Posted On: August 10, 2023

Stock Report: AIAENG (NSE) 09 AUG 23

Industry: Specialty Industries Machinery

AIA Engineering stands as the world’s foremost producer of High Chrome Mill Internals, boasting an unparalleled total capacity of 522,000 MT across innovative greenfield and brownfield manufacturing sites. this company unique distinction lies in providing comprehensive end-to-end solutions encompassing grinding optimization and recovery enhancements. These achievements are fortified by ISO 9001:2015 certifications for all facilities, housing cutting-edge automation, precise heat treatment, and rigorous testing.

#xCalData predicts AIAENG will continue its Bullish phase over the next five days and trend in the range of 3493 to 3744.

In comparison to the previous month, the price of the stock has experienced an increase of 12.78% indicating a Bullish.

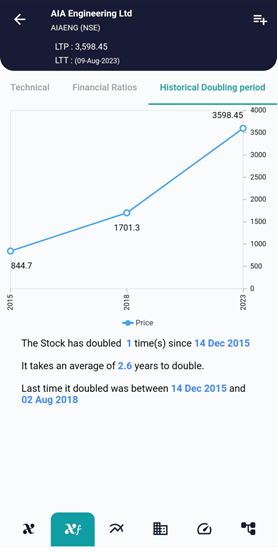

The Stock has doubled once since 14 Dec 2015 and took an average of 2.6 years to double.

The stock has not shown seasonality trend in the past.

Reviewing the returns for the past 5 years for the same week, we see the stock has given negative returns in 2 years in the past.

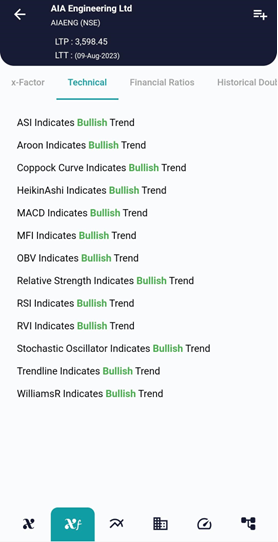

Majority of the technical ratios trend towards Bullish side of the spectrum

Collectively, xCalData suggests the stock would be in Bullish zone for next 5 days.

#xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData