Stock of Interest

Posted On: July 7, 2023

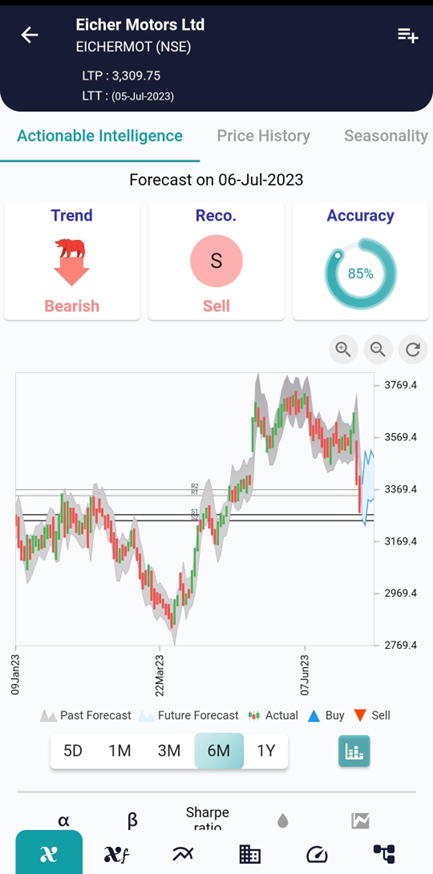

Stock Report : EICHERMOT (NSE) 6 Jul 2023

Outlook: Bullish

Eicher Motors Limited is an Indian multinational automotive company that specializes in motorcycles and commercial vehicles. Founded in 1948 by Vikram Lal, the company is headquartered in New Delhi. Its notable subsidiary, Royal Enfield, is a renowned manufacturer of middleweight motorcycles known for their classic designs and performance. Eicher Motors also owns VE Commercial Vehicles, which produces commercial trucks and buses. With a workforce of 4,739 employees as of 2022, Eicher Motors has achieved significant revenue growth, reaching 15,037.29 crores INR (approximately US$1.9 billion) in 2023.

xCalData predicts EICHERMOT will continue its bearish phase over the next five days.

During this period, EICHERMOT is expected to be within the range of 3,491 to 3,336.

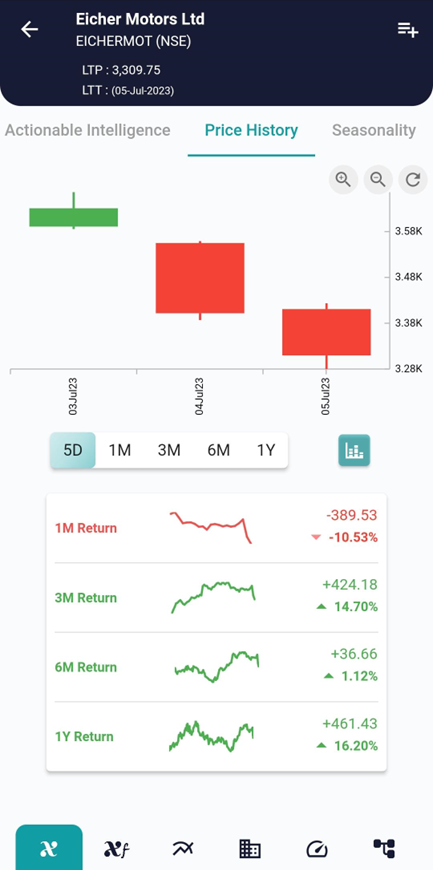

In comparison to the previous month, the price of the stock has experienced a decline of 10.53%. This decrease indicates a negative movement in the stock’s price during that period. It’s important to note that a 10.53% decline over one month is a significant drop, and it suggests a bearish sentiment in the market.

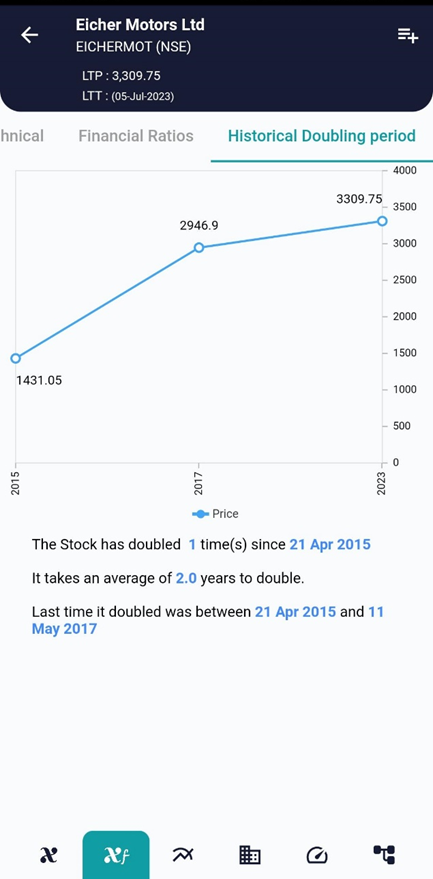

The Stock has doubled once since 21 Apr 2015 and took an average of 2.0 years to double.

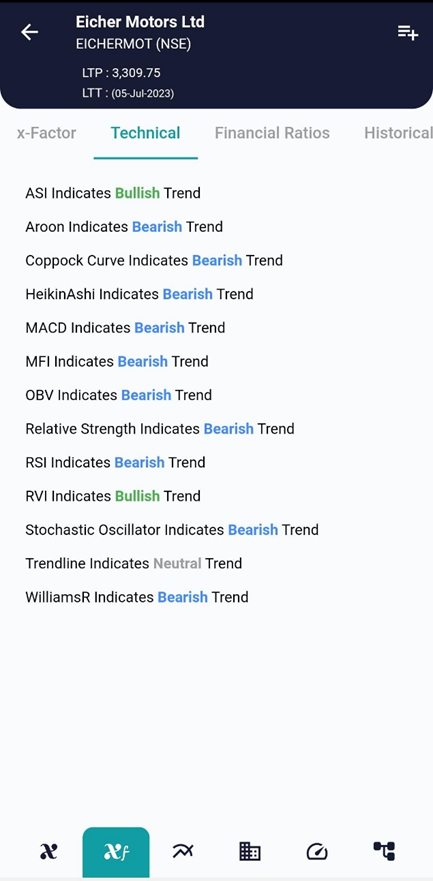

Majority of the technical ratios trend towards bearish side of the spectrum. Only 2 of the technical indicators namely ASI and RVI indicate bullish view.

Collectively, xCalData suggests the stock would be in Bearish zone for this week ending 7th July.

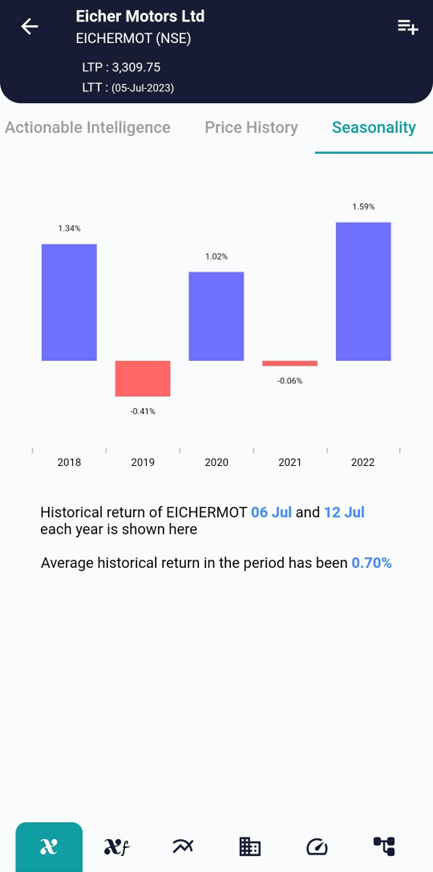

the stock has not shown the seasonality trend in the past.

However, reviewing the returns for the past 5 years for the same week, we see the stock has given positive returns in 3 years and negative returns in 2 years in the past.

xCalData is an exceptional app available on Android devices offering unbiased insights into stocks, enabling investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData is a valuable resource for anyone interested in the stock market.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData.

Disclaimer: The securities quoted are for illustration only and are not recommendatory.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight