Strategy

Posted On: January 25, 2024

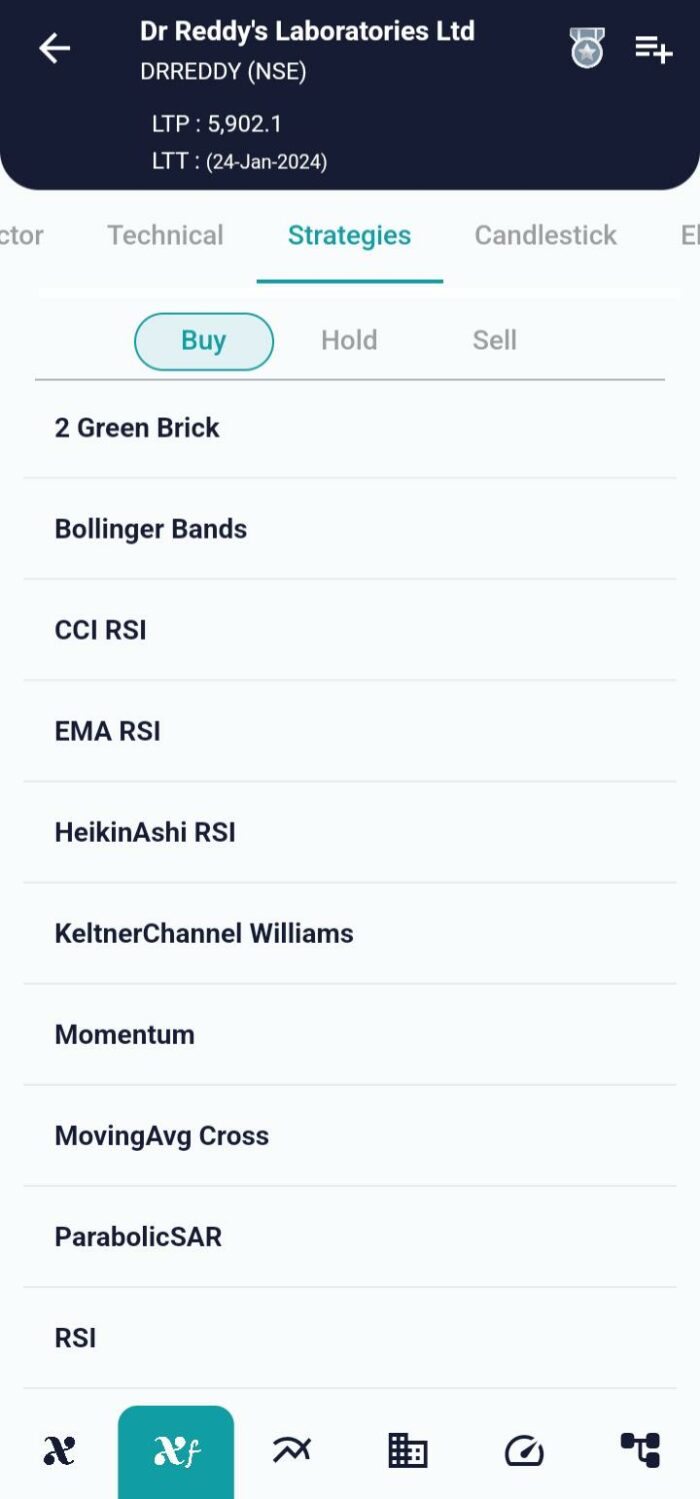

Navigating Trends: Heikin Ashi – RSI Strategy

In the ever-evolving landscape of financial markets, the Heikin Ashi – RSI Strategy emerges as a potent tool, seamlessly blending the strengths of Heikin Ashi and RSI indicators. Renowned for their accuracy, these indicators, when combined, offer traders a comprehensive approach to trend identification. However, this strategy, like any other, carries inherent risks, and traders are urged to approach it with caution. In this blog post, we dissect the nuances of the Heikin Ashi – RSI Strategy, exploring the indicators, datasets, parameters, and the precise conditions triggering buy and sell signals by using xCaldata App.

Unveiling the Heikin Ashi – RSI Strategy

The Heikin Ashi – RSI Strategy leverages the unique characteristics of Heikin Ashi and RSI indicators, aiming to provide traders with a nuanced understanding of market trends. By combining these indicators, the strategy becomes a valuable asset for traders seeking accurate trend identification and effective decision-making.

Key Components of the Strategy

- Heikin Ashi Indicator:

- Close Values: The Heikin Ashi Close values play a crucial role, representing the average price movement and aiding in trend identification.

- RSI Indicator:

- RSI Values: The Relative Strength Index (RSI) values are pivotal in determining the strength and momentum of a price trend.

Essential Datasets for Implementation

The Heikin Ashi – RSI Strategy draws its strength from three primary datasets:

- Technical Data:

- This dataset encompasses various technical indicators, with a focus on Heikin Ashi and RSI values. It forms the bedrock of the strategy’s analytical prowess.

- Price Data:

- Information on opening, closing, high, and low prices is crucial for calculating indicators and deriving valuable insights into market trends.

- Calendar Data:

- Timely updates on market events and economic releases are vital for contextualizing the broader market environment and enhancing decision-making.

Parameters Guiding the Strategy

The successful execution of the Heikin Ashi – RSI Strategy relies on specific parameters:

- Previous Technical Data:

- Access to the previous 2 days’ technical data is essential for trend analysis and generating buy/sell signals.

- Heikin Ashi Close Value:

- Determining the closing values based on Heikin Ashi provides insights into the average price movement, aiding in trend identification.

- RSI Values:

- RSI values act as a crucial parameter, offering insights into the strength and momentum of the prevailing trend.

Buy and Sell Conditions

Buy:

- Initiate a buy position when the Heikin Ashi Close is in an uptrend, and the RSI value is above 50, signaling a potential upward momentum.

Sell:

- Execute a sell position when the Heikin Ashi Close is in a downtrend, and the RSI value is below 50, indicating a potential shift towards a downward trend.

Conclusion: Precision in Trend Navigation

In conclusion, the Heikin Ashi – RSI Strategy equips traders with a comprehensive approach to trend identification. By leveraging the strengths of Heikin Ashi and RSI indicators, this strategy becomes a guiding light in the intricate world of financial markets. While exhibiting good accuracy, traders are reminded to exercise caution, understanding the inherent risks. As the Heikin Ashi – RSI Strategy becomes an integral part of a trader’s toolkit, it stands as a testament to the precision achievable in navigating trends and making informed decisions in dynamic market conditions.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight