Candlestick Pattern

Posted On: December 11, 2025

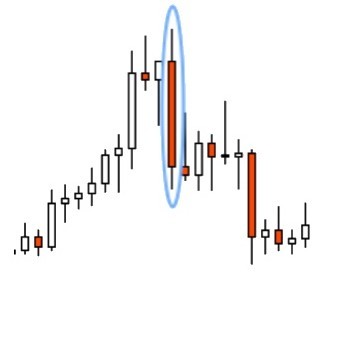

Spotting Market Tops with the Bearish Key Reversal Pattern

The Bearish Key Reversal Pattern is a powerful candlestick signal that forms at the top of an uptrend and warns of a potential downward reversal. It occurs when the market makes a new high but closes significantly lower than the previous day’s close. This sudden shift from strong buying to aggressive selling indicates that the bullish momentum is weakening and sellers are taking control. Traders use this pattern to identify potential market tops and prepare for a decline in price

Importance

Strong Bearish Reversal Signal

It clearly indicates a shift in control from buyers to sellers, making it one of the most reliable signals of a trend reversal.

Shows Rejection of Higher Prices

The pattern forms when the market attempts to move higher but gets pushed down strongly, reflecting heavy selling pressure.

Easy to Spot on the Chart

Its structure is visually clear, making it useful for traders of all experience levels.

Helps Identify Market Tops Early

Traders use it to exit long positions or prepare for short trades before a downtrend fully develops.

High Psychological Impact

The sudden and sharp reversal signals fear among buyers and confidence among sellers

Conclusion

The Bearish Key Reversal Pattern is a highly effective tool for identifying potential market tops and anticipating a shift from bullish to bearish momentum. By marking a strong rejection of higher prices and showing clear seller dominance, the pattern helps traders take timely decisions such as exiting long trades or preparing for short positions. When combined with volume and additional confirmation signals, the Bearish Key Reversal becomes a reliable guide for navigating upcoming downward movements in the market.

Where can I see further insights on this stock?

xCalData offers unbiased insights into stocks. Download the app from google play. For Actionable Intelligence, subscribe to xCalData app on Android devices: Download here

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight