Strategy

Posted On: January 10, 2024

Navigating Trends with Moving Average Crossovers: Unveiling the MovingAvg2Line Cross Strategy

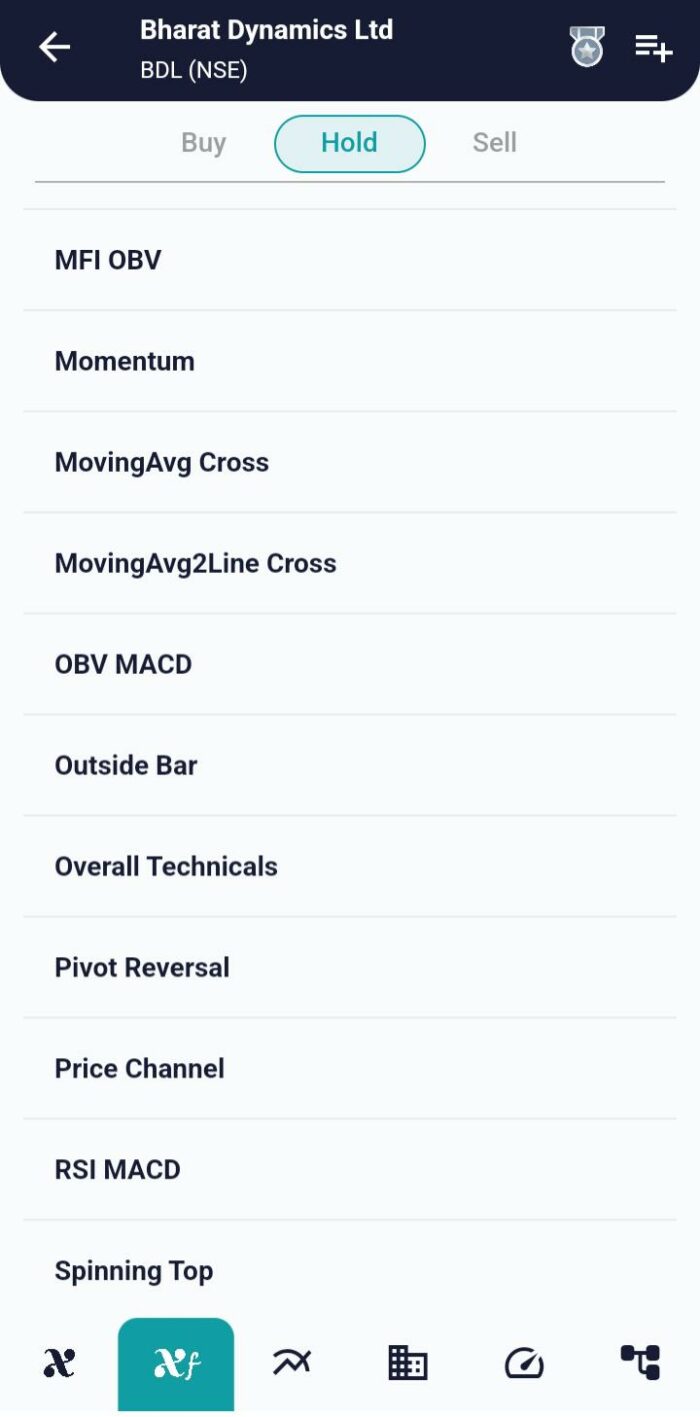

The MovingAvg2Line Cross Strategy, which makes use of moving average crossings, stands out among the many trading strategies as a flexible and useful instrument. The interaction of two moving averages serves as the basis for this technique, which dynamically adjusts to shifting market conditions. We will discuss the MovingAvg2Line Cross strategy’s basic ideas, workings, and potential benefits for swing and momentum traders in this blog post and showing you how to use this effective tool using the xCaldata App.

Understanding the Moving Average 2 Line Cross Strategy:

Technical analysts frequently employ moving average crossings as a tactic, and this is the foundation of the MovingAvg2Line Cross strategy. By calculating a slow moving average (MA) and a rapid moving average (MA), this indicator enables traders to identify both short- and long-term trends. These moving averages’ user-defined lengths provide flexibility in customizing the technique to individual trading preferences. The slow MA has a length of 18 by default, whereas the quick MA has a length of 9.

Key Operating Principles:

Long Entry on Fast MA Crossing Above Slow MA:

The MovingAvg2Line Cross strategy initiates a long position when the fast moving average crosses above the slow moving average. This bullish crossover signals a potential uptrend, prompting the strategy to enter a long trade.

Short Entry on Fast MA Crossing Below Slow MA:

Conversely, a short position is triggered when the fast moving average crosses below the slow moving average. This bearish crossover indicates a potential downtrend, prompting the strategy to enter a short trade.

In summary:

In conclusion, the MovingAvg2Line Cross strategy emerges as a valuable asset for traders seeking to navigate market trends with precision. The synergy between fast and slow moving averages provides a holistic view of price movements, enabling traders to make informed decisions. Whether applied to familiar symbols or tested across various timeframes, this strategy’s adaptability and simplicity make it a potent tool for traders across different experience levels. As users fine-tune moving average lengths and witness the strategy in action, the MovingAvg2Line Cross strategy becomes an integral component in the toolkit of those exploring the dynamic world of financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight