Stock of Interest

Posted On: July 14, 2023

Stock Report : TATACONSUM (NSE) 13 Jul 2023

Outlook: Bearish

Tata Consumer Products, an Indian fast-moving consumer goods company and a part of the renowned Tata Group, has its registered office located in Kolkata and corporate headquarters in Mumbai. Founded in 1962 in Kolkata, it has grown to become the world’s second-largest manufacturer and distributor of tea, as well as a significant producer of coffee. Under the leadership of CEO Sunil A. D’Souza since April 4, 2020, the company has thrived and expanded its operations. Tata Consumer Products has a workforce of 3,040 employees as of 2023. It operates as a subsidiary of both the Tata Group and Tata Chemicals, benefiting from the conglomerate’s extensive resources and expertise. The company has achieved impressive financial success, with a revenue of 13,952 crores INR (equivalent to approximately US$1.7 billion) in 2023. Tata Consumer Products owns several well-known brands, including Tata Coffee, Tata Starbucks, Tetley, Good Earth Tea, and MORE, reinforcing its prominent presence in the industry.

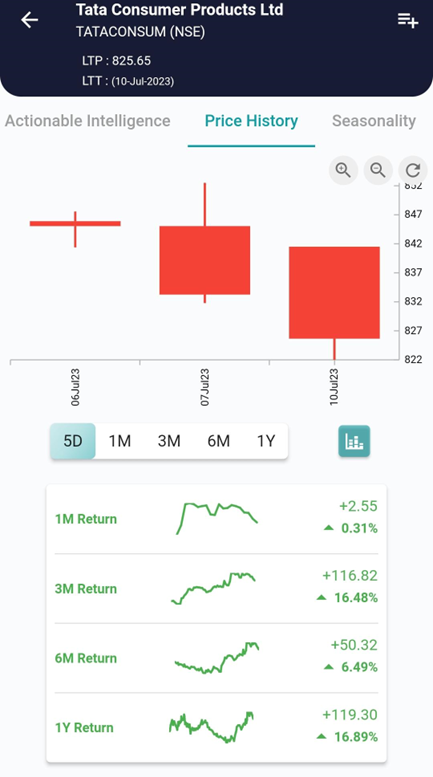

xCalData predicts that TATACONSUM will continue its bearish phase over the next five days trending in the range of 848 and 810.

In comparison to the previous month, the price of the stock has experienced an increase of 0.31% suggesting a bearish sentiment in the market.

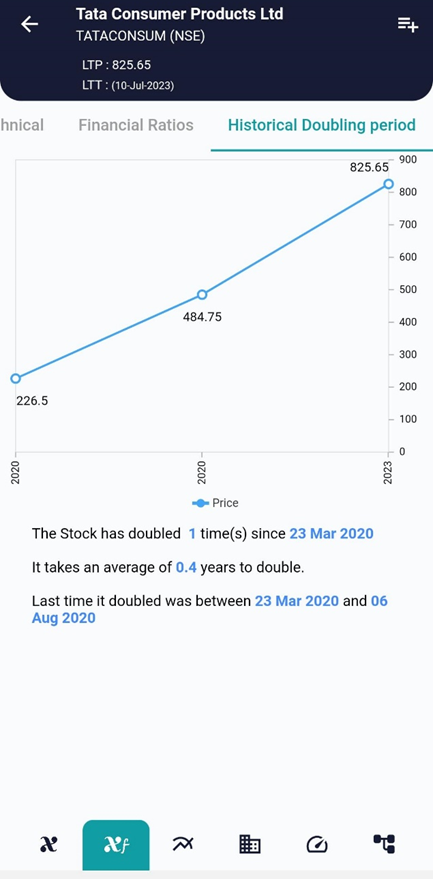

The Stock has doubled once since 23 Mar 2020 and took an average of 0.4 years to double.

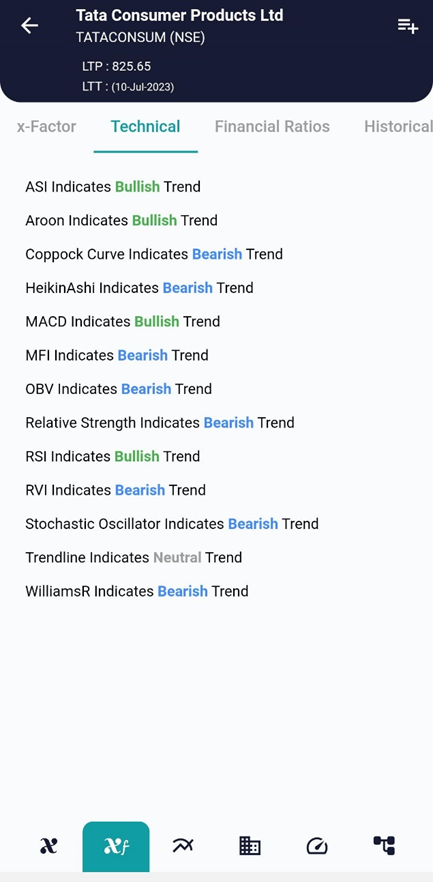

Majority of the technical ratios trend towards bearish side of the spectrum. Only some of the technical indicators namely ASI, Aroon, MACD, and RSI indicates bullish view.

Collectively, xCalData suggests the stock would be in Bearish zone for this week ending 17th July.

Yes, the stock has not shown the seasonality trend in the past.

However, reviewing the returns for the past 3 years for the same week, we see the stock has given positive returns in 2 years and negative returns in 1 years in the past.

Popular Posts

-

Stock of Interest . August 23, 2024

#HSCL (NSE) Stock Report | 23 Aug 2024

-

Stock of Interest . August 23, 2024

Add Zerodha trading account to xCalData

-

Stock of Interest . August 23, 2024

What is xCalData , how to use it and how accurate is it?

-

Stock of Interest . August 23, 2024

Jurik Moving Average (JMA): A Profit Trading Insight