Strategy

Posted On: January 10, 2024

Navigating Trends with Precision: The MovingAvg Cross Strategy Unveiled

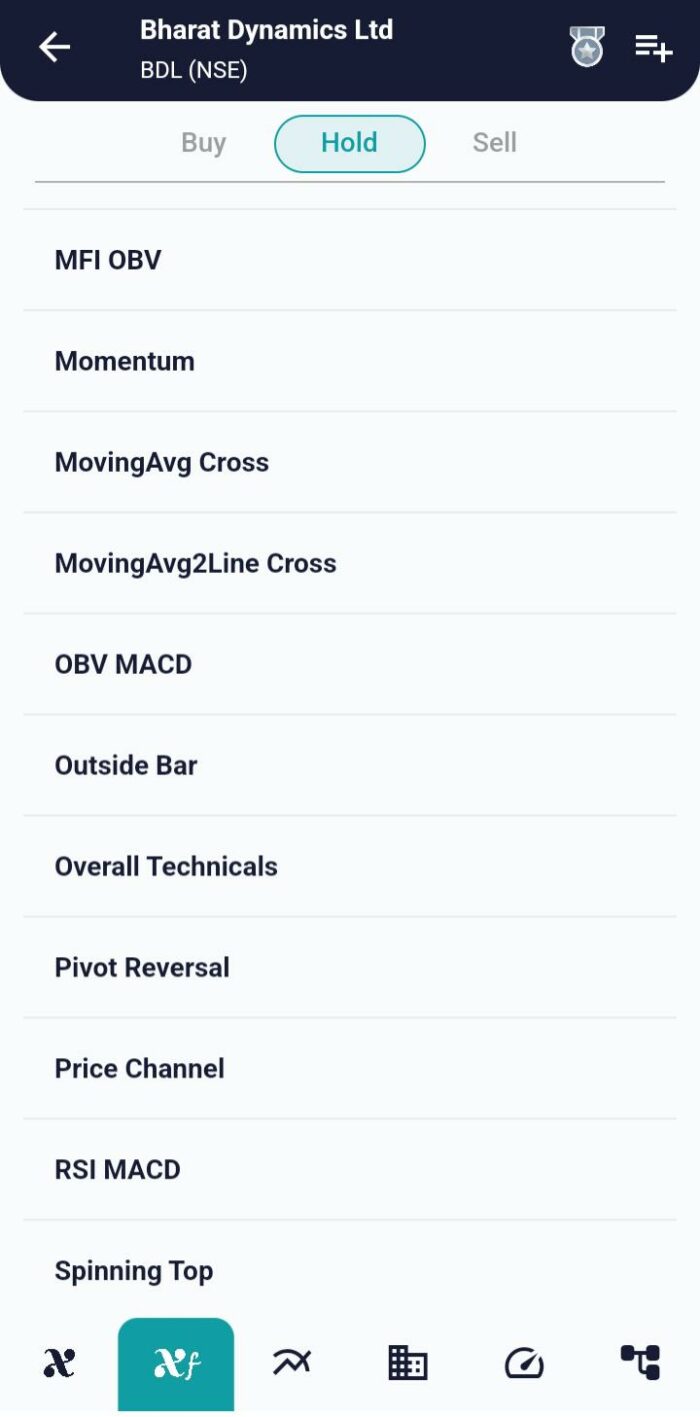

An effective weapon in traders’ toolbox, the MovingAvg Cross method makes use of the interaction between a moving average and the closing price to identify trend reversals. This article will examine the nuances of this approach ,breaking down , comprehending its essential elements, and investigating how traders can utilize it for tactical market maneuvering and showing you how to use this effective tool using the xCaldata App.

Deciphering the MovingAvg Cross Strategy:

The MovingAvg Cross technique is based mostly on the closing price and a moving average (MA). The default input traders to specify the moving average’s length is 9 , and the strategy decides whether to open long or short positions based on how the closing price and the moving average relate to each other. The approach only responds to consistent trends as opposed to sporadic price swings .

Key Operating Principles:

Confirmatory Bars:

The parameter establishes the number of consecutive bars required to confirm a trend that is 9. This feature enhances the strategy’s ability to filter out noise and respond to sustained price movements.

Long and Short Entry Signals:

The strategy triggers a long entry when the closing price is consistently above the moving average for the specified confirmatory bars. Conversely, it initiates a short position when the closing price consistently falls below the moving average.

In summary:

In conclusion, the MovingAvg Cross strategy emerges as a versatile tool for traders seeking precision in identifying trend reversals. The strategic interplay between the closing price and the moving average, coupled with confirmatory conditions, provides a robust framework for making informed decisions. Traders can leverage the customization options to align the strategy with their preferences, making it a valuable asset for navigating trends with precision in the ever-evolving financial markets. As traders explore different combinations of moving average lengths and confirmatory bars, the MovingAvg Cross strategy becomes a cornerstone in their quest for strategic and effective market navigation.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight