Stock of Interest

Posted On: October 16, 2023

Stock Report: MASTEK(NSE) 13 Oct 2023

Outlook: Bearish

Sector: Technology

Industry: Information Technology Services

Mastek Ltd, along with its subsidiaries is a provider of vertically-focused enterprise technology solutions. The company’s offering portfolio consists of information technology consulting, application maintenance, application development, application management outsourcing, testing, data warehousing, business intelligence, and application security. It also focuses on agile consulting, legacy modernisation, Oracle Cloud, Oracle ERP Cloud, product-as-a-service solutions and machine learning, and digital e-commerce. Geographically the company exports its services to the United Kingdom, North America, the Middle East, and Other regions. The United Kingdom region generates maximum revenue for the company.

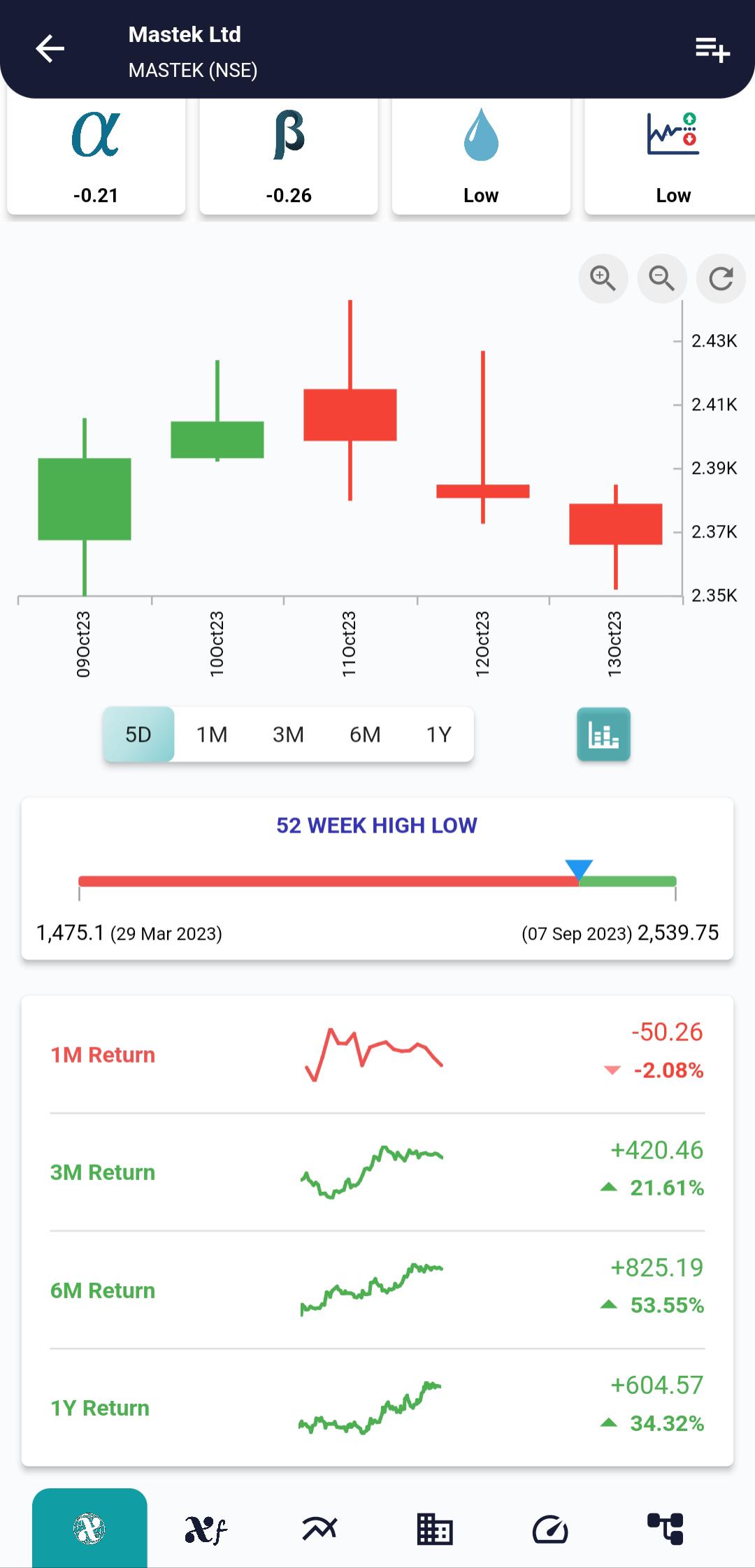

#xCalData predicts that # MASTEK will continue its bearish phase over the next five days and trend within the range of 2299 to 2415.

In comparison to the previous month, the price of the stock has experienced a decline of 2.08% indicating a bearish.

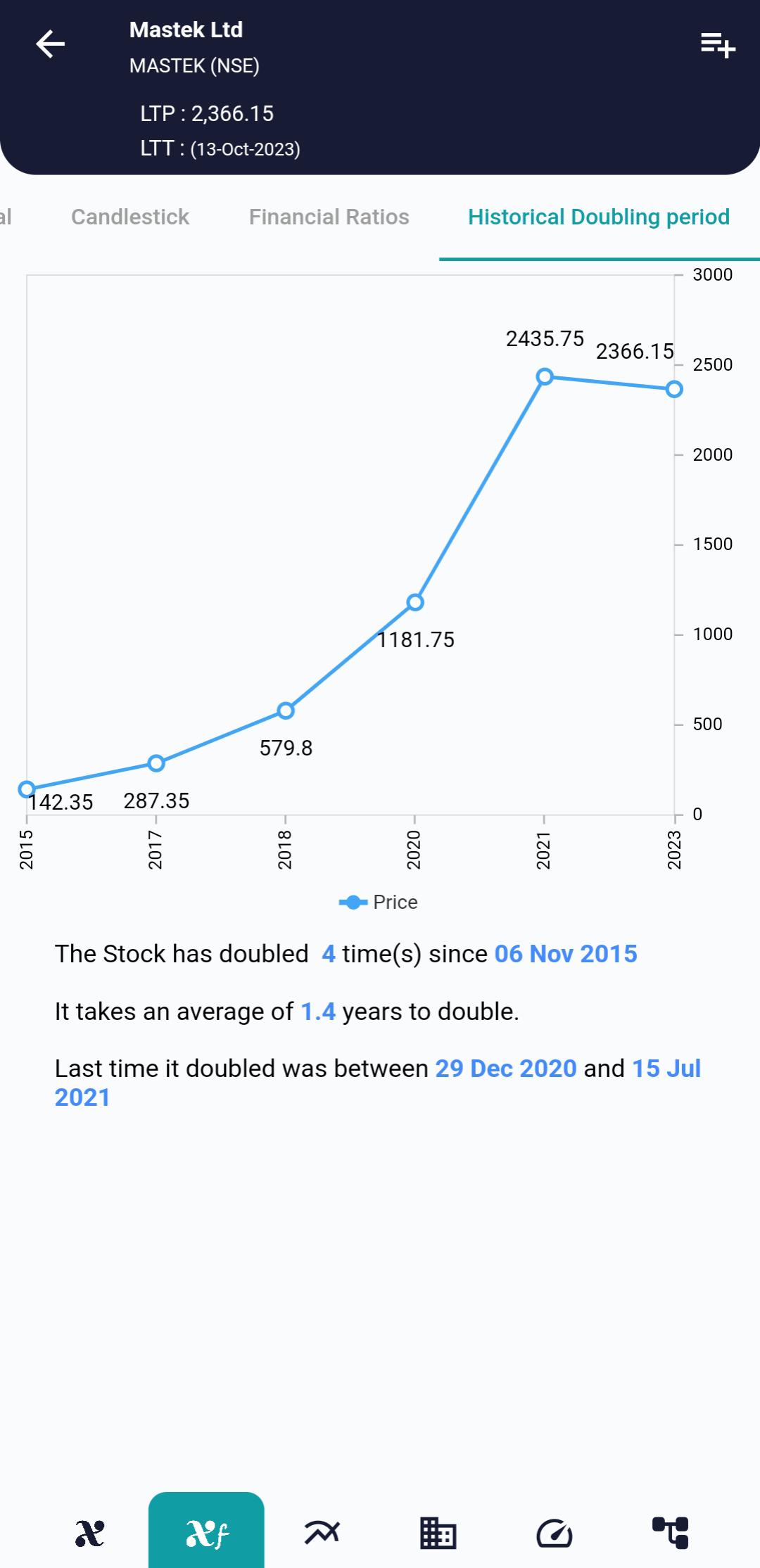

The Stock has doubled 4 time(s) since 06 Nov 2015 and took an average of 1.4 years to double.

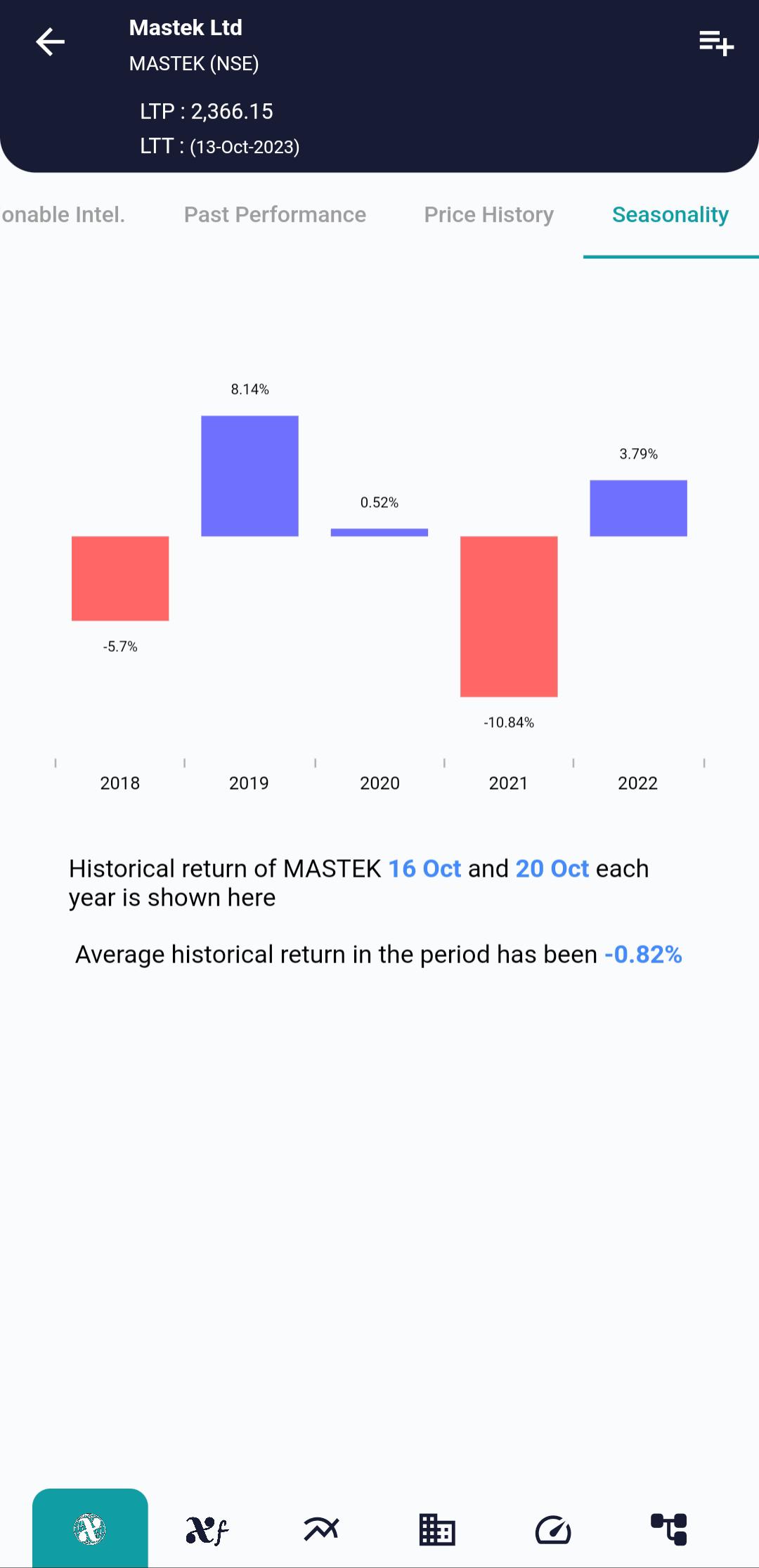

The stock has not shown seasonality trend in the past.

Reviewing the returns for the past 5 years for the same week, we see the stock has given negative returns in 2 years in the past.

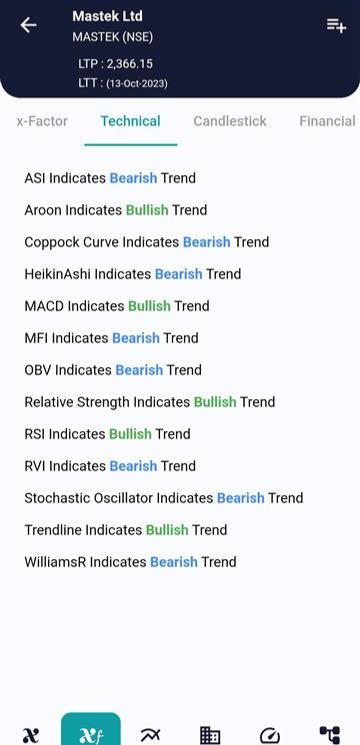

Majority of the technical ratios trend towards Bearish side of the spectrum. Only some of the technical indicators namely MACD indicate Bullish view.

Collectively, xCalData suggests the stock would be in Bearish zone for next 5 days.

#xCalData is an exceptional app available for Android devices that offers unbiased insights into stocks, allowing investors to make informed decisions. With its user-friendly interface and comprehensive features, xCalData provides a valuable resource for anyone interested in the stock market. Download the app from google play.

For Actionable Intelligence, subscribe to xCalData app on Android devices: https://tinyurl.com/downloadxCalData

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight