)

Introduction:

In the intricate landscape of financial markets, the Volume-Weighted Average Price (VWAP) technical indicator emerges as a crucial metric, offering traders a nuanced perspective on the average trading price over a specific period. By integrating both price and volume data, VWAP provides a comprehensive measure of market dynamics, aiding traders in deciphering trends and making informed decisions.

Key Components:

- Price-Volume Ratio:

- Volume-Weighted Average Price is the ratio of the total value of a security traded to the overall volume of transactions during a designated trading session.

- It reflects the average price at which a financial asset is traded, accounting for the impact of both price and volume.

VWAP = (Cumulative typical price x volume)/cumulative volume

Interpretation of Volume-Weighted Average Price:

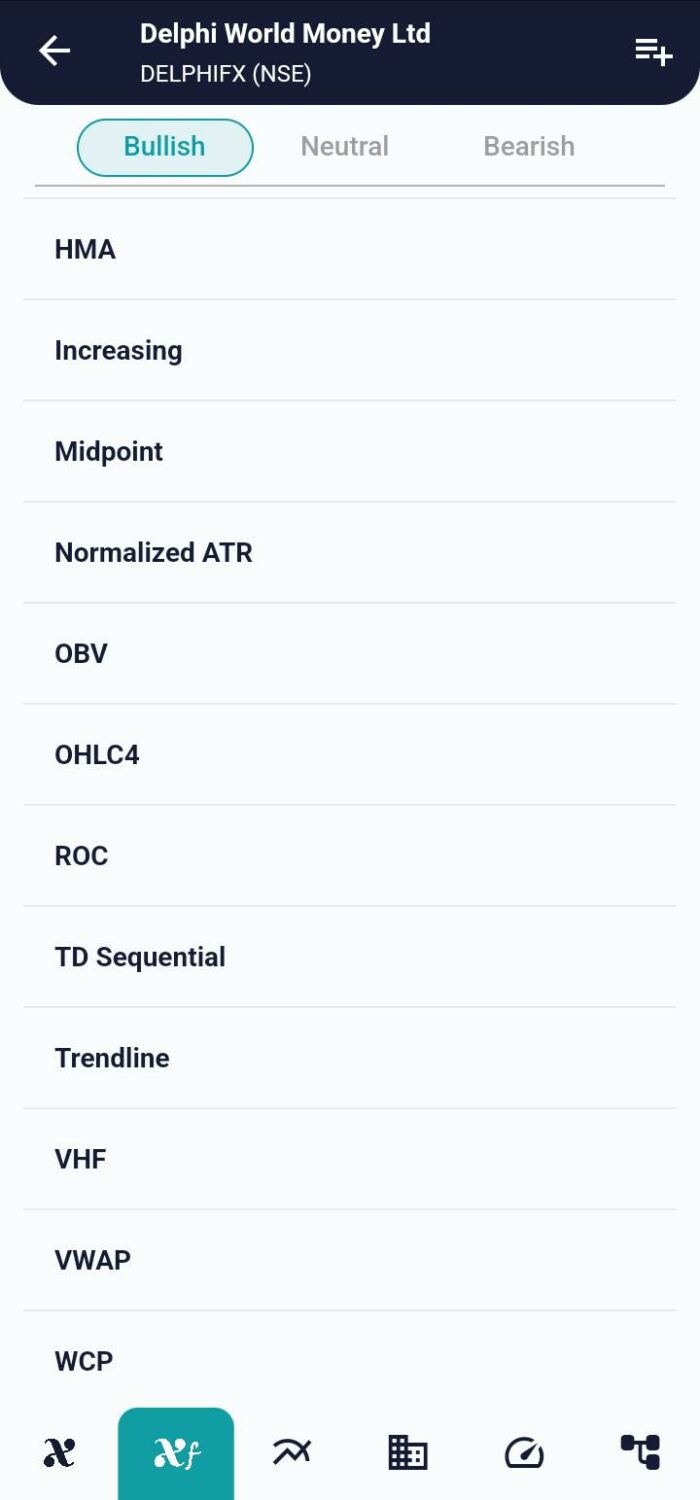

- Bullish Signal – VWAP Increase:

- When the Volume-Weighted Average Price value exhibits an increase compared to the previous period, it signals a potential bullish scenario.

- The upward movement suggests that, on average, the security is being traded at higher prices, prompting traders to consider bullish positions.

- Bearish Signal – VWAP Decrease:

- Conversely, if the Volume-Weighted Average Price value decreases from its previous level, it indicates a potential bearish scenario.

- A decline in the average trading price may signify weakening demand or selling pressure, prompting traders to exercise caution and consider bearish positions.

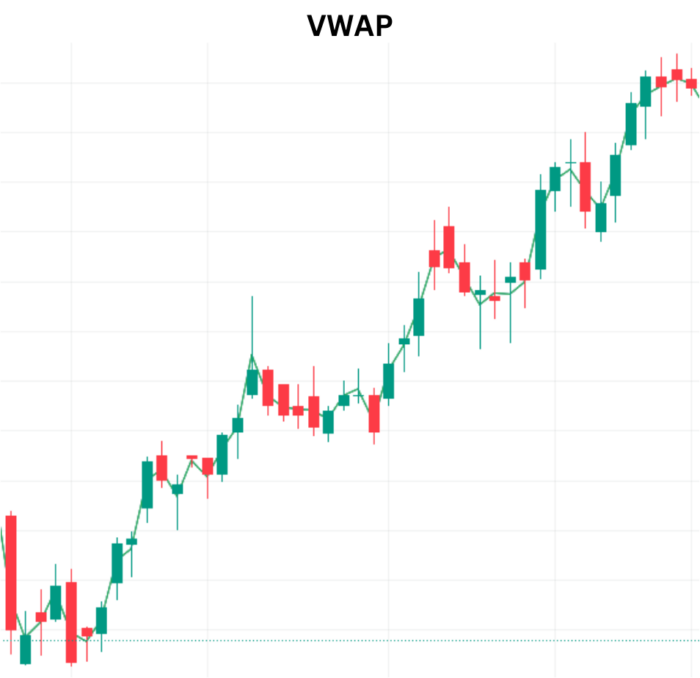

Visualizing Market Dynamics:

- Intraday Trend Insights:

- Volume-Weighted Average Price is particularly valuable for intraday traders, offering insights into the evolving trend during a single trading session.

- Traders can observe how the average price reacts to volume fluctuations throughout the day.

- Benchmark for Traders:

- Volume-Weighted Average Price serves as a benchmark against which traders can assess the efficiency of their trades.

- Comparing executed trade prices to the VWAP helps traders evaluate the quality of their entry or exit points.

Decision-Making Tool:

- Strategic Trading Decisions:

- Traders often use Volume-Weighted Average Price as a tool for making strategic trading decisions, especially in the context of intraday trading.

- By considering the relationship between current prices and the VWAP, traders can fine-tune their strategies.

Conclusion:

The Volume-Weighted Average Price (VWAP) stands as a versatile and insightful metric, offering traders a multifaceted view of market behavior. Its incorporation of both price and volume data makes it a valuable tool for those seeking a comprehensive understanding of average trading prices. As traders navigate the complexities of financial markets, Volume-Weighted Average Price serves as a guide, providing nuanced signals that aid in decision-making.

Whether signaling a bullish trajectory through an increase in Volume-Weighted Average Price or cautioning against a bearish scenario with a decrease, this indicator equips traders with essential information. As a dynamic metric that adapts to intraday fluctuations, Volume-Weighted Average Price contributes to the trader’s toolkit, fostering a deeper comprehension of market trends and facilitating well-informed trades.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight