Stock of Interest

Posted On: September 4, 2023

Stock Report: KSL(NSE) 01 Sep 2023

Outlook: Bullish

Sector: Basic Materials

Industry: Steel

Kalyani Steels Ltd manufactures forging and engineering quality carbon and alloy steel. Its product portfolio consists of carbon steel, carbon-manganese steel, chrome steel, chrome-manganese steel, chrome-nickel steel, chrome-moly steel, low carbon chrome-nickel-moly steel, medium carbon cr-ni-mo steel and bearing steel. The company’s products are used in automotive forging, construction equipments, bearings, seamless tubes, and aluminum smelting. The majority of the revenue is generated by the sale of Rolled Products, As Cast Blooms and Pig Iron. These operating segment have been aggregated into one reportable business segment which is Forging and Engineering quality carbon and alloy steels.

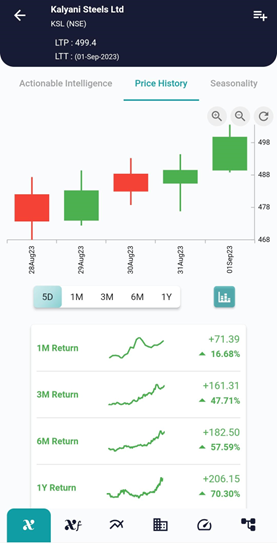

#xCalData predicts that KSL will continue its bullish phase over the next five days and trend within the range of 480 to 518.

In comparison to the previous month, the price of the stock has experienced a increase of 16.68% indicating a bullish.

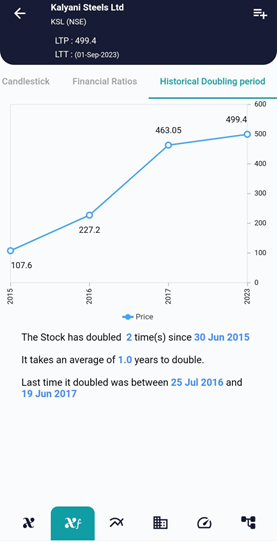

The Stock has doubled twice since 30 Jun 2015 and took an average of 1.0 years to double.

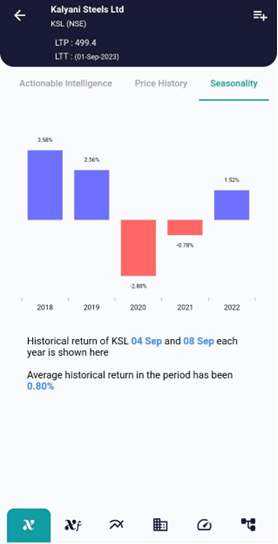

The stock has not shown seasonality trend in the past.

Reviewing the returns for the past 5 years for the same week, we see the stock has given negative returns in 2 years in the past.

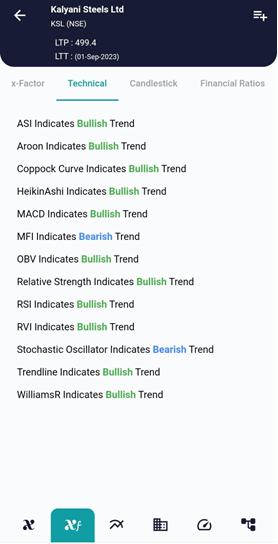

Majority of the technical ratios trend towards Bullish side of the spectrum. Only some of the technical indicators namely MFI indicate Bearish view.

Collectively, xCalData suggests the stock would be in Bullish zone for next 5 days.

#xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight