Technical Indicator

Posted On: February 7, 2024

Pascal’s Weighted Moving Average (PWMA): A Powerful Indicator

Introduction:

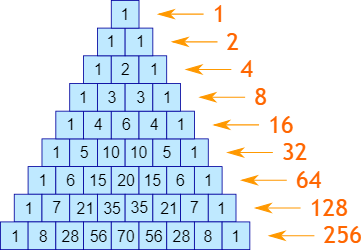

Pascal’s Weighted Moving Average (PWMA) introduces a unique technical indicator to calculating moving averages, drawing inspiration from Pascal’s Triangle. This guide explores the intricacies of PWMA, shedding light on its weighted structure and how it can be leveraged to identify potential buying or selling signals in the market.

Decoding Pascal’s Weighted Moving Average (PWMA):

Unlike traditional moving averages, Pascal’s Weighted Moving Average employs weights derived from Pascal’s Triangle values, creating a symmetric triangular window. This distinctive weighting mechanism offers a nuanced perspective on price trends, making it a noteworthy tool for technical analysts.

Analyzing PWMA Signals:

Buy Signal:

- Condition: If the Pascal’s Weighted Moving Average value changes to a higher value compared to its previous calculation.

- Interpretation: The occurrence of a higher PWMA value signals a potential bullish trend, presenting a Buy signal for traders.

Sell Signal:

- Condition: If the Pascal’s Weighted Moving Average value changes to a lower value compared to its previous calculation.

- Interpretation: A decrease in the PWMA value suggests a potential bearish trend, triggering a Sell signal for traders to consider.

Strategies for Implementation:

- Trend Confirmation:

- Use Pascal’s Weighted Moving Average signals to confirm prevailing market trends, especially when changes in the PWMA align with other technical indicators.

- Integration into Trading Strategies:

- Incorporate Pascal’s Weighted Moving Average signals into comprehensive trading strategies, leveraging them alongside other analytical tools for a more robust decision-making process.

- Dynamic Risk Management:

- Leverage PWMA insights to dynamically manage risk, adjusting positions based on the identified trend signals.

Conclusion:

Pascal’s Weighted Moving Average (PWMA) introduces a novel perspective on moving averages, integrating principles from Pascal’s Triangle to derive weighted values. By keeping a watchful eye on changes in PWMA values, traders can uncover potential buying or selling opportunities, contributing to a more informed and strategic approach to market participation.

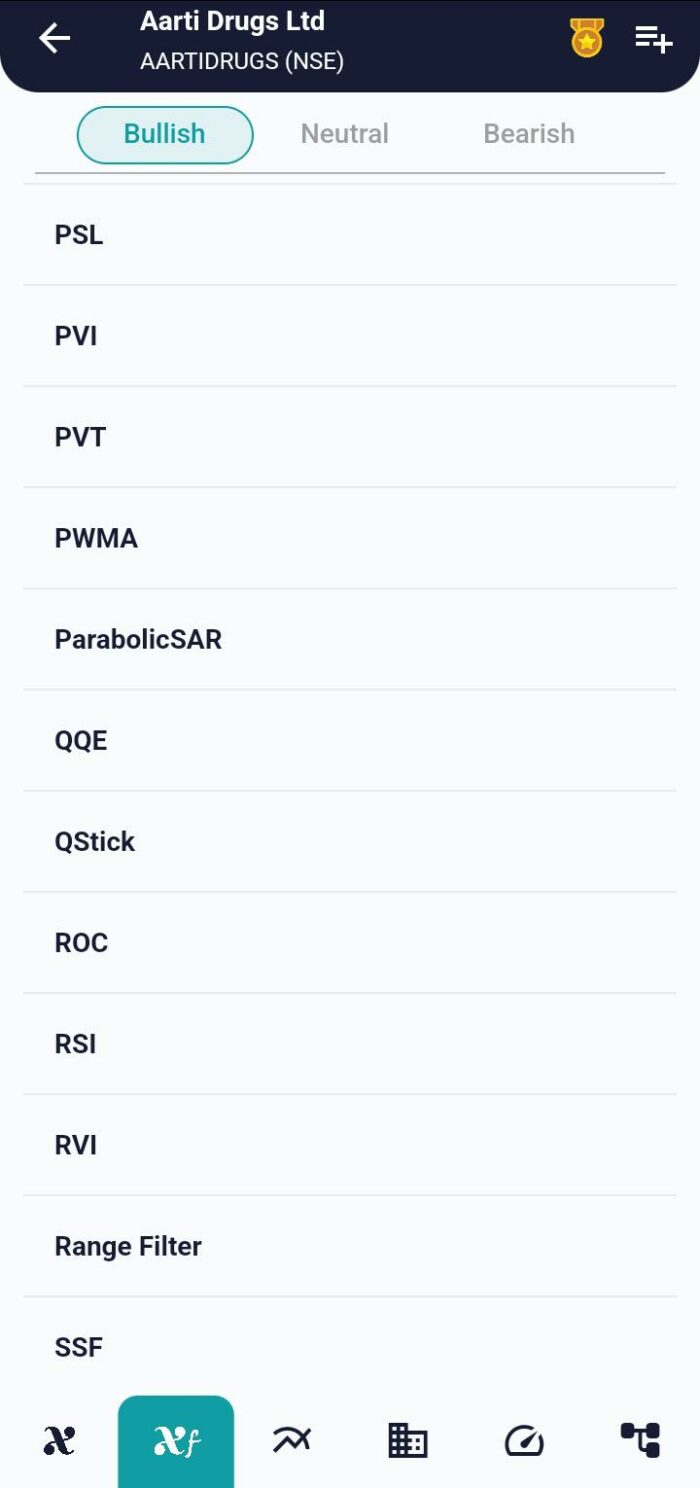

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight