Technical Indicator

Posted On: February 8, 2024

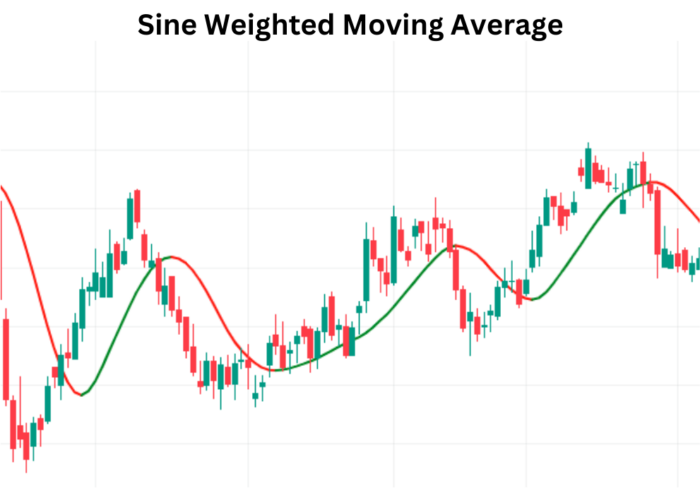

Power of Sine Weighted Moving Average (SINWMA) in Trading Success

Introduction:

In the ever-evolving landscape of financial markets, traders seek innovative tools to navigate price trends and make informed decisions. Enter the Sine Weighted Moving Average (SINWMA), a dynamic technical indicator that derives its weighting from the rhythmic cycles of a sine wave. This article delves into the intricacies of SINWMA, exploring its calculation, application, and the signals it generates for traders looking to ride the waves of market movements.

Understanding Sine Weighted Moving Average (SINWMA):

Sine Weighted Moving Average distinguishes itself by taking inspiration from the sine wave cycle, allocating the most weight to the data in the middle of the dataset. This unique weighting mechanism positions SINWMA as a valuable tool for traders seeking a nuanced moving average that adapts to the cyclical nature of market trends.

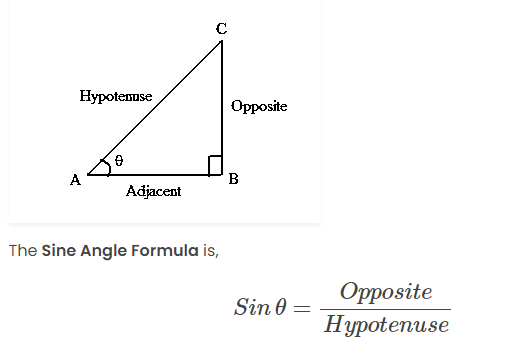

Calculation of SINWMA:

The calculation of SINWMA involves assigning weights based on the first half of a sine wave cycle. This approach ensures that the central data points receive the highest weighting, capturing the essence of market movements with a focus on the middle of the dataset.

sin values = sin(1 to 14)/sum(sin(1 to 14))

SINWMA = sin values * close

where,

sin = np. sin((i+1) * np. pi /(sinwma_window+1))

Interpreting SINWMA Signals:

- Bullish Signal (Buy):

- Condition: SINWMA value changes into high from its previous level.

- Interpretation: Indicates a buy signal, suggesting a potential upward movement in the market. Traders may consider entering or strengthening long positions.

- Bearish Signal (Sell):

- Condition: SINWMA value changes into low from its previous level.

- Interpretation: Signals a sell opportunity, implying a potential downward movement in the market. Traders may assess options to enter or reinforce short positions.

Practical Application of SINWMA in Trading:

- Trend Confirmation:

- Utilize SINWMA to confirm prevailing market trends, providing insights into the direction of price movements.

- Dynamic Support and Resistance:

- Identify dynamic support and resistance levels by observing how SINWMA interacts with price data, aiding in strategic entry and exit points.

- Cycle-Based Trading:

- Align trading strategies with the cyclical nature of SINWMA, adapting to shifts in market sentiment and trend reversals.

- Swing Trading Opportunities:

- Incorporate SINWMA signals into swing trading strategies, leveraging its responsiveness to changes in the middle of the dataset.

- Combination with Other Indicators:

- Enhance trading decisions by combining SINWMA signals with other technical indicators for a comprehensive market analysis.

Conclusion:

As traders seek tools that resonate with the dynamic nature of financial markets, the Sine Weighted Moving Average (SINWMA) emerges as a compelling choice. By drawing inspiration from sine wave cycles, SINWMA provides a unique perspective on market trends, offering valuable signals for both bullish and bearish scenarios. Traders are encouraged to integrate SINWMA into their toolkit, complementing it with comprehensive market analysis and risk management strategies. The ability of SINWMA to adapt to market cycles positions it as a versatile indicator for traders across various trading styles, inviting them to ride the waves of market movements with confidence.

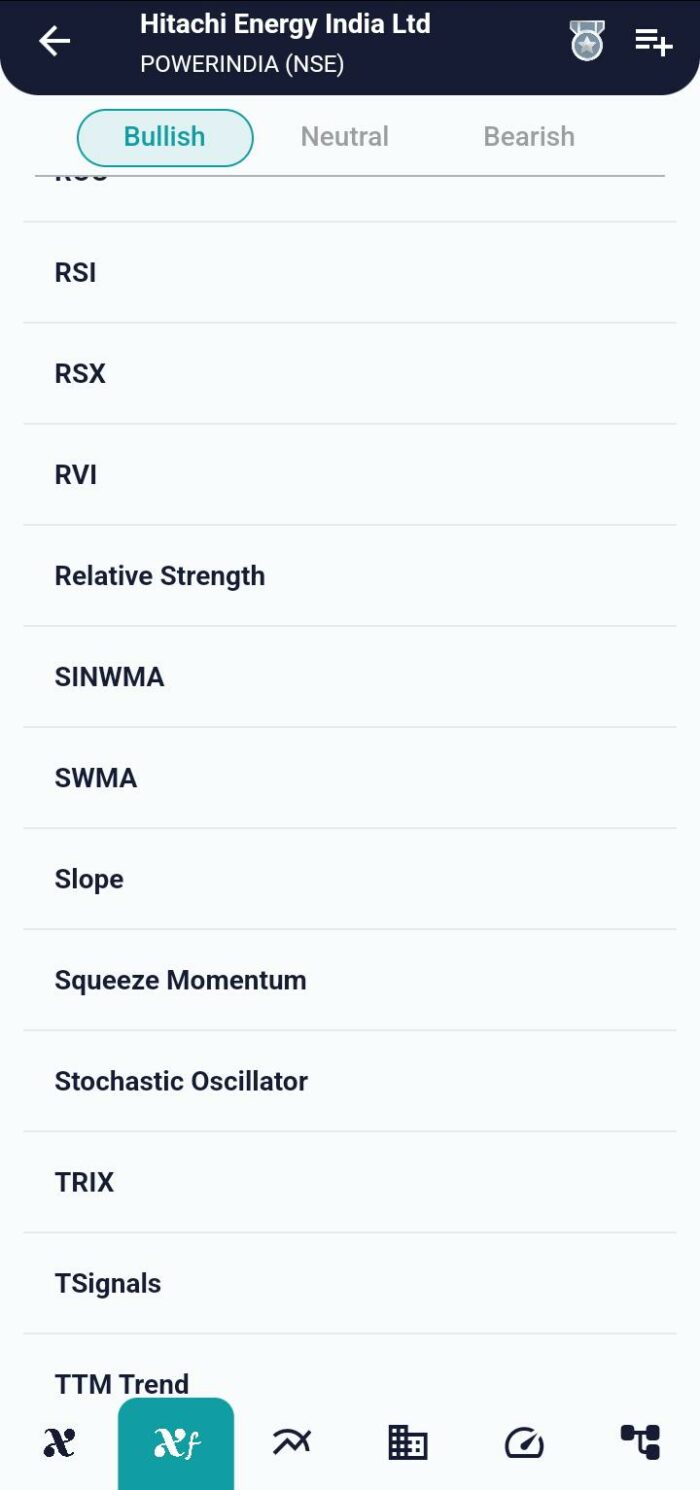

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight