Technical Indicator

Posted On: February 8, 2024

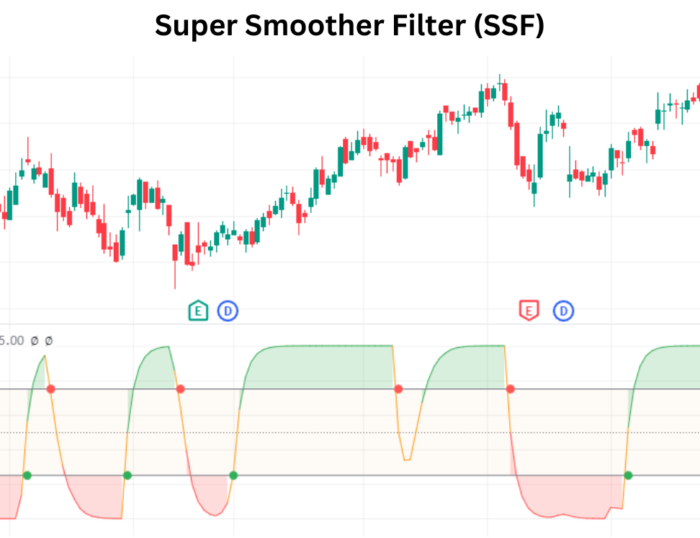

Schaff Trend Cycle(STC) Throw Your Trading Fear

Introduction:

In the dynamic world of trading and investing, staying ahead of market trends is crucial for making informed decisions. One valuable technical indicator that traders employ for this purpose is the Schaff Trend Cycle (STC). Developed by Doug Schaff, the STC is designed to enhance moving average trading by incorporating cycle analysis. This article explores the intricacies of the Schaff Trend Cycle, focusing on its role in detecting trends, measuring strength, and generating trade signals.

Understanding the Schaff Trend Cycle (STC):

The Schaff Trend Cycle is an oscillator that goes beyond traditional moving average analysis. It not only identifies trends but also assesses the strength of these trends and the rate of price changes. By incorporating cycle analysis, the STC aims to provide a comprehensive view of market dynamics, making it a valuable tool for both traders and investors.

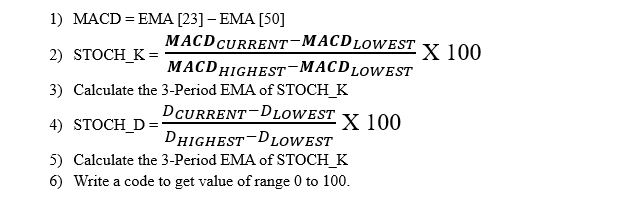

Mathematical Formula for STc:

Key Conditions for STC Trade Signals:

- Buy Signal Condition:

- Criteria:

- Yesterday’s ‘STC Value’ is below a LOWER threshold.

- Current ‘STC Value’ is equal to or greater than the LOWER threshold.

- Interpretation:

- Signals a potential “Buy” opportunity.

- Indicates a shift from a lower value to a value meeting or exceeding the LOWER threshold.

- Criteria:

- Sell Signal Condition:

- Criteria:

- Yesterday’s ‘STC Value’ is above an UPPER threshold.

- Current ‘STC Value’ is equal to or less than the UPPER threshold.

- Interpretation:

- Triggers a “Sell” signal.

- Suggests a transition from a higher value to a value meeting or falling below the UPPER threshold.

- Criteria:

- Hold Signal Condition:

- Criteria:

- Neither of the above conditions is met.

- Interpretation:

- Implies a “Hold” recommendation.

- No decisive shift in STC values, advocating a wait-and-watch approach.

- Criteria:

Practical Application of STC Signals:

- Trend Detection:

- Leverage STC signals to identify emerging trends and potential trend reversals.

- Enhance trend-following strategies with timely buy and sell signals.

- Strength Measurement:

- Gauge the strength of trends using the STC, enabling traders to assess the momentum in price changes.

- Integrate STC insights into risk management strategies.

- Cycle Analysis Advantage:

- Benefit from the unique advantage of cycle analysis embedded in the STC.

- Understand the cyclical nature of market trends for more nuanced decision-making.

Conclusion:

The Schaff Trend Cycle (STC) stands as a powerful tool in the realm of technical analysis, providing traders and investors with a nuanced perspective on market trends. By incorporating cycle analysis and offering precise trade signals, the STC contributes to more informed decision-making. Whether identifying buying opportunities, signaling potential sell-offs, or advocating a hold strategy, the STC proves its worth as a versatile and comprehensive indicator in the ever-evolving landscape of financial markets.

xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight