Strategy

Posted On: January 23, 2024

Navigating Trends: The Awesome Oscillator & Ichimoku Strategy

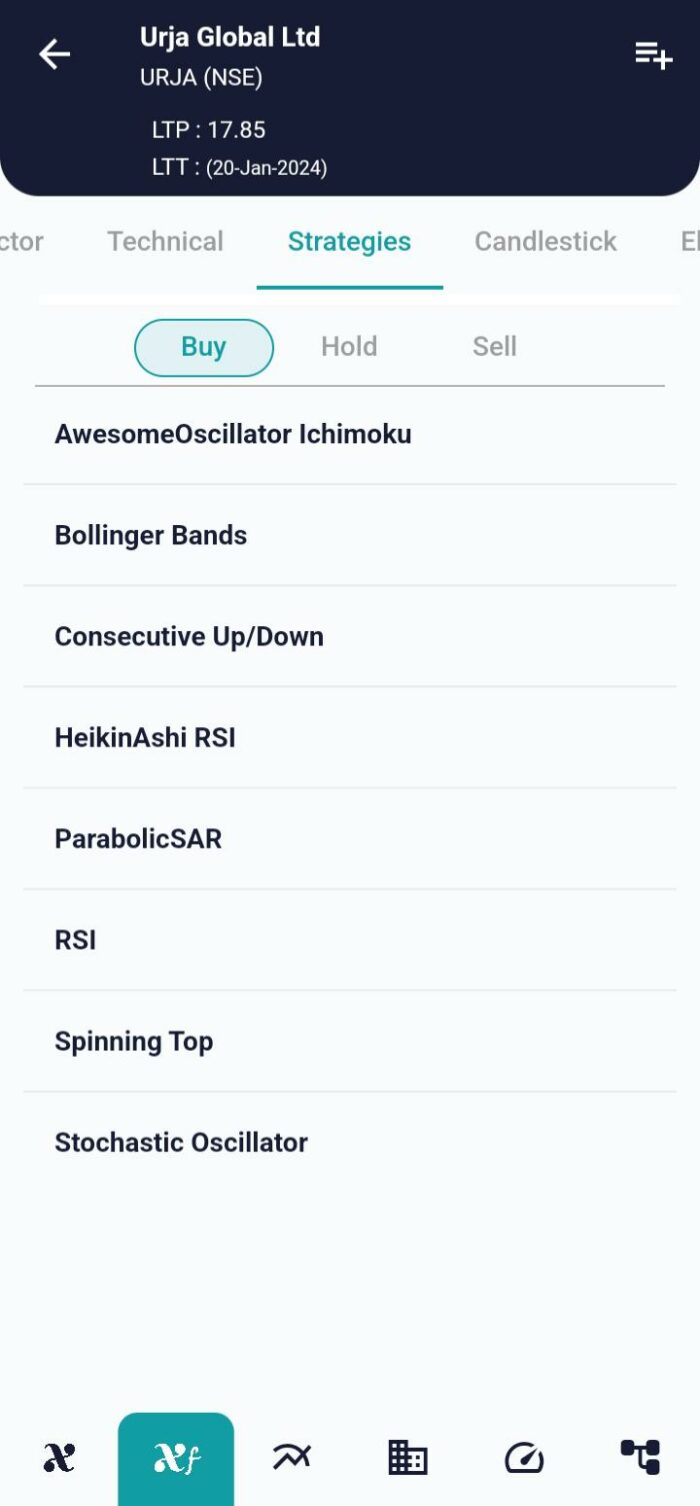

In the realm of trading strategies, the fusion of the Awesome Oscillator & Ichimoku indicators brings forth a potent approach for market participants. This strategy adeptly combines trend identification through Ichimoku and momentum analysis using the Awesome Oscillator. While showcasing effectiveness, it’s crucial to acknowledge the inherent risks, prompting traders to exercise caution and take calculated risks. This blog post aims to unravel the intricacies of the Awesome Oscillator & Ichimoku Strategy, exploring its indicators, datasets, parameters, and buy/sell conditions using XCaldata app.

Introduction to the Awesome Oscillator & Ichimoku Strategy

The Awesome Oscillator & Ichimoku Strategy harnesses the synergies of two powerful indicators – the Awesome Oscillator and Ichimoku. The former provides insights into market momentum, while the latter aids in identifying trends. This strategy, though robust, demands prudent risk management due to potential uncertainties.

Indicators Utilized in the Strategy

To execute the Awesome Oscillator & Ichimoku Strategy successfully, traders rely on two key indicators:

- Awesome Oscillator: This indicator gauges market momentum by computing the difference between a 34-period and a 5-period Simple Moving Average (SMA) of the bar’s midpoints.

- Ichimoku: This versatile indicator offers a comprehensive view of potential support/resistance levels, trend direction, and momentum. Components include the Kumo Cloud, Senkou Span A/B, Tenkan Sen, and Kijun Sen.

Datasets Utilized in the Strategy

Three crucial datasets contribute to the strategy’s effectiveness:

- Technical Data: This dataset encompasses various technical indicators, including the Awesome Oscillator and Ichimoku components. Technical analysis forms the backbone of the strategy.

- Price Data: Essential for calculating indicators and identifying buy/sell signals, price data provides information on opening, closing, high, and low prices.

- Calendar Data: Timely market events and economic releases are crucial for understanding broader market dynamics and enhancing decision-making.

Key Parameters of the Strategy

The Awesome Oscillator & Ichimoku Strategy relies on specific parameters for effective implementation:

- Previous Price Data: Access to the previous 33 days’ price data for a single business day is crucial for trend and momentum analysis.

- Awesome Oscillator Value: This parameter involves the specific value derived from the Awesome Oscillator, guiding buy/sell decisions.

- Ichimoku Tenkan-sen Value: The Ichimoku Tenkan-sen (conversion line) value is another critical parameter influencing trading decisions.

Buy/Sell Conditions

Buy:

- Initiate a buy position when the Awesome Oscillator is above the zero line, and the price crosses above the Ichimoku Tenkan-sen (conversion line). This condition signals potential upward momentum.

Sell:

- Execute a sell position when the price crosses below the Ichimoku Tenkan-sen. This condition suggests a potential reversal or downward momentum.

Conclusion: Navigating Trends with Precision

In conclusion, the Awesome Oscillator & Ichimoku Strategy equips traders with a holistic approach to market analysis. By integrating momentum insights from the Awesome Oscillator and trend identification from Ichimoku, traders can make informed decisions. However, given the inherent risks, traders must exercise caution and stay vigilant in adapting to market dynamics. As this strategy becomes an integral part of a trader’s toolkit, it enhances precision and opens doors to potential opportunities in the dynamic landscape of financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight