General

Posted On: October 20, 2023

Seasonality: A Deep Dive into Stock Market Trends and Cycles

Seasonality in the stock market is a fascinating phenomenon that has intrigued investors and analysts for generations. It involves the recurring patterns and trends in stock prices at specific times of the year. Understanding stock market seasonality can offer valuable insights for investors, guiding them in making informed decisions and optimizing their investment strategies. In this blog, we’ll explore what seasonality means in the context of the stock market and provide real-world examples to illustrate its significance.

I. What is Stock Market Seasonality?

Seasonality, in the stock market, refers to the consistent and predictable patterns in stock prices and market behavior during certain times of the year. These patterns may be influenced by a variety of factors, including economic cycles, investor psychology, and external events.

It refers to the phenomenon where certain recurring patterns and trends can be observed in the financial markets during specific times of the year. These patterns are typically on an annual or monthly basis and are not necessarily driven by fundamental economic factors. Instead, they are often influenced by investor sentiment, historical trends, and external events. Investors and traders analyze these seasonal patterns as part of their investment strategies, though it’s important to note that past performance does not guarantee future results, and these patterns may not hold true every year.

II. Significance:

- Investment Timing: Recognizing seasonal trends can help investors choose optimal entry and exit points for stocks, potentially maximizing returns.

- Risk Management: Understanding when stocks historically perform well or poorly can assist in risk mitigation and portfolio diversification.

- Sector and Industry Focus: Different sectors and industries may be affected by seasonality in unique ways, necessitating diversified investment strategies.

III. Examples of Stock Market Seasonality:

- The “January Effect”: Small-cap stocks often experience a surge in January. This is attributed to investors selling stocks in December for tax purposes and buying them back in January.

- Summer Doldrums: Summertime is known for lower trading volumes and reduced volatility, often leading to sideways market movement as traders take vacations.

- Holiday Rally: A “Santa Claus Rally” typically occurs during the last five trading days of December and the first two trading days of January due to positive sentiment around the holidays.

- Earnings Season: Quarterly earnings reports can significantly impact stock prices and create distinct trends during the seasons in which they are released.

- October Volatility: Historically, October has been a month marked by significant market volatility, with some of the most notorious market crashes occurring in this month.

IV. Using Seasonality Data:

- Research: Access historical stock data and utilize specialized tools to analyze patterns for specific stocks or sectors.

- Diversification: Adjust your portfolio based on seasonal trends, such as reducing exposure to historically weak sectors during their underperforming months.

- Risk Management: Be prepared for potential increased volatility during historically turbulent periods and adapt your risk management strategies accordingly.

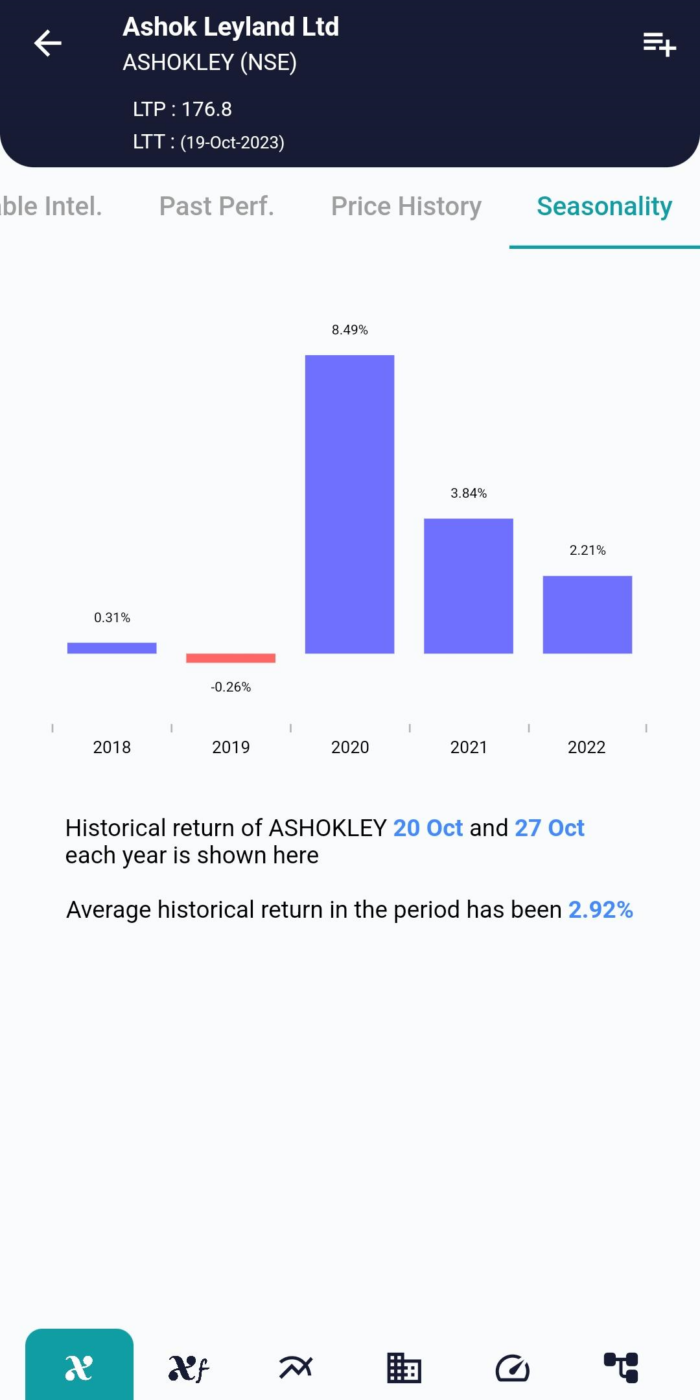

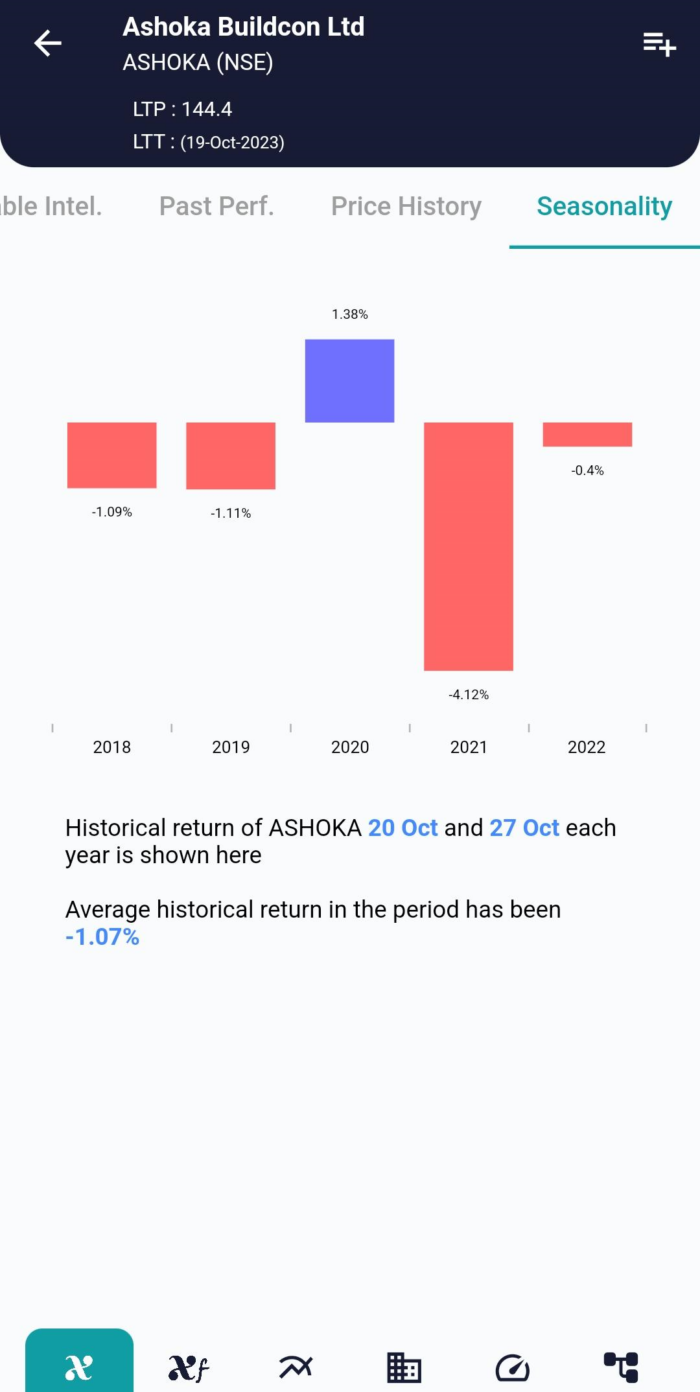

V. Where can I Find Seasonality of the Stocks:

The Answer for your question is XCalData, This Application you can find Seasonality, Historical Doubling Period, Stock Reports, Forecast, Strategies, Support and Resistance, Stop Loss, Trend, Target Price, Technical Ratios, Financial Ratios, and Many more.

VI. Conclusion:

Stock market seasonality is a captivating aspect of financial markets. By understanding and leveraging the historical trends and patterns associated with different times of the year, investors can make more informed decisions and enhance their overall investment strategies.

Examining real-world examples of seasonality offers investors valuable insights into the complexities of the stock market. These insights can help improve investment outcomes, manage risk effectively, and potentially lead to more successful investing experiences. It is a powerful tool that, when used wisely, can enhance your investment journey and drive better results.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight