Stock of Interest

Posted On: August 7, 2023

Stock Report: INDHOTEL(NSE) 04 Aug 23

Outlook: BULLISH

Sector: Consumer Cyclical

Industry: Lodging

The Indian Hotels Company Limited (IHCL), a subsidiary of Tata Group, is a prominent Indian hospitality firm managing a diverse range of properties including hotels, resorts, safaris, and palaces. Founded in 1902 by Jamsetji Tata, IHCL’s flagship Taj Mahal Palace Hotel in Mumbai is a symbol of luxury and heritage. Their renowned hotel chains include Taj, SeleQtions, Vivanta, and Ginger. Over the years, IHCL has expanded internationally and is known for its strategic partnerships, such as Taj SATS Air Catering and collaborations with GIC Private Limited for hotel asset acquisitions.

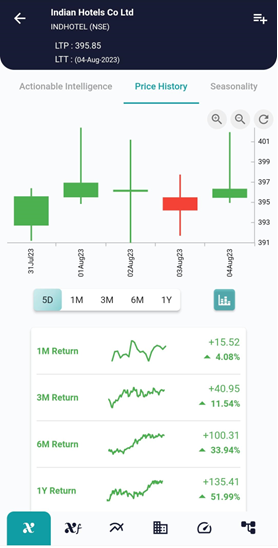

#xCalData predicts INDHOTEL will continue its Bullish phase over the next five days and trend in the range of 390 to 409.

In comparison to the previous month, the price of the stock has experienced an increase of 4.08% indicating a Bullish.

The Stock has doubled twice since 07 Sep 2015 and took an average of 3.8 years to double.

The stock has not shown seasonality trend in the past.

Reviewing the returns for the past 5 years for the same week, we see the stock has given negative returns in 2 years in the past.

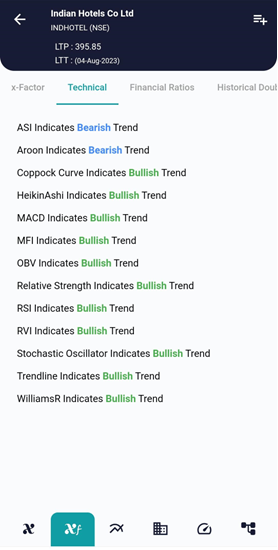

Majority of the technical ratios trend towards Bullish side of the spectrum. Only ASI and Aroon indicates bearish trend.

Collectively, xCalData suggests the stock would be in Bullish zone for next 5 days.

#xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight