Stock of Interest

Posted On: June 30, 2023

Stock Report : CANBK (NSE) 30 Jun 2023

Outlook: Bearish

Canara Bank is one of the largest public sector banks in India. It was established in 1906 and has its headquarters in Bengaluru, Karnataka. The bank operates through a vast network of branches and ATMs across the country, providing a wide range of banking products and services.

xCalData predicted that CANBK will continue its bearish phase over the next five days.

During this period, the price trend of CANBK is expected to fall within the range of 283 to 294.

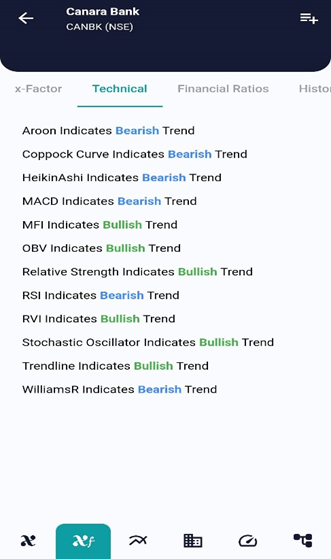

Most of the technical ratios analysed for the stock lean towards the bearish side, indicating a potential downward trend in its price. Notably, the Relative Strength Index (RSI) strongly supports this bearish view, reflecting a decline in the stock’s price momentum. However, it is worth mentioning that not all indicators align with this bearish sentiment. The Accumulative Swing Index (ASI) suggests a more bullish outlook, indicating a potential increase in buying pressure.

Based on the xCalData forecast, the stock price is expected to continue its bearish trend for the next five days, indicating a projected decline in price during this period. This forecast suggests that investors may observe a downward movement in the stock’s value over the specified timeframe.

xCalData offers unbiased insights into stocks.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Disclaimer: The securities quoted are for illustration only and are not recommendatory

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight